Tristan is a technology journalist and editorial leader with 8 years of experience covering science, deep tech, finance, politics, and business. Before joining Coinspeaker, he wrote for Cointelegraph and TNW.

Las Vegas Bitcoin miner CleanSpark is entering the AI data center market, leveraging its infrastructure expertise while the mining sector shows recovery signals.

Editor Marco T. Lanz

Updated

2 mins read

Editor Marco T. Lanz

Updated

2 mins read

Las Vegas-based Bitcoin BTC $71 255 24h volatility: 1.7% Market cap: $1.43 T Vol. 24h: $54.33 B mining firm CleanSpark announced plans to expand into the development and operation of artificial intelligence data centers and AI infrastructure.

According to an Oct. 20 press release, the firm seeks to capitalize on the experience it has gained establishing Bitcoin mining facilities to conduct rapid buildout operations in the AI sector.

— CleanSpark Inc. (@CleanSpark_Inc) October 20, 2025

Expanding into AI

CleanSpark has hired Jeffrey Thomas as Senior Vice President of AI Data Centers to oversee the expansion. Per the press release, Thomas previously orchestrated the Kingdom of Saudi Arabia’s multi-billion AI data center program.

Chief development officer Scott Garrison said, in a statement, the company had “recently contracted for additional power and real estate in College Park to deliver high-value compute to the greater Atlanta metro area.” He added that CleanSpark was evaluating further opportunities to build large-scale facilities.

CleanSpark’s expansion comes amid a moment of turbulence for the cryptocurrency and digital assets markets. After reaching new all-time highs in the $125,000 range in early October, Bitcoin retreated to around $105,000, as the entire crypto market fell. Bitcoin sits at about $111,000 as of the time of this article’s publication.

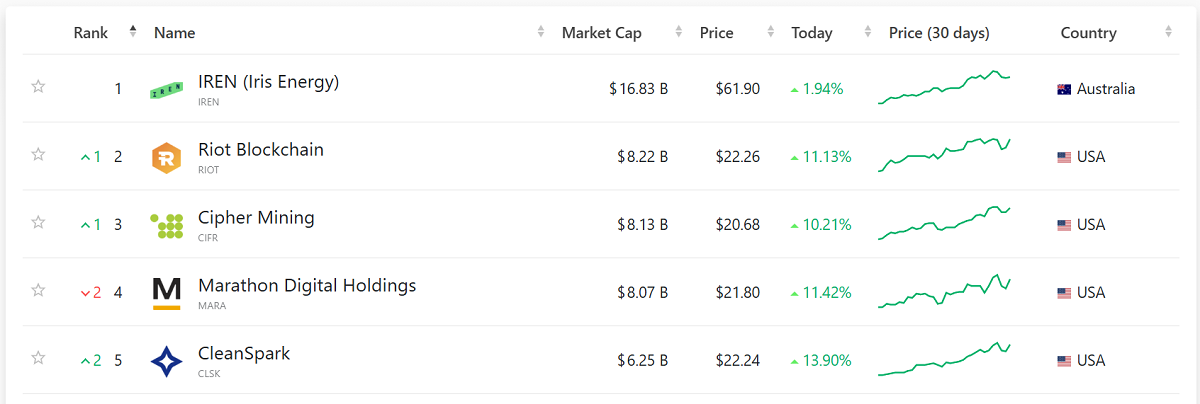

Despite the market downturn, miners appear to be showing signs of strong recovery to kick off the week of Oct. 20. Per data from Companiesmarketcap, nearly every Bitcoin mining firm in the top 20 by market cap is signaling a rising recovery pattern.

Nearly every major mining firm is bucking broader crypto market trends | Source: Companiesmarketcap

The top five Bitcoin mining firms by cap, IREN, Riot, Cipher, Marathon, and CleanSpark, are up an average of 9.72% for the past 24 hours, as of Oct. 20, with CleanSpark up nearly 14%.

Meanwhile, the market size for AI data centers seems to be growing at an exponential rate. Despite the fact that it is dominated by companies such as Nvidia, Microsoft, Meta, Google, Amazon, and IBM, there remains a strong demand for more entrants to the space.

According to analysts at Gartner, global AI expenditure is expected to reach $2 trillion in 2026, with growth largely driven by AI data center and infrastructure investment.

Disclaimer: Coinspeaker is committed to providing unbiased and transparent reporting. This article aims to deliver accurate and timely information but should not be taken as financial or investment advice. Since market conditions can change rapidly, we encourage you to verify information on your own and consult with a professional before making any decisions based on this content.

Tristan is a technology journalist and editorial leader with 8 years of experience covering science, deep tech, finance, politics, and business. Before joining Coinspeaker, he wrote for Cointelegraph and TNW.