March 5th, 2026

Truly great news come from Coinbase, which, to the joy of large XRP community, decided to add XRP to its professional trading platform, Coinbase Pro.

The new ICO solution has been jointly developed by Microsoft Azure and Stratis – an ICO platform that offers KYC solutions, custom branding and support for different currencies.

Here comes another alternative of ICO, that is known as Security Token Offering (STO). There are analysts who believe that STOs will eventually replace ICOs. Here’s what makes them think like that.

After a year-long break, CoinList platform is back on a track offering the U.S. accredited investors and international customers to buy out Ocean’s utility tokens.

Konstantin Rabin, financial expert and crypto enthusiast, takes a look at how regulatory institutions are different in terms of Bitcoin regulation and whether they will come to an agreement at all.

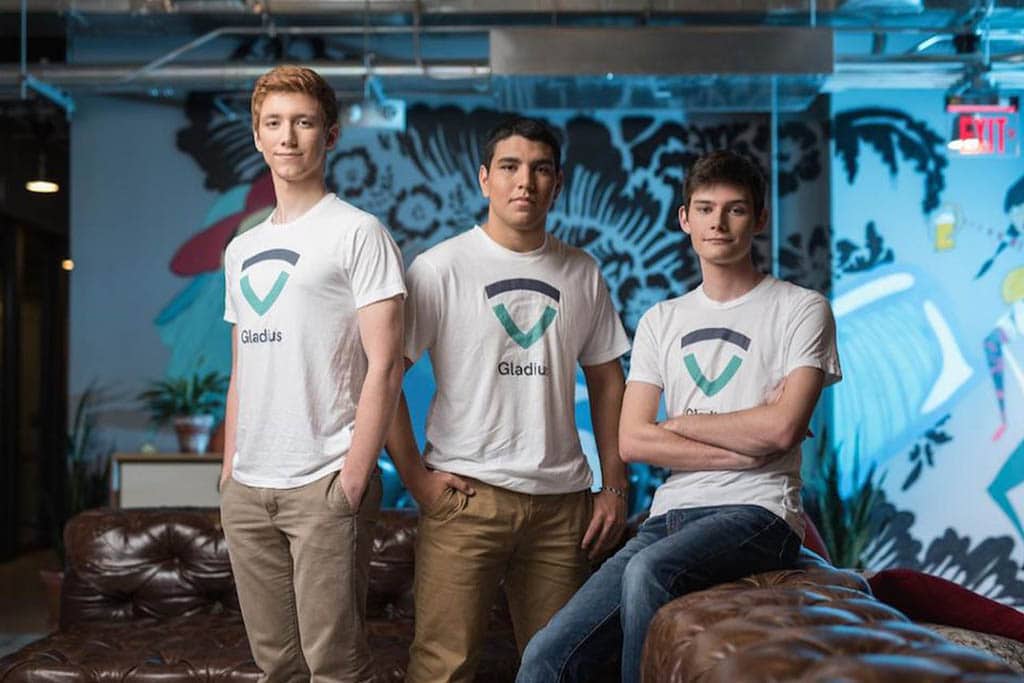

Gladius Network LLC self-reports to the SEC for overseeing an unregistered ICO enabling them to avoid penalties provided that they pay all the investors who request for a refund.

On April 5th, 2019, the SEC will have to announce their decision to either approve, deny or extend the decision-making period on Cboe/VanEck/Solid X’s Bitcoin ETF.

Here’s a look into the growing popularity of Security Tokens and the regulatory path for the token issuers lying ahead.

Digitex Futures, a non-custodial, zero-fee futures exchange with ultra-sleek user interface, and decentralized account balances hits a whooping 1 million signups for its waitlist.

Crypto mom Hester Pierce says that she can speculate the timing of Bitcoin ETF arrival, but doesn’t expect it to happen anytime this year.

The crypto-darling SEC commissioner Hester Peirce is explaining delays in a regulatory toolset for token offerings as she mobilizes financial authorities to work on a deliberate approach to digital assets.

According to Ric Edelman, the founder of Edelman Financial Engines, ETFs will eventually meet the demands of the SEC and get the Commission’s approval.

Autonomous technology startup Nuro said on Monday it raised $940 million from SoftBank Group Corp, which valued the Silicon Valley-based company at $2.7 billion.

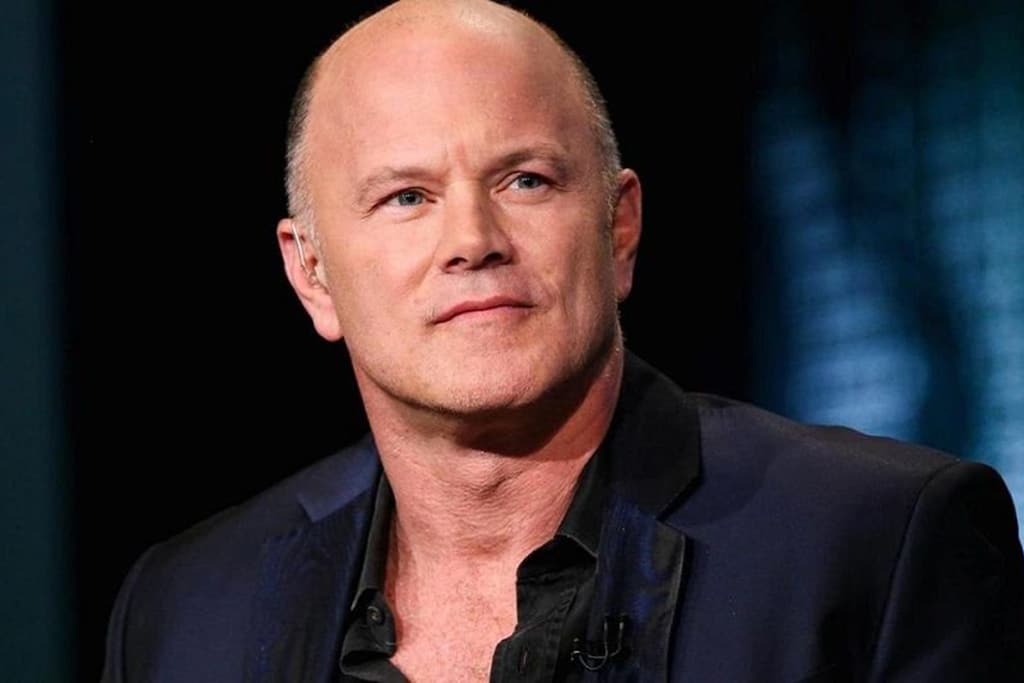

Mike Novogratz, the chief executive of the TSX-listed Galaxy Digital, made a surprising remark that came straight out of left field saying that he doesn’t understand why large macro funds don’t have a 1% position in Bitcoin (BTC).

SEC Commissioner Robert J. Jackson recently did an interview with Congressional Quarterly, a publishing company who report primarily on the United States Congress, where he expressed views that an SEC-approved Bitcoin ETF is inevitable.