March 5th, 2026

Jay Clayton said that ICOs should willingly follow securities laws which ensure higher protection of customers’ funds while eliminating fraud and manipulation.

As investors have been eagerly waiting for the Bitcoin price reversal after a continuous price-drop, here’s look into what experts from the crypto industry have to say.

The price of Bitcoin has plunged more than 9% in the last 24 hours following the announcement from the SEC that once again delays its decision on the rule change for a VanEck’s Bitcoin exchange-traded fund. The new deadline is February 27, 2019.

At the Digital Asset Investment Forum held in Washington D.C., a commissioner of the United States Securities and Exchange Commission (SEC), Hester Peirce said it’s better not to hold our breath waiting for a Bitcoin exchange-traded fund (ETF).

Warren Davidson, the biggest bitcoin enthusiast in Congress is set to introduce a new pro-ICO and crypto legislation. He believes that cryptocurrencies can thrive in a Federal-regulated environment.

The ICO market has exploded in the last two years attracting an ever-rising number of fraudsters. A SEC official now believes that international cooperation is crucial to bring the scammers to justice.

The U.S. District Court for the Southern District of California ruled a case between the SEC and Blockvest in favor of the ICO project.

With VanEck facilitating OTC trades for its Bitcoin ETF, there is a higher possibility that the SEC might approve its proposal.

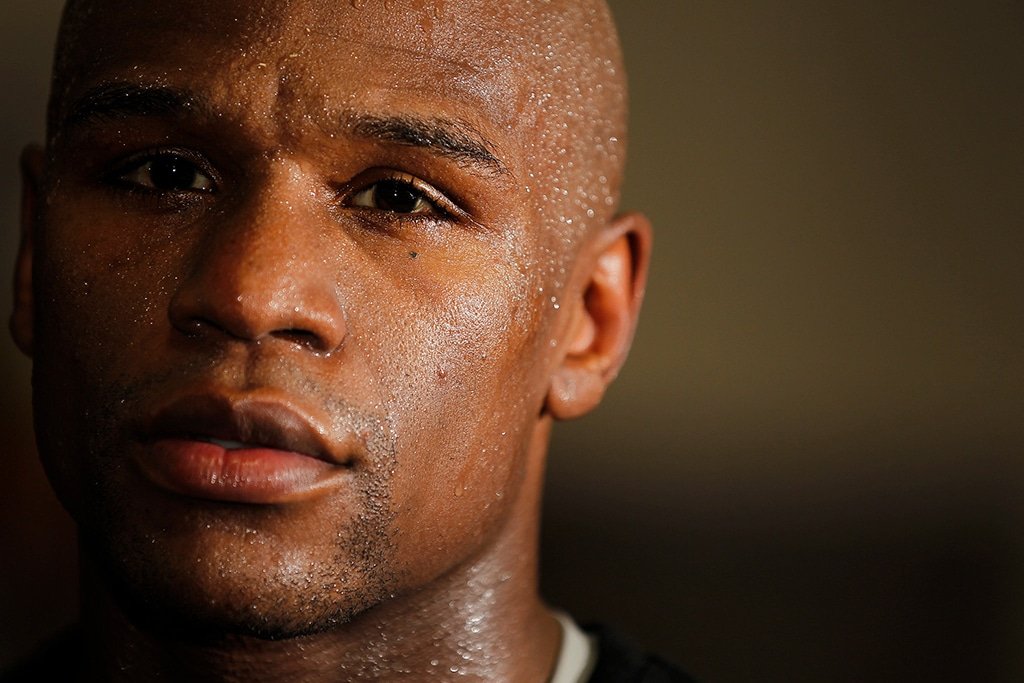

In its first cases, the SEC has brought violations against Floyd Mayweather Jr. and music producer DJ Khaled involving ICO promotion. The SEC noted that using celebrity endorsers was a crucial part of the ICO issuers’ promotional strategy.

Speaking at the Consensus: Invest conference, Clayton said that exchanges need to employ better surveillance tools to prevent market manipulation on its platform.

Maybe XRP cannot be classified as a security anymore. Max Rich, deputy counsel at the crowdfunding platform Republic says the SEC will use the DAO debacle that happened in the summer of 2016, as the cut-off point.

The notorious SEC does not truly kill ICOs in fact, the two regulations issued back in 2015 allowing companies to secure between $1 million and $50 million.

Ripple, the company that stands behind XRP, has definitely positioned itself strongly during the last few months as one of the most important companies for the crypto sector as well as the whole blockchain technologies scene.

Samuel Leach, crypto millionaire, founder and CEO of Yield Coin project, shares his vision of the current cryptocurrency landscape explaining the key issues faced by the industry.

The SEC notes that EtherDelta allowed its customers to trade ERC20 which were deemed as securities, and without registering with the agency.