Crypto Market Bleeds: Here’s Why Bitcoin (BTC) Price Might Crash Under $95K

Amid the crashing global markets, Bitcoin bleeds quickly. Losing the $2 trillion valuation and the $100K support, bears are targeting an extending rally to $94K?

Everything you need for the flagship crypto: from price movements and halving cycles to institutional adoption, on‑chain metrics and market strategy around Bitcoin. Follow how Bitcoin’s narrative evolves, why it matters to global finance, and what shifts could impact its future role as digital gold.

Amid the crashing global markets, Bitcoin bleeds quickly. Losing the $2 trillion valuation and the $100K support, bears are targeting an extending rally to $94K?

The House Oversight Committee launches an investigation into claims of systematic crypto debanking, requesting evidence from industry leaders amid regulatory shift.

MicroStrategy unveils plans to redeem $1.05 billion in convertible senior notes due 2027, with holders having until February 2025 to convert notes to Class A shares.

The convertible senior notes, set to mature in 2030, provide Semler with capital flexibility while giving investors the option to convert debt into shares.

BlackRock’s iShares Bitcoin Trust (IBIT) has seen significant inflows, acquiring over 11,000 BTC in the past week.

Morgan Stanley signals deeper crypto market involvement, working with US regulators to expand digital asset services while adapting to evolving regulatory landscape.

Fathom Holdings announces strategic Bitcoin investment and integration plans, marking a significant shift towards digital currency adoption in real estate transactions and treasury management.

Senator Cynthia Lummis has proposed legislation to establish a national bitcoin reserve, planning to purchase 1 million BTC worth $108 billion over five years.

Trump reaffirms his commitment to making the US the global crypto capital, showing efforts to lead in cryptocurrency.

Senator Cynthia Lummis’s appointment as Chair of the Senate Panel on digital assets marks a pivotal shift in US crypto policy, with focus on establishing a Bitcoin reserve amid BRICS’ challenge to dollar dominance.

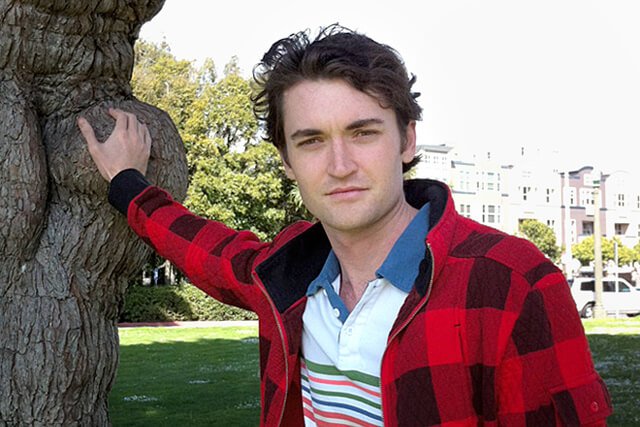

To many, Ulbricht symbolizes Bitcoin’s original promise — an uncensored, decentralized financial system beyond government reach.

The US spot Bitcoin ETF issuers registered a daily total net inflow of about $248 million on Wednesday following the crypto market confidence instilled by the Donald Trump administration.

BlackRock CEO Larry Fink believes that Bitcoin could soon hit the $700,000 price tag if the fears of currency destabilization and economic instability remain high.

Coinbase’s Conor Grogan identified 430 dormant BTC linked to Ross Ulbricht as the Silk Road founder received a full pardon from Trump.

Bitcoin options trading reflects unprecedented bullish sentiment on CME, while spot Bitcoin ETFs continue to see massive inflows despite Trump’s inaugural speech.