Hada DBank: The First Blockchain-Based Islamic Bank

With the emergence of Islamic banking principles to forge a new future ahead of the current conventional banking and financial systems, Kuala Lumpur-based Hada DBank is working to place itself at the forefront, founded on the Islamic values of fair and transparent risk and responsibility sharing, augmented by the technological innovation of blockchain.

Why Islamic Banking?

Despite seemingly similar operations on the surface, Islamic banking is distinguished from traditional banking in two major principles: the first is sharing of profit and loss, the second is the prohibition of interest by both lenders and investors, discarding all interest-bearing models that have been proven to be unsustainable and complicit in the failures of global banking.

Less risk: Owing to stricter principles with regards to capital requirements and deposit mobilization, Islamic Banking by definition carries less risk and results in more resilient operations than its conventional counterparts.

Transparency: Depositors in Islamic banks are entitled to being fully informed about exactly what and how banks utilize their deposits. Depositors are also democratically allowed to have a say in where their money is invested.

The Hada DBank edge

Because of Islamic Financial Laws prohibiting risky ventures, Hada DBank will have a maximum Liability to Asset ratio of 1:3. All savings will always be backed by valuable assets such as precious metals, and are fully insured according to Islamic banking principles.

All users will have access to a full-feature personal banking service including:

- free encrypted account and e-Wallet, accessible via smartphones and non-smart mobiles.

- savings accounts at a probable 5% Hibah (discretionary gift usually based on business performance) per annum, with no withdrawal fee.

- zero-fee transfer or remittance of funds (both fiat and cryptocurrency) between savings and e-Wallet

- HADA Exchange, featuring zero-fee on cryptocurrency exchanges, or on major crytpo-fiat currency exchanges.

- 0% loan interest with a probable 10% investment return (based on fixed-rate Islamic investment product according to Murabahah (Cost-Plus Sale) and Tawarruq (Commodity Cost-Plus Sale) Islamic financial concepts).

- Physical and virtual debit cards with cashback and discount programs with affiliate partners and merchants.

Users will also have access to Bot HUDA, a financial management bot that helps them manage their spending, income and financial goals. Users can also take advantage of sophisticated artificial intelligence (AI) in the form of a personal financial advisor (HADI) that can help make informed investment decisions based on objective advice and assessment.

Caring and personal

Hada DBank’s core values of caring and personal shapes its services, transactions, interactions and business operations. Recognizing that its customers are the backbone of a bank, Hada DBank aspires to care, working to improve lives, rather than simply to profit from them. It will work hard to personalize services and attention, encouraging and fostering the great diversity of needs and requirements from each individual customer.

Far from exclusion, Islamic banking is not simply for Muslims. Islamic banking principles urge for universal inclusion and carry in its name a distinct message of transparency and risk-sharing for all.

Media partnership with Bitcoin PR Buzz

As a pioneering digital bank aiming to augment Islamic banking modules with blockchain technology, Hada DBank is cognizant of the need for widespread advocacy and awareness-raising of its innovative project.

As such, it is proud to announce a partnership with Bitcoin PR Buzz as its strategic media partner. As the world’s first cryptocurrency and blockchain PR agency, it benefits from its intimacy and reputation with various information distribution platforms such as CryptoCoinsNews, The Merkle, Coinspeaker, CoinIdol and many other international Bitcoin news sites. In addition, its network extends to several hundred online news outlets.

Bitcoin PR Buzz welcomed the new partnership, saying: “We are excited to support the world’s first blockchain-based Islamic bank.”

With a solid media partnership formed, Hada DBank looks forward to increased visibility and heightened presence in the industry.

Hada DBank development and HADACoin

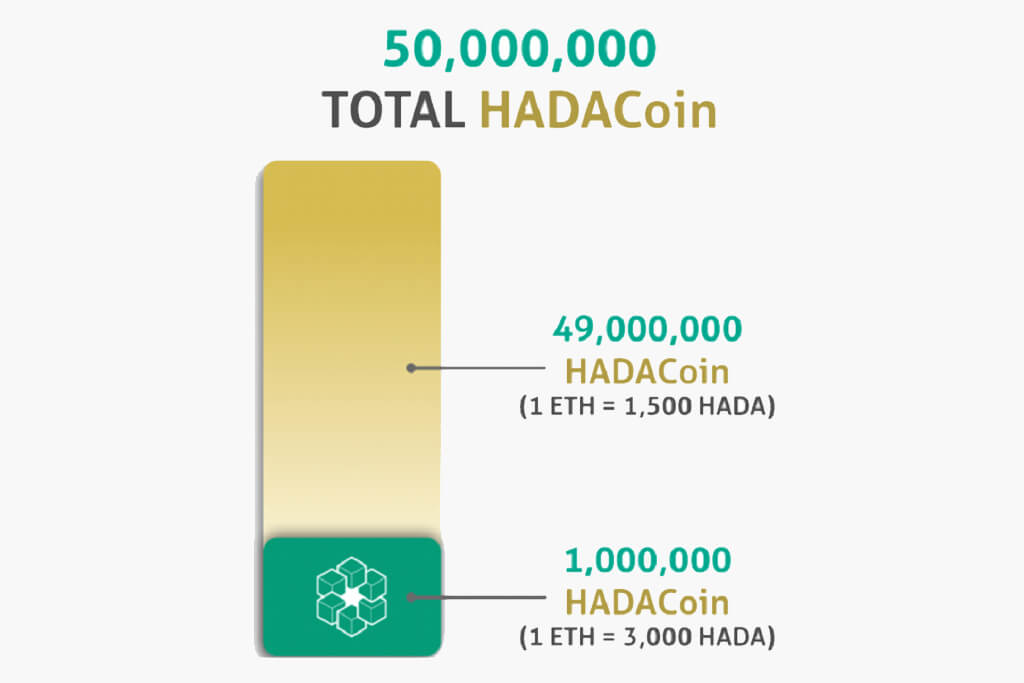

To raise the funds necessary for the full development of products and services of the world’s first blockchain-based Islamic digital bank, Hada DBank will host a crowdfunding campaign through the HADACoin token sale.

HADACoin will be the native digital asset to enable users to conduct basic and daily banking transactions, convertible to and from other fiat and cryptocurrencies within the Hada DBank platform and debit card. Based on the Ethereum platform, HADACoin benefits from the transparency of a public blockchain and the security of smart contracts.

HADACoin will be sold during the pre-sale at increasingly higher rates adjusting to supply, starting at rate of 1 ETH = 2,000 HADACoins for the first 10 million tokens, gradually reducing every 10 million tokens. A flash sale is now live, with ETH granting participants with 4000 tokens, for the 1st 1 million Coins

With the recent acquisition of several strategic partners, including BPRB, Hada DBank has decided to extend its pre-sale to February 28th, 2018 to take advantage of enhanced marketing and market penetration.

Once the Hada DBank platform launches, HADACoin will be trading on the F1Cryptos exchange the first of many exchange platform partnerships in the pipeline.

The Team

Hada DBank’s development team benefits from the diverse experience of its members in business, blockchain, computer security, investment and banking sectors.

Some of its key team members include:

Mohd Al-Shazanous, CEO/CFO/Co-founder

With a decade of experience in financial and risk management within the banking and energy sectors, Mohd has profound insight into economic issues of poverty and believes that the freedom, transparency and fairness of both Islamic banking and blockchain principles can forge a future foundation for a new, resilient global economy. https://www.linkedin.com/in/mohd-al-shazanous-mohd-bakar-56410a106/

Linda Azmi, CMO/Co-founder

Having managed marketing projects for some of the biggest names in Southeast Asia, Linda has an eye for developing cutting-edge marketing strategies and understands the value of digital marketing. https://www.linkedin.com/in/lindaazmi/

Juan Mahussin, CTO/Co-founder

A true tech geek at heart, Juan has the uncanny ability to dissect any technology and improve upon it. He speaks Solidity and Python, and also happens to be a skilled graphic and 3D designer. https://www.linkedin.com/in/juanmahussin/

Marcos Macias, COO

A natural-born leader, Marcos foresight results in effective management or projects and flawless execution, with a deep respect for the nuances of personal and professional relationships. https://www.linkedin.com/in/marcos-joel-macias-97203867/

Ernest Loh, PR & Spokesperson

Nurturing aspirations of being a social influencer, Ernest’s keen interest for social media and blockchain technology makes him the perfect public face for Hada DBank. https://www.linkedin.com/in/ernestloh/

The team is also backed by multi-faceted advisory board with some of the leading lights of academia, legal and banking, including the likes of Prof Emeritus Dr Barjoyai Bardai (Islamic Banking and Finance), Ayad Almutairi (Islamic Banking and Investment), Dr Guan Seng Khoo (Risk and Data Scientist) and Robby Schwertner (Blockchain Economy Expert).

Disclaimer: This publication is sponsored. Coinspeaker does not endorse or assume responsibility for the content, accuracy, quality, advertising, products, or other materials on this web page. Readers are advised to conduct their own research before engaging with any company mentioned. Please note that the featured information is not intended as, and shall not be understood or construed as legal, tax, investment, financial, or other advice. Nothing contained on this web page constitutes a solicitation, recommendation, endorsement, or offer by Coinspeaker or any third party service provider to buy or sell any cryptoassets or other financial instruments. Crypto assets are a high-risk investment. You should consider whether you understand the possibility of losing money due to leverage. None of the material should be considered as investment advice. Coinspeaker shall not be held liable, directly or indirectly, for any damages or losses arising from the use or reliance on any content, goods, or services featured on this web page.