Let’s talk web3, crypto, Metaverse, NFTs, CeDeFi, meme coins, and Stocks, and focus on multi-chain as the future of blockchain technology. Let us all WIN!

Fred Thiel, CEO and Chairman at MARA Holdings, announced that the company had mined 249 Bitcoin blocks in December 2024, thus ending the year with 44,893 BTCs.

Edited by Julia Sakovich

Updated

3 mins read

Edited by Julia Sakovich

Updated

3 mins read

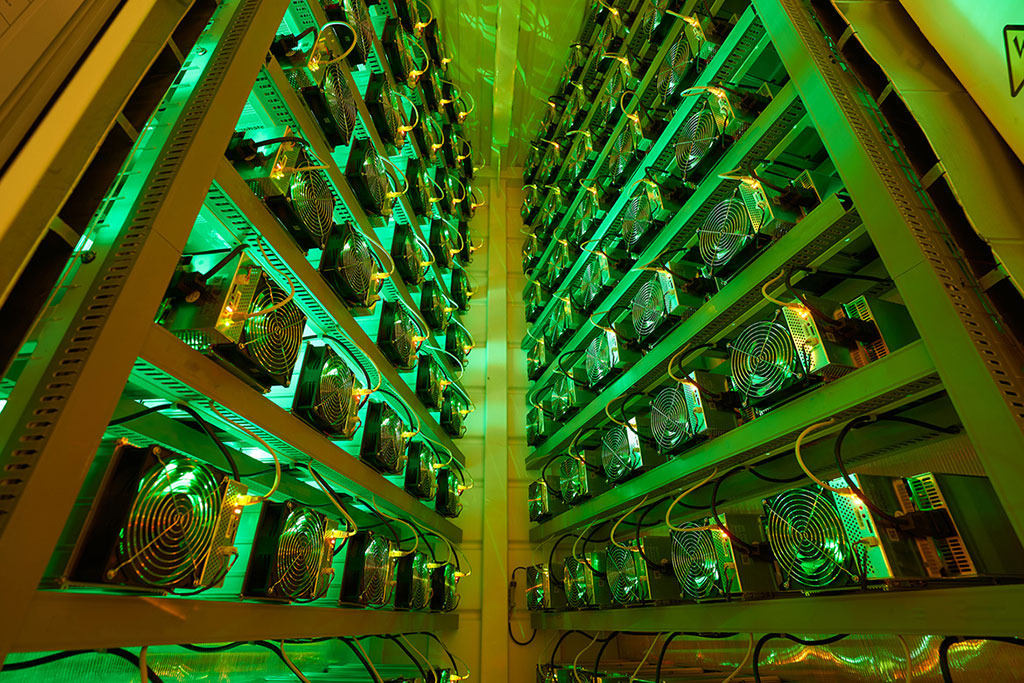

MARA Holdings Inc (NASDAQ: MARA), a top-tier Bitcoin BTC $108 041 24h volatility: 0.8% Market cap: $2.15 T Vol. 24h: $20.72 B miner, released its unaudited BTC production and miner installation updates for the last month of 2024. In December, MARA Holdings managed to mine the second most blocks in a month since its inception of about 249 blocks, thus a total reward of 890 Bitcoins.

According to the announcement, MARA Holdings increased its total Bitcoin hash rate by 15% to about 53.2 EH/s. As a result, the MARA Pool and Foundry mining pools now account for 38.5% of all Bitcoin blocks mined, up from 18% in January 2022. Moreover, MARA’s total hash rate surged by 168% in 2024, which heavily outpaced the entire network’s growth of 49%.

“These results underscore the substantial progress we’ve achieved in expanding our operations and enhancing performance, further solidifying our leadership within the industry,” the company noted.

As Coinspeaker reported in early December, MARA Holdings acquired a 114-megawatt wind farm in Hansford County, North Texas. The company is keen to add more mining capacity through renewable energy sources including wind and solar power.

In addition to the Bitcoin mining operations, MARA Holdings has been selling its stock market to strengthen its BTC holdings. In 2024, MARA Holdings acquired 22,066 BTCs at an average price of about $87,205, thus ending the year with a total of 44,893 BTCs.

The company announced that it has 7,377 BTCs loaned to third parties generating additional returns to the shareholders as of December 31, 2024.

”As a miner that mines and buys bitcoin, the hybrid approach provides us significant flexibility to acquire bitcoin at attractive prices. It further allows us to capitalize on market conditions by buying BTC during price declines, optimizing our acquisition cost,” the company added.

MARA Holdings has helped the Bitcoin network stand the test of time during the 2022 crypto bear market, which was largely described by low liquidity and demand. The success of the company’s mining operations in addition to the Bitcoin strategy akin to MicroStrategy Inc (NASDAQ: MSTR) and Metaplanet Inc (Tokyo: 3350) has been a huge boost to the Bitcoin network.

Moreover, the overall supply of Bitcoin on centralized exchanges (CEXes) has continued to shrink at a faster rate than the miners’ daily rewards. In the past seven days, more than 46K Bitcoins have been withdrawn from CEXes and the total balance is about 2.21 million coins as of this writing.

Amid the expected adoption of Bitcoin by nation-states and more institutional investors, the undervalue will continue to rally exponentially in the coming months. Furthermore, technical analysis shows that the parabolic phase of the 2024/2025 bull market has not yet happened.

Disclaimer: Coinspeaker is committed to providing unbiased and transparent reporting. This article aims to deliver accurate and timely information but should not be taken as financial or investment advice. Since market conditions can change rapidly, we encourage you to verify information on your own and consult with a professional before making any decisions based on this content.

Let’s talk web3, crypto, Metaverse, NFTs, CeDeFi, meme coins, and Stocks, and focus on multi-chain as the future of blockchain technology. Let us all WIN!