NFT Sales on Rise with Bitcoin Dominating This Space

Out of all NFT hosting platforms, Bitcoin stands out with an impressive 44% increase in its daily NFT trading volume, surging to $16 million.

Everything you need for the flagship crypto: from price movements and halving cycles to institutional adoption, on‑chain metrics and market strategy around Bitcoin. Follow how Bitcoin’s narrative evolves, why it matters to global finance, and what shifts could impact its future role as digital gold.

Out of all NFT hosting platforms, Bitcoin stands out with an impressive 44% increase in its daily NFT trading volume, surging to $16 million.

Santiment revealed that wallets holding between 10 and 10,000 BTC collectively accumulated 51,959 Bitcoin on Sunday alone.

The increased volatility of Bitcoin has not discouraged institutional investors from expressing a strong interest in the cryptocurrency.

Despite the market sentiment, altcoins sparked investor interest, resulting in a net inflow of $16 million.

According to Michaël van de Poppe, most of altcoins have reached the bottom level and are now stabilizing.

The positive sentiment is driven by the world’s largest assets manager firm BlackRock recently announcing its tokenized fund targeting Ethereum’s BUIDL products.

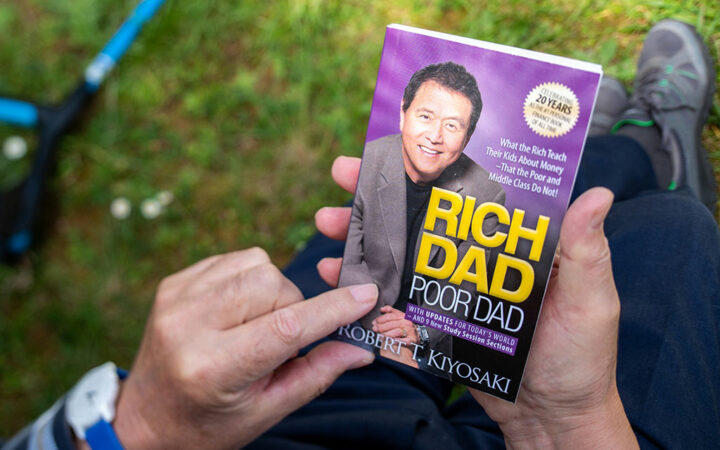

Kiyosaki suggested that the current market conditions present an opportunity to invest in Bitcoin, predicting that the coin could reach $100,000 by September.

The rise in Bitcoin mining difficulty reflects an influx of new miners joining the network, indicating heightened interest in securing a portion of the remaining unmined BTC from the total supply.

Amid the recent approval of the spot Bitcoin ETFs, institutional clients of Goldman Sachs have been seeking exposure to cryptocurrency derivative products.

JPMorgan strategists expect further downside in Bitcoin price amid slowing inflows into spot Bitcoin ETFs. They believe that BTC is currently in the ‘overbought’ territory.

According to the research, BTC price exhibited a huge spike both before and after the last halving event.

Analysts are bullish for Bitcoin to hit new all-time highs, amid the strong bounce back, before the Bitcoin halving event 2024 in April.

Unlike previous halving events, which are usually accompanied by Bitcoin reaching a new all-time high, the crypto asset has already hit a new ATH this month ahead of the event.

With the Fed opting for a steady course, the immediate impact on Bitcoin and other cryptocurrencies was mixed, reflecting the complex interplay between macroeconomic policies and digital asset valuations.

The negative shift suggests a weakening demand for Bitcoin in the US, coinciding with slowed inflows into spot ETFs and a record outflow from Grayscale’s ETF.