Altseason Looms as Altcoins Approach Key Resistance Levels

Altcoins have been a center of attraction in the past week following Ether’s (ETH) 27% gain over the course of the duration.

Breaking news coverage from cryptocurrency world about key figures, exchanges, startups, investment, applications, regulation and more.

Altcoins have been a center of attraction in the past week following Ether’s (ETH) 27% gain over the course of the duration.

FRIEND is down by 27% in the last 24 hours to trade at $0.9762. The market capitalization is pegged at $14.25 million while the trading volume is $10.26 million.

The recent approval of spot Ethereum (ETH) ETF has triggered an intensified crypto cash rotation from Bitcoin to the altcoin industry.

The surge in Layer 2 adoption can be traced back to the recent green light given to spot Ethereum ETFs by the US SEC.

Bitcoin developer and Ordinals supporter Udi Wertheimer warned that the incident involving GCR might be part of a broader operation targeting celebrity X accounts.

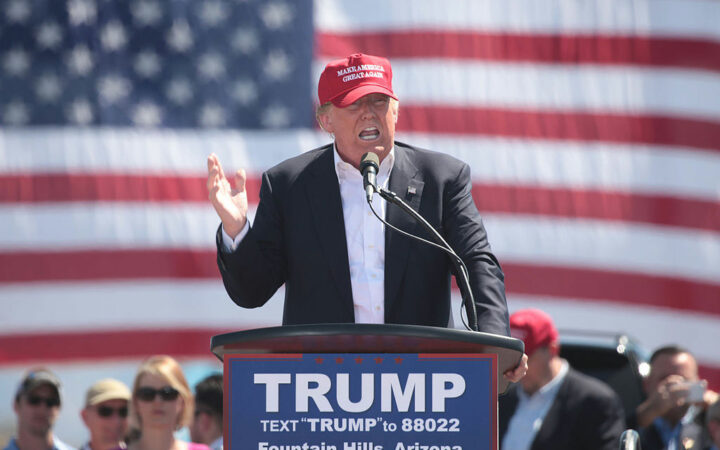

After Trump’s recent comments and overwhelming promise of supporting the crypto industry, some crypto market analysts says that the former President has a hit of retracing on his commitments.

The newly raised capital is important for the growth ambitions of xAI.

The approval of spot Bitcoin ETFs in the US led to a 70% surge in Bitcoin prices in two months. If history repeats, Ether could reach its all-time high near $6,000 by July’s end.

Since the launch of the Open League initiative, TON’s TVL has soared from $23 million in early March to its current $317 million.

Dabba opted to launch its DePIN and onboard users even before considering rolling out Web 3.0 features like tokenization.

The recent Ethereum price dip appears to be a classic case of “buy the rumor, sell the fact” behavior. Experts forecasts that Ether price could jump by more than 60% soon, driven by growing interest from institutional investors in futures.

Standard chartered executive stated that similar to Ethereum, other altcoins previously under the SEC scrutiny, such as the XRP case, could also be absolved of the ‘security’ status.

The decrease in the burn rate has pushed the number of circulating coins to its highest level since early March, currently averaging 120,000 ETH.

The newest iteration of Binance Web3 Wallet introduces enhanced swap services, integrating Base Chain, bolstered security measures, and customizable settings accessible directly within the wallet interface.

Despite the adversity, FTX embarked on a series of restructuring efforts, including the liquidation of various assets such as Solana tokens and shares in successful startups.