March 5th, 2026

Even though last week a lot of sources were reporting about Japan’s approving Bitcoin ETFs as an alternative to Bitcoin futures, it seems that this will not be the case after all.

The regulatory watchdog has recently published a report which talks about the examination and compliance inspection of the emerging cryptocurrency market.

Crypto index fund provider Bitwise Asset Management applied to launch a new bitcoin-backed exchange-traded fund (ETF) with the Securities and Exchange Commission on Thursday.

The former SEC attorney will help Tron build effective interaction with financial authorities as its first head of compliance.

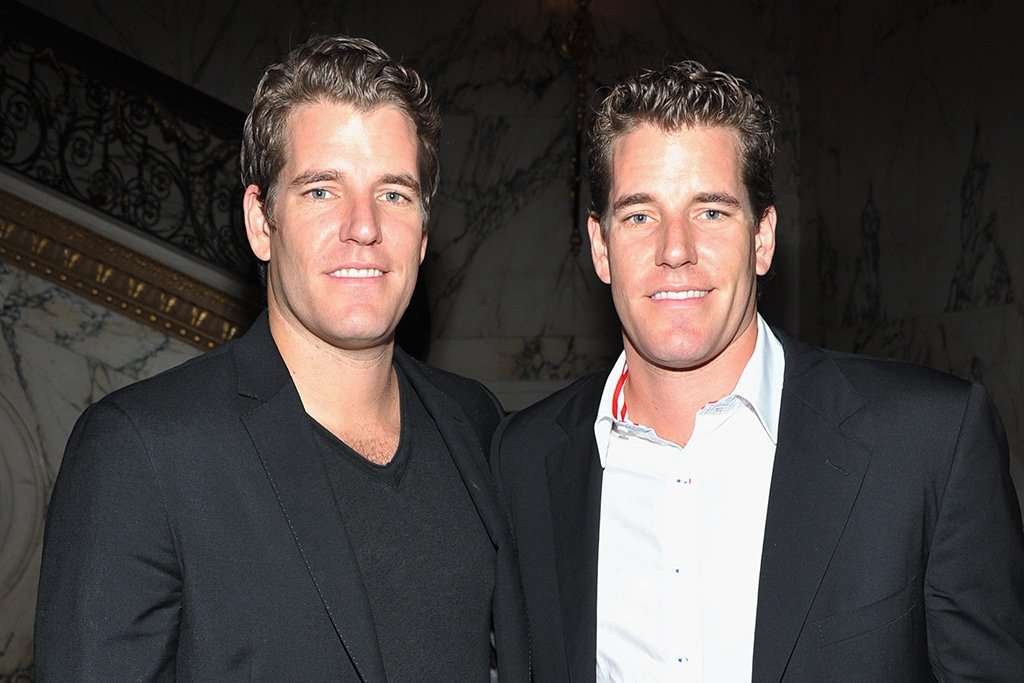

The Winklevoss brothers has expressed their optimistic attitude to Bitcoin and new ambitions of making Bitcoin ETFs a reality during the latest AMA session on Reddit.

After barring crypto derivatives, Japan is currently gauging industry interest in ETFs tracking digital currencies. The Liberal Democratic Party will reportedly submit draft legislation by March 2019.

At the end of the year, we’ve put together a list of the biggest predictions made by blockchain and crypto enthusiasts, revealing which loud forecasts failed and which turned out to be true in the expiring year.

Citing heavy client demand, Investment advisor Wealthfront announced Coinbase integration which will allow its users to track cryptocurrency investments. Savings and checking accounts to be provided within the first few months of 2019.

Two U.S. congressmen Warren Davidson and Darren Soto, are introducing a bill that would exclude digital currencies from securities classification and substantially improve the tax treatment for cryptocurrencies.

As a result of the deal, newly launched TokenSoft Global Markets LLC. will enable issuers to choose whether to host a token sale themselves or work with a broker-dealer to manage the token sale on their behalf.

Konstantin Rabin, financial expert and crypto enthusiast, unveils what hides behind the recent shut down of once promising stablecoin project – Basis.

The Bitcoin community is rejoicing the appointment of Mick Mulvaney, the new U.S. Chief of Staff, known for his pro-Bitcoin stand in the past. He will resume the office at the beginning of 2019.

Good news for blockchain token projects concerning their ability to bypass U.S. securities registration requirements. While before they had to stand in the queue to fill out all the documents, now they can obtain so-called no-action letters from the SEC.

Basis, a stablecoin project, that raised $133 million this April, is shutting down its operation and returning money to investors.

For operating a fraudulent Initial Coin Offering, former AriseBank executives have to pay nearly $2.7 million in fines and are prohibited from serving as officers of public companies or engaging in offerings of digital securities.