Solana Price Prediction: French Banking Giant Chooses SOL for Stablecoin Rollout – How Quickly Can SOL Hit $1,000?

Solana (SOL) has been making headlines after a 4% price surge in the past 24 hours, thanks to the recent announcement from France’s financial titan, Societe Generale.

On June 10, the bank’s crypto arm, Societe Generale-FORGE, launched a USD-pegged stablecoin, USD CoinVertible (USDCV), selecting Solana and Ethereum as the underlying blockchain infrastructures.

While Ethereum remains the default institutional choice, Solana’s inclusion signals trust in its high-speed, low-cost capabilities. The stablecoin is designed to facilitate near-instant settlement in both USD and EUR, with BNY Mellon reportedly acting as custodian.

Interestingly, Bloomberg analysts now project Solana as the top candidate for ETF approval among altcoins. Seven issuers have already submitted filings for spot Solana ETFs, with strategists Eric Balchunas and James Seyffart predicting an “altcoin ETF summer”.

SOL Technical Analysis: Cup-and-Handle Pattern Suggests Major Breakout

On the technical front, Solana’s weekly chart is aligning perfectly with the narrative. A massive cup-and-handle formation has formed over a two-year timespan. The handle portion appears to be resolving with a bullish breakout, as SOL just breached the descending trendline resistance.

The breakout suggests a possible price target of $450 – the height of the cup projected upward from the breakout point. A weekly close above $200 would be critical to confirm this trajectory.

Meanwhile, the RSI is at 50.41, hovering near the midpoint and hinting at the beginning of a new bullish trend. The MACD is showing bullish momentum, with the MACD line crossing above the signal line and positive histogram bars starting to build again.

SOL Weekly Chart. Source: TradingView

While a jump to $450 based on the cup-and-handle formation is already ambitious, hitting $1,000 would require a roughly 6x move from current levels. If Solana captures a similar market capitalization to Ethereum’s peak during the 2021 bull run, $1,000 becomes feasible.

Solana’s Surge Puts Spotlight on Solaxy ($SOLX)

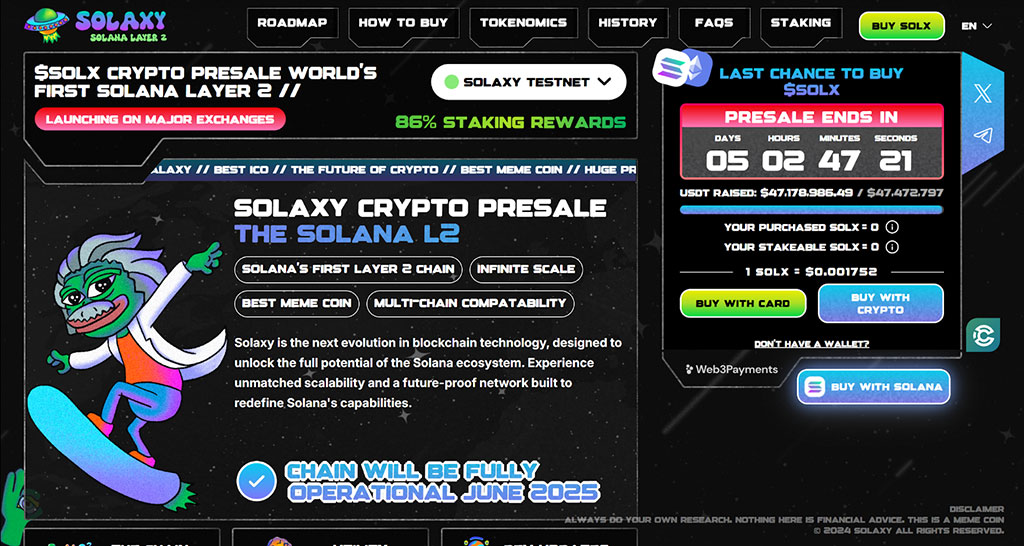

Solana’s potential surge to $1,000 and dominance in DeFi could propel Solaxy ($SOLX) – a next-generation Layer 2 blockchain solution built to enhance and scale the Solana network. It has already raised a whopping $47.17 million in its ongoing presale.

Despite Solana’s high throughput capabilities, it faces challenges such as network congestion, scalability limitations, and unreliable transaction performance during peak demand.

Solaxy aims to directly address these issues through an innovative combination of off-chain processing, transaction bundling, and secure Layer 1 settlement.

By offloading computations and bundling transactions before committing them to Solana’s mainnet, Solaxy reduces the burden on Layer 1, improving both speed and cost efficiency.

Source: Solaxy

The native token, $SOLX, is currently priced at $0.001752, with 5 days, 2 hours until the presale ends. Holders can stake their tokens to gain a massive ~86% staking reward.

To purchase the coin, simply visit the official Solaxy website and connect a supported wallet, like Best Wallet.

Simply swap crypto or use fiat with cards to complete the transaction.

Disclaimer: This publication is sponsored. Coinspeaker does not endorse or assume responsibility for the content, accuracy, quality, advertising, products, or other materials on this web page. Readers are advised to conduct their own research before engaging with any company mentioned. Please note that the featured information is not intended as, and shall not be understood or construed as legal, tax, investment, financial, or other advice. Nothing contained on this web page constitutes a solicitation, recommendation, endorsement, or offer by Coinspeaker or any third party service provider to buy or sell any cryptoassets or other financial instruments. Crypto assets are a high-risk investment. You should consider whether you understand the possibility of losing money due to leverage. None of the material should be considered as investment advice. Coinspeaker shall not be held liable, directly or indirectly, for any damages or losses arising from the use or reliance on any content, goods, or services featured on this web page.