Crypto Market Plunges 6%, $556M Liquidated in 24 Hours

A total of 105,849 traders were liquidated in the past 24 hours.

Your essential daily read: our featured Story of the Day highlights the most impactful development across crypto, blockchain, or regulation—curated for urgency, significance, and insight. Don’t miss what moves the market today.

A total of 105,849 traders were liquidated in the past 24 hours.

Bitcoin price is currently retesting a crucial support level around $60.6k, which must hold to avoid further bleeding in the near term.

The Bitcoin and Ethereum price slump in the past 24 hours has forced over $500 million in crypto liquidations.

Gold price gained in value in the past 24 hours while Bitcoin price declined around 4 percent as Iran attacked Israel in an escalating Middle East geopolitical crisis.

Bitwise confirmed that its application of XRP ETF is legitimate thereby driving excitement in the market/ However, the XRP price moved down amid the broader market correction following Israel-Iran war-like situation.

FTX’s restructuring plan gains strong creditor backing, setting the stage for the distribution of $6.83 billion to impacted crypto traders and users.

The October crypto bullish narrative could help Bitcoin price regain a crucial macro rising trend and potentially reach a new all-time high.

Crypto investment products in the United States take the stage as fund flow tops $1.2 billion.

Crypto investors will be watching two major macro developments this week that includes the Fed Chair Jerome Powell speech and the upcoming US non-farm payrolls report on Friday.

Bitcoin has crossed the 160-day threshold since the last halving event, which historically marks the point where major upward price movement begins.

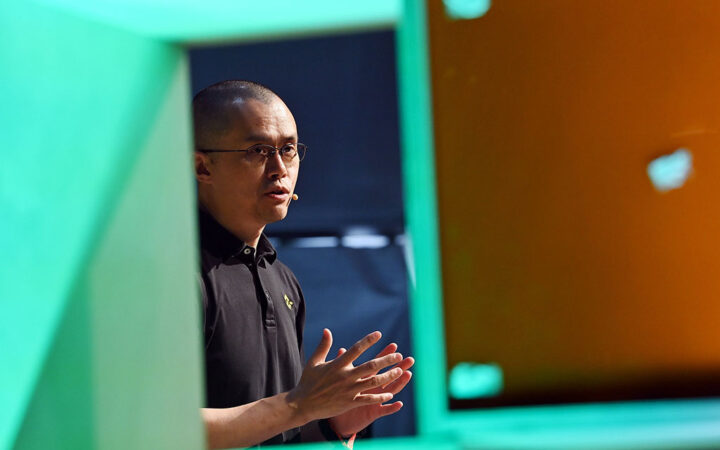

Binance’s former CEO Changpeng Zhao is now free after his incarceration in a California prison.

More institutional investors have shown higher confidence in Bitcoin and its long-term success amid rising global geopolitical tensions and constant fiat devaluations.

Despite the regulatory hurdles, the Binance (BNB) coin has remained the fourth largest crypto project with a market cap of over $88 billion.

Hamster Kombat airdrop is live and the token is listed on several exchanges.

Ahead of the monthly close, Bitcoin price must consistently close above $65k to avoid further capitulation below $49K.