What Does the Frequent Appearance of XRP Whales in December Mean? How Can Retail Investors Make Profits?

On December 20th, as the BTC price reached a $24K all-time high, the BTC price increase in December exceeded 20%, but XRP fell by 15%. What does the operation of these transfers mean? How much you know about XRP and how can investors follow the whale to make quick profits?

What is XRP?

“XRP is a digital asset built for payments. It is the native digital asset on the XRP Ledger—an open-source, permissionless, and decentralized blockchain technology that can settle transactions in 3-5 seconds. XRP can be sent directly without needing a central intermediary, making it a convenient instrument in bridging two different currencies quickly and efficiently”, this is the official explanation from Ripple’s website, a digital payments platform.

Unlike other cryptocurrencies, XRP is born to help people become independent of the traditional financial system. Ripple is used by institutional clients or banks for digital payments. It has become a popular method for cross-border remittances, which is more convenient and fast than other methods. XRP has lower fees and settles transactions in a matter of merely a few seconds. Ripple wasn’t created to replace fiat currency. However, one can speculate on the price movements of XRP to earn profits.

What are the Factors that Influence Its Price?

Ripple functions in a different way to other cryptocurrencies, thus there are many unique factors affecting the price of XRP.

- XRP supply

Unlike bitcoin, XRP coins are not produced by mining. Instead, it is minted by the company Ripple. Out of the total 100,000,000,000 supply of XRP, over 45 billion is currently in circulation. So the company takes control of its price in some way.

- Bank adoption of ripple

Ripple’s main clients are banks and other major institutions, like Bank of America, Royal Bank of Canada, and UBS. There are more and more companies adopting this technology, which naturally improves XRP’s price.

- Other mainstream cryptocurrencies

Investors who tend to look for the next potential cryptocurrency find XRP’s large market cap and low cost per coin as a buying opportunity. So when the digital currency market is rallying, ripple may follow. Just like what happened on December 16th. However, if the market turns bearish, XRP could drop fast as well.

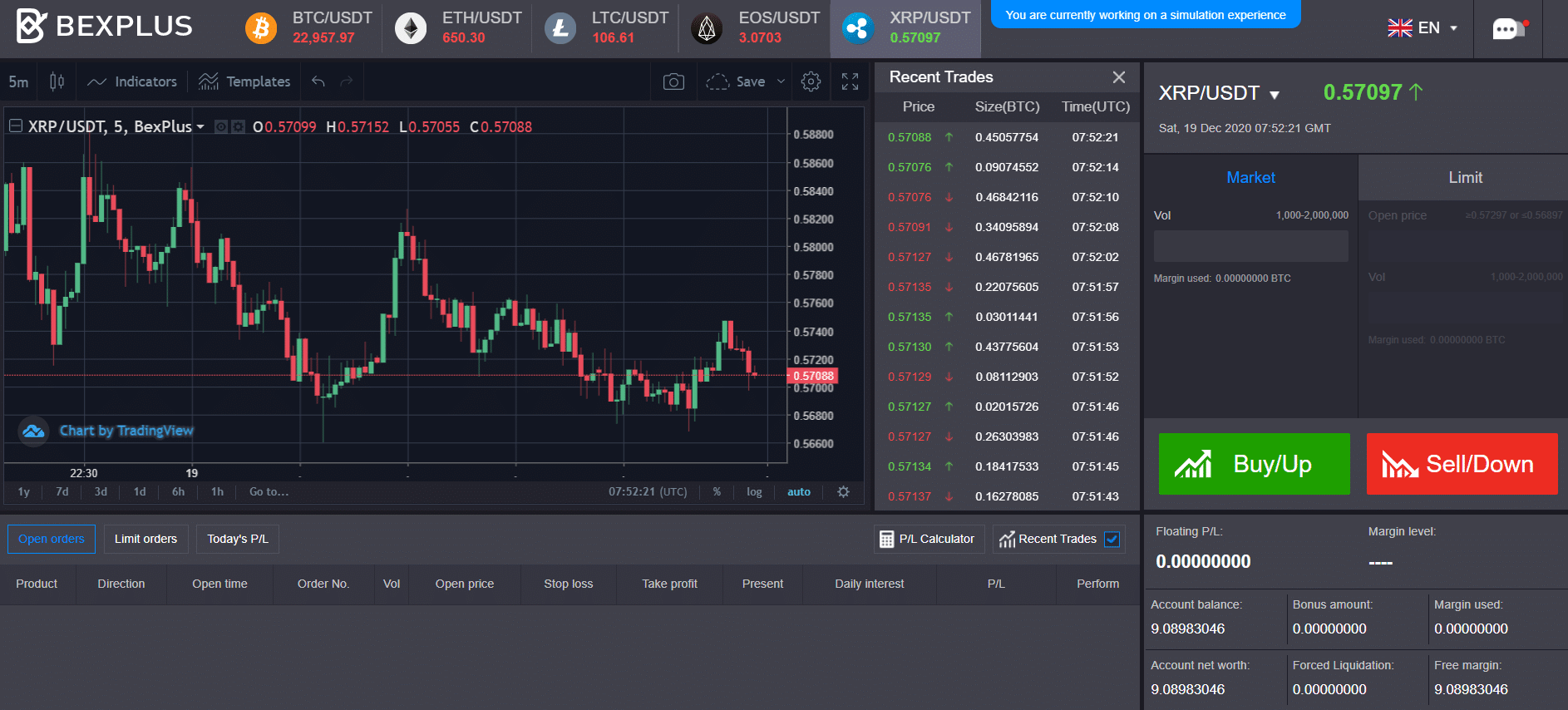

How to Trade Ripple with Bexplus?

Bexplus is a leading crypto derivatives platform offering 100x leverage in BTC, ETH, XRP, LTC, and EOS futures contracts. No KYC, no deposit fee, traders can receive the most attentive services, including 24/7 customer support.

- Create your trading account

Bexplus requires no KYC so you only need to open an account with an Email address, in just 1 minute. Once registration is completed, a trading account and a demo account with 10 BTC are opened automatically.

- Start demo trading with 10 Free BTC

No matter if you are a newbie or experienced trader, it is necessary to do simulation trading to get familiar with the crypto market as well as the platform. The successful traders will practice their skills and strategies carefully before they start real-time trading.

- Deposit BTC to start your ripple trading

After the simulation trading, it is time to gain your real profits. Copy BTC address or scan QR code in the deposit page to finish the transaction. If you would like to expand your fund and earn more profits, please do not hesitate to participate in the 100% Deposit Bonus activity, which can get you a corresponding bonus right after your deposit.

The bonus can be used as a margin and can be traded. For example, if you deposit 0.1 BTC, you will get a 0.1 BTC bonus, thus there are 0.2 BTC in total credited in your trading account. Each user can get up to 10 BTC for each deposit.

- Take good use of Take-profit and Stop-loss

To set a take-profit and stop-loss price is to prevent market violation. The preset price is based on how much loss you can bear and how much profit you want.

For example, you open a long position when the XRP price is increasing and you believe it will keep moving as you expected. But the market sometimes fluctuates strongly, one may encounter the forced liquidation if the price decreases sharply. Then it is suggested to set a take profit price and stop-loss price to protect your profit and lower your loss.

Disclaimer: This publication is sponsored. Coinspeaker does not endorse or assume responsibility for the content, accuracy, quality, advertising, products, or other materials on this web page. Readers are advised to conduct their own research before engaging with any company mentioned. Please note that the featured information is not intended as, and shall not be understood or construed as legal, tax, investment, financial, or other advice. Nothing contained on this web page constitutes a solicitation, recommendation, endorsement, or offer by Coinspeaker or any third party service provider to buy or sell any cryptoassets or other financial instruments. Crypto assets are a high-risk investment. You should consider whether you understand the possibility of losing money due to leverage. None of the material should be considered as investment advice. Coinspeaker shall not be held liable, directly or indirectly, for any damages or losses arising from the use or reliance on any content, goods, or services featured on this web page.