Vini Barbosa has covered the crypto industry professionally since 2020, summing up to over 10,000 hours of research, writing, and editing related content for media outlets and key industry players. Vini is an active commentator and a heavy user of the technology, truly believing in its revolutionary potential. Topics of interest include blockchain, open-source software, decentralized finance, and real-world utility.

Key Notes

- Former Binance Labs backs startup building decentralized trading infrastructure with CZ as advisor.

- The investment prioritizes alignment with vision of combining CEX sophistication and DEX privacy advantages.

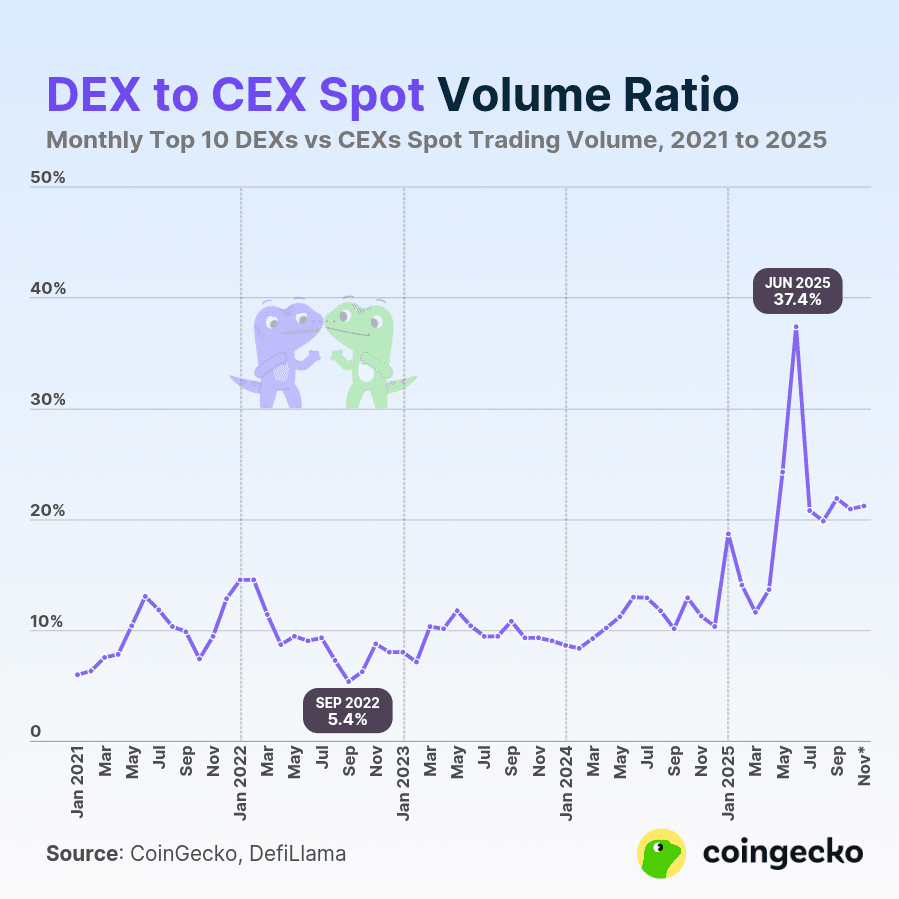

- DEX market share has grown from 6% in 2021 to over 21% by late 2025, signaling shift in trader preferences.

YZi Labs—formerly Binance Labs, Binance’s venture capital and investment arm—has announced a $10 million seed investment in Genius Terminal. Genius is described as a professional trading terminal for private, high-velocity onchain operations.

According to the announcement, Binance and YZi Labs co-founder Changpeng Zhao (CZ) has been nominated as one of the startup’s advisors under claims of “alignment” to YZi Labs’ vision of backing infrastructure to compete with centralized exchanges (CEXs). Armaan Kalsi, co-founder and CEO of Genius, is deemed to be “creating an on-chain Binance.”

“The funding is about alignment more than anything else; aligning with YZi Labs means we have the industry’s most thorough and well-resourced backer taking a meaningful swing at creating an ‘on-chain’ Binance, while focusing on what makes CEXs better than DEXs right now: privacy,” said Kalsi.

YZi Labs staff have also vouched for the startup and the mission it is aiming to accomplish. Head of YZi Labs Ella Zhang told how she met Armaan at the NYC Builder Bunker during a BNB Chain MVB demo and praised his attitude and vision. Additionally, Alex Odagiu, investment partner at YZi Labs, elaborated on the thesis that motivated this capital allocation, explicitly mentioning how Genius can offer a private experience with high-velocity execution.

“As the decentralized economy matures, the market is moving beyond basic tools toward a true execution layer with the sophistication of traditional financial terminals,” said Odagiu. “DeFi has long been fragmented and complex. By unifying liquidity and prioritizing privacy and high-velocity execution, Genius is well positioned to become a powerful ‘command center’ for the next generation of institutional and power users.”

DEX-CEX Volume Ratio Favors Decentralized Venues in 2026

According to the announcement and backed by publicly available data, the volume ratio between decentralized exchanges and centralized exchanges (DEX-CEX volume ratio) has been shifting favorably towards decentralized venues in 2026.

Crypto-native traders and other users have been favoring the use of DEXs over CEXs, enjoying the extra security and sovereignty layer of self-custody and credible neutrality blockchains can offer.

In November 2025, CoinGecko reported the exponential growth for the DEX-CEX ratio growing more than three times in the past five years—going from 6% in November 2021 to 21.2% by reporting time. Decentralized exchanges saw a peak of 37.4% market share in June 2025.

DEX to CEX spot volume ratio from January 2021 to November 2025 | Source: CoinGecko

Notably, centralized enterprises like Bitfinex have noted this trend and acted to strengthen their position in response, as Coinspeaker covered in December 2024. Bitfinex, in particular, cut its trading fees to zero in an attempt to regain market share.

On that note, another Binance-backed decentralized exchange and the leading DeFi protocol on the BNB Chain, PancakeSwap, has now proposed a supply reduction for its governance token CAKE, as Coinspeaker reported.

Disclaimer: Coinspeaker is committed to providing unbiased and transparent reporting. This article aims to deliver accurate and timely information but should not be taken as financial or investment advice. Since market conditions can change rapidly, we encourage you to verify information on your own and consult with a professional before making any decisions based on this content.