S&P 500 Hits New Record Close as Market Awaits Wall Street Earnings and Fed Decision on Interest Rates

While all three major indexes rose, the S&P 500 hit a new record barely a week after setting a previous one.

While all three major indexes rose, the S&P 500 hit a new record barely a week after setting a previous one.

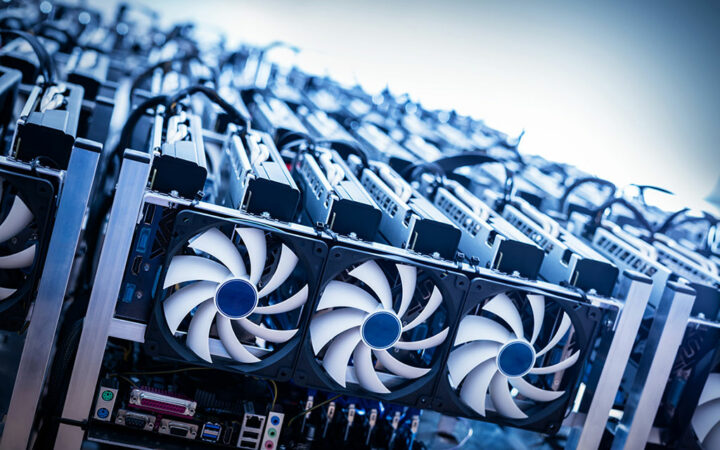

Marathon Digital’s spectacular performance aligns with the broader boom in the Bitcoin mining sector.

Marathon Digital and Riot Platforms, sensing the potential for increased demand, have made strategic moves to fortify their positions in the market.

Recent reports demonstrate that Marathon Digital has been eager to expand its business.

The analyst said TradFi institutions trying to get into crypto, but are unsure how to begin, may use Coinbase stock to enter.

The collaboration between Affirm and Walmart is expected to increase the purchasing power during the end-of-year festive season as more shoppers can pay over time.

The three major indexes, the S&P 500, the Dow, and the Nasdaq are enjoying a continued rally as the market hopes for rate cuts.

With the Bitcoin mining landscape gaining steam, the competition is heating up and the most positioned miners will be the biggest beneficiaries moving forward.

Dubbed Gaudi3, Intel intends to attract generative AI companies like OpenAI away from Nvidia and bolster its stock market performance.

There was a general rise in the Dow, S&P 500 and Nasdaq Composite indexes following hints that the Fed policy would favor the general market.

With yesterday’s historic high, the Dow Jones extends its Q4 rally to more than 10%. On the other hand, the technology sector also makes a fresh all-time high.

JPMorgan chosen Amazon and Alphabet stocks as the most probable front-runners for 2024.

As the crypto market braces for the Federal Reserve’s decision, traders are showing caution, evidenced by a 40% drop in trading volume over the last 24 hours.

The gains have come while traders await the conclusion of the final Fed meeting of 2023.

While Cathie Wood has been aggressively selling off her investments in crypto firms, she’s making fresh bets in the AI space acquiring shares of top tech companies like Microsoft and Meta.