Yana Khlebnikova joined CoinSpeaker as an editor in January 2025, after previous stints at Techopedia, crypto.news, Cointelegraph, and CoinMarketCap, where she honed her expertise in cryptocurrency journalism.

The IMF just warned that fast-growing dollar stablecoins could hollow out weaker national currencies and stifle central bank control, while calling for stricter, globally coordinated rules that could upend today’s stablecoin market.

Editor Julia Sakovich

Updated

4 mins read

Editor Julia Sakovich

Updated

4 mins read

The IMF published a new 56-page departmental paper, “Understanding Stablecoins,” on December 2, 2025, warning that large foreign‑currency stablecoins can accelerate currency substitution and erode monetary control in weaker economies. The report is available on the IMF site and is authored by Tobias Adrian and 15 co‑authors from the fund’s Monetary and Capital Markets Department.

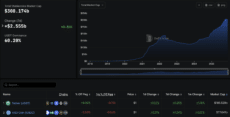

The paper notes that global stablecoin capitalization now exceeds $300 billion. About 97% of outstanding tokens reference the U.S. dollar, concentrating influence in issuers such as Tether’s USDT and Circle’s USDC.

USDT trades at $1.00026 with a market cap of roughly $185.3 billion as of December 4, 2025. USDC trades at $0.9999 with a market cap near $78.0 billion and 24‑hour volume above $11.0 billion.

Stablecoin market ar press time | Source: DeFi Llama

The IMF warns that foreign stablecoins can bypass domestic banks and payment rails. The authors write that stablecoins can penetrate an economy rapidly via the internet and smartphones. The use of foreign‑currency tokens could lead to currency substitution and potentially undermine monetary sovereignty, particularly in the presence of unhosted wallets. The paper stresses that this risk is most acute in countries with high inflation, weak institutions, or low confidence in the local currency.

The report argues that if a large share of domestic payments and savings migrates into dollar‑denominated stablecoins, central banks lose traction over liquidity conditions, credit creation, and interest‑rate transmission. The authors add that late‑launched CBDCs may struggle to displace private stablecoins once they achieve network effects in retail payments, cross‑border remittances, and merchant settlement.

On regulation, the IMF aligns with the G20 and FSB by endorsing the “same activity, same risk, same regulation” principle. The paper calls for harmonized legal definitions of stablecoins, strict reserve and redemption standards, granular disclosure of reserve composition and custody, and cross‑border supervisory colleges to prevent issuers from exploiting jurisdictional gaps.

The IMF singles out high‑risk structures such as algorithmic or partially collateralized stablecoins, warning that runs on these tokens can transmit volatility into both crypto markets and local banking systems. The authors contrast those designs with fully backed fiat‑referenced coins that hold short‑dated government securities and cash at regulated institutions. However, they still flag concentrated exposure to a single foreign currency as a macro‑financial vulnerability for smaller states.

The paper points to the fragmented rulebook across the U.S., EU, UK, and Asia, noting that regimes such as the EU’s MiCA, Japan’s stablecoin framework, and various U.S. state‑level regimes create scope for regulatory arbitrage. It urges authorities to coordinate licensing, reserve rules, AML/CFT requirements, and redemption rights to avoid a repeat of the “shadow banking” buildup that preceded the 2008 crisis.

“Without consistent global regulation, stablecoins could bypass national safeguards, destabilize vulnerable economies, and transmit financial shocks across borders at high speed,” the IMF authors write.

The publication follows several country‑level consultations in which IMF staff pushed back against unregulated dollar stablecoin usage in Latin America, Sub‑Saharan Africa, and parts of Eastern Europe, and it effectively codifies that line into a global template.

Macro desks should read this paper as a roadmap for how regulators will treat large stablecoin issuers over the next cycle. The IMF just framed dollar stablecoins as a monetary sovereignty issue, not a niche payments product. It places USDT, USDC, and similar tokens squarely in the same policy conversation as capital controls, FX intervention, and CBDCs. That usually ends with bank‑like regulation, tighter cross‑border controls, and higher compliance overhead.

For traders, this shifts long‑term risk from “will the reserves hold up” toward “will policymakers tolerate offshore dollar rails sitting on top of their economies.” That risk lands hardest on non‑U.S. venues and DeFi protocols that rely on unrestricted offshore stablecoin flows for liquidity.

Disclaimer: Coinspeaker is committed to providing unbiased and transparent reporting. This article aims to deliver accurate and timely information but should not be taken as financial or investment advice. Since market conditions can change rapidly, we encourage you to verify information on your own and consult with a professional before making any decisions based on this content.

Yana Khlebnikova joined CoinSpeaker as an editor in January 2025, after previous stints at Techopedia, crypto.news, Cointelegraph, and CoinMarketCap, where she honed her expertise in cryptocurrency journalism.