Burj Khalifa Owner Wants to Issue Its Own Crypto Token, Plans ICO

The Burj Khalifa developer, Emaar Group, plans to take over the cryptocurrency world by storm with the introduction of its digital token with an ICO planned for a year later.

Covering the launch side of crypto: initial coin offerings (ICOs), token sales news, airdrops, fundraising rounds and project tokenomics reveal. Stay informed about upcoming opportunities, regulatory angles and how new tokens position themselves in the crowded digital‑asset market. Ideal for those watching for early‑stage projects.

The Burj Khalifa developer, Emaar Group, plans to take over the cryptocurrency world by storm with the introduction of its digital token with an ICO planned for a year later.

The second ICO round is set to commence today, on March 12. Amid the launch of its Klaytn platform, the Ground X developers are planning to raise the same $90 million.

Now, with SeedInvest acquisition, Circle is capable of to ofingfer blockchain-based securities, under the control of the US Securities and Exchange Commission (SEC) and the Financial Industry Regulatory Authority (FINRA).

Security token platform Polymath has teamed up with Loopring to trial peer-to-peer trading of security tokens on a decentralized exchange.

Inveniam Capital Partners is leading the way in tokenizing significantly large real estate assets on the blockchain with their four projects said to be worth around $260 million.

DX Exchange and Perlin are collaborating to empower millions of retail investors from the world’s poorest populations to own fractional shares in leading traditional stocks like Apple, Facebook and Tesla in digital “tokenized” form.

The new ICO solution has been jointly developed by Microsoft Azure and Stratis – an ICO platform that offers KYC solutions, custom branding and support for different currencies.

Here comes another alternative of ICO, that is known as Security Token Offering (STO). There are analysts who believe that STOs will eventually replace ICOs. Here’s what makes them think like that.

After a year-long break, CoinList platform is back on a track offering the U.S. accredited investors and international customers to buy out Ocean’s utility tokens.

BTG, the largest investment bank Brazil, is going to launch its own blockchain-based security token backed by distressed real estate assets.

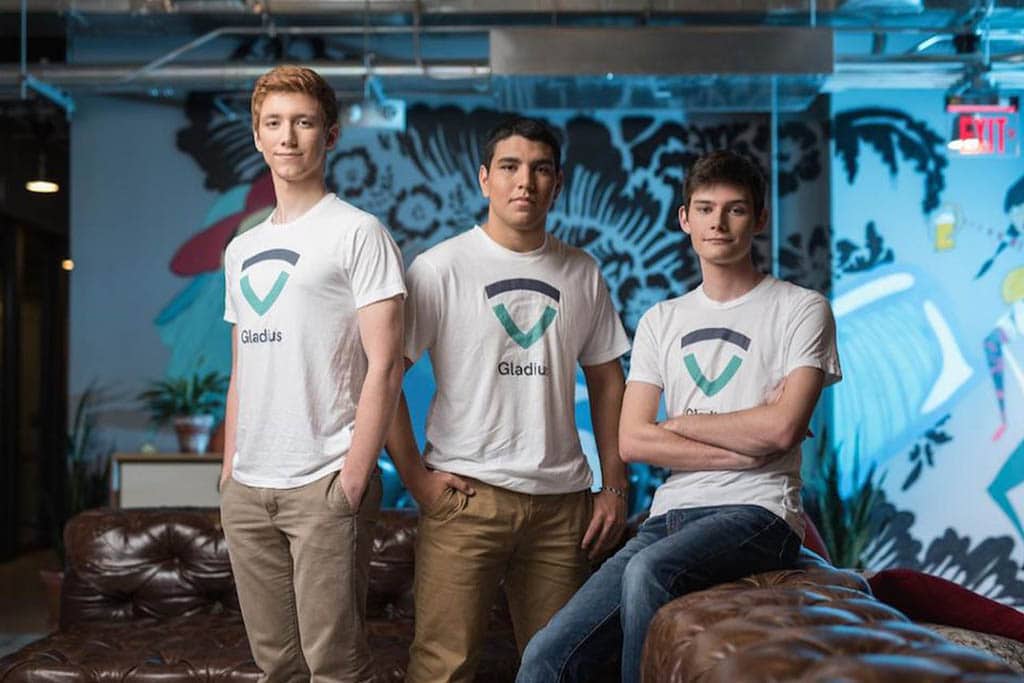

Gladius Network LLC self-reports to the SEC for overseeing an unregistered ICO enabling them to avoid penalties provided that they pay all the investors who request for a refund.

Securitize, that is supported by Coinbase, and OTCXN are joining forces to streamline the process of issuing and trading security tokens.

The new legal framework mandates companies to register their securities offerings over the blockchain before distribution to investors.

Here’s a look into the growing popularity of Security Tokens and the regulatory path for the token issuers lying ahead.

The crypto-darling SEC commissioner Hester Peirce is explaining delays in a regulatory toolset for token offerings as she mobilizes financial authorities to work on a deliberate approach to digital assets.