Visa Invests in FinTech Startup VGS Just Days after Acquiring Plaid

Visa has made a new strategic investment in a fintech company – Very Good Security (VGS). This comes days after it has become known about the acquisition of Plaid for $5.3 billion.

The word “fintech” is derived from “financial technology” which means the integration of technological tools and innovations into financial operations in order to enhance and automate the financial processes. Fintech is used to assist financial institutions, businesses in the management of their operations to provide better services to their customers. As the industry of fintech is actively evolving, there is no surprise at all that the news from this sphere can attract wide attention.

Adoption of fintech by a company would mean a significant change to their mode of operations as it involves the use of specialized algorithmic models, mobile applications and dedicated computer software packages.

At its initial introduction stage, companies from a range of industries including banking, education, fundraising, health, venture management, etc. only used fintech for back end systems where they get absolute and full control. Nowadays, most industries have started using the innovation for consumer-oriented services in an attempt to serve their clients better while increasing the transparency in their operations.

As we move towards a significantly digitized world, from the introduction of the internet to social media, smartphone evolution and now blockchain technology, the need for adoption of cryptocurrency cannot be overemphasized. As the underlying framework of pioneer cryptocurrency bitcoin, the blockchain is a vital part of fintech. We’ve seen a number of blockchain-powered fintech apps being employed by banking industries and data inclined platforms.

Fintech has become a major part of the finance space in recent years, this points to the fact that major conglomerates have identified and prioritized its importance in growing their businesses. Fintech works closely with other new technologies such as data-driven analytics and marketing, machine learning, artificial intelligence, etc.

Coinspeaker presents the best and latest Fintech news, ranging from its use in cross border payments, startup business fundraisers, venture management, credit application, to remote banking, as investors and stakeholders’ awareness about the innovation continues to rise daily.

Visa has made a new strategic investment in a fintech company – Very Good Security (VGS). This comes days after it has become known about the acquisition of Plaid for $5.3 billion.

Two Prime’s FF1 Token combines the features of a close-ended fund, asset-backed token, and a secure store of value. The token sale will take place not in the form of a typical ICO but as a Continuous Token Offering (CTO).

Ripple’s partner MoneyGram is starting 2020 with expansion plans into India. It may have a positive influence on the XRP adoption and price.

Ripple CEO Brad Garlinghouse expects to see more ‘consolidation’ in 2020 after Visa acquired fintech startup Plaid for $5.3 billion. Will it affect the XRP price?

Financial technology startup Fundbox is preparing for conducting an IPO in the future and has created a position of a CFO in its corporate structure.

The acquisition of Plaid will bring benefits to both companies. It may add 100 basis points to Visa’s net revenue growth by 2021.

As Lightnet has secured a Series A funding, its CEO suggests the funds will be used for more fintech acquisitions. The platform is also planning to expand.

MakerDAO is taking part in CES 2020 in Las Vegas to push decentralized finance (DeFi) to as many people as possible.

If you read Zuckerberg’s post where he shared his ideas about a new decade, it may seem to you that he has already forgotten the Libra project announced last summer.

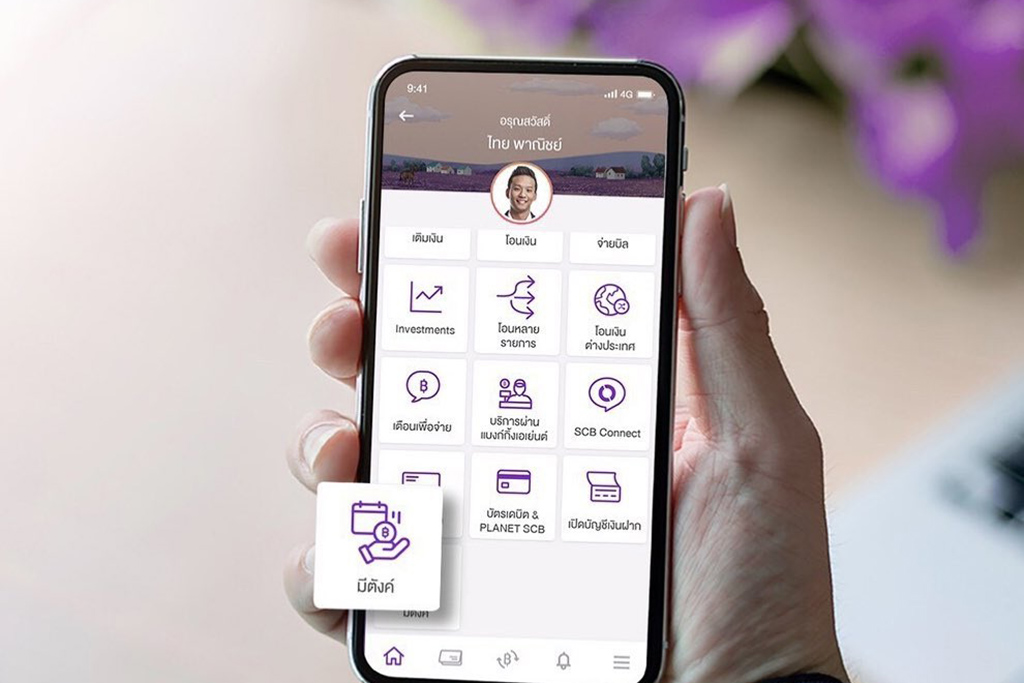

SCB, which is the oldest bank in Thailand, announced that it wants to go digital. In order to do that, it has partnered with Ripple to provide instant, low-cost cross-border payments.

The collaboration between Tencent and UnionPay would allow merchants to accept payments from one customer using WeChat Pay and another using UnionPay’s QuickPass by presenting both with the same scannable code.

In theory, Libra was presupposed to be managed by a Geneva-based independent association linking several companies and non-profit groups.

The American economist said that Ripple’s XRP-based solutions address the concerns of modern banking and thrive on the failure of banking systems like SWIFT to adapt to today’s world.

With the significant growth of the FinTech space in 2019, the next year is expected to strengthen the bond between technology and financial services. Experts predict major changes in the banking space.

Tencent is going to create a digital currency research group to support the development of a digital payment sector by using blockchain technology.