Adidas Teams Up with Popular Digital Artist FEWOCiOUS for NFTs Linked to Sneakers

The Adidas Originals x FEWOCiOUS collection will include an NFT along with an artist-designed physical Adidas Originals Campus 00’s sneaker.

Stay ahead of the crypto curve with in‑depth coverage of the digital‑asset ecosystem. Here you’ll find the latest on new coin launches, regulatory shifts, wallet innovations and market movements across major chains. Whether you’re a seasoned trader or just exploring the space, our timely updates offer clarity on the crypto universe’s fast‑evolving landscape.

The Adidas Originals x FEWOCiOUS collection will include an NFT along with an artist-designed physical Adidas Originals Campus 00’s sneaker.

According to Irish watchdog DPC, Google has not provided enough information about Bard and specifically about how its generative AI tool ensures Europeans’ privacy.

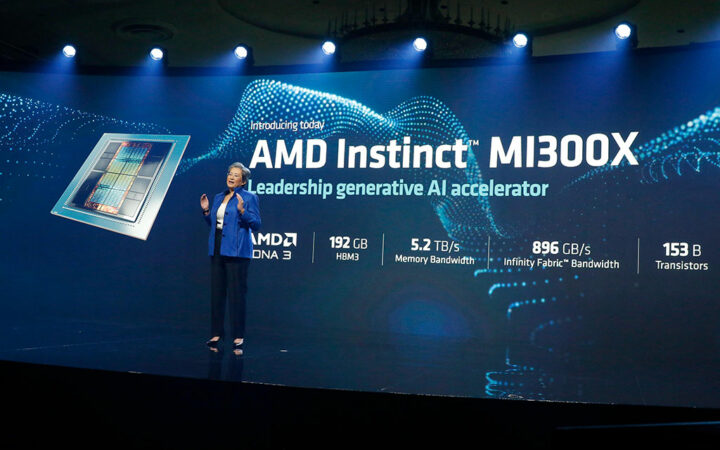

A notable difference between AMD’s MI300X and Nvidia’s H100 is the storage facility. While the AMD AI chip can use up to 192 GB of memory, Nvidia’s chip supports 120 GB.

Saylor believes huge institutional money will proliferate the Bitcoin market as confusion and anxiety subside with increased crypto regulatory clarity.

Puma noted the Black Station is open for everyone to explore but only RB token holders can purchase the physical Rulebreaker sneaker and claim the 2 digital wearables.

The documents might help the likes of Ripple, Coinbase and other businesses that have had a run-in with the SEC.

During the second investor day within a year, Fanatics delivered presentations explaining its future growth strategy to over 100 prospective institutional investors from big firms such as Barclays and Goldman Sachs.

The deal will require Binance.US to submit its operating expenses to the court and the SEC to protect the business as the case progresses.

Damus has announced it will remove the zaps feature that allows users to tip, following potential dismissal from the App Store.

In addition to the Passport Series, Snoop is also announcing Snoop Selects, which all the NFTs holders will receive.

On Tuesday, June 13, the markets reacted positively to the publication of inflation data.

The Maverick Protocol will be available on the Binance Launchpool as the newest project launched after the Sui blockchain in April.

The crypto market has turned bearish since the SEC charged Binance and Coinbase with listing unregistered securities last week.

As the permissionless beta launch of TON.Vote. goes live, Orbs’ L3 Guardians technology will be required to boost security.

Through the latest funding, the firm aims to make video creation easy for everyone and has already served many businesses worldwide.