With over 3 years of crypto writing experience, Bena strives to make crypto, blockchain, Web3, and fintech accessible to all. Beyond cryptocurrencies, Bena also enjoys reading books in her spare time.

Bitcoin led digital asset inflows with $486 million last week, while BlackRock’s IBIT topped Bitcoin ETFs with $40.48 billion in cumulative inflows, contrasting with Grayscale’s $21.89 billion outflows.

Edited by Julia Sakovich

Updated

3 mins read

Edited by Julia Sakovich

Updated

3 mins read

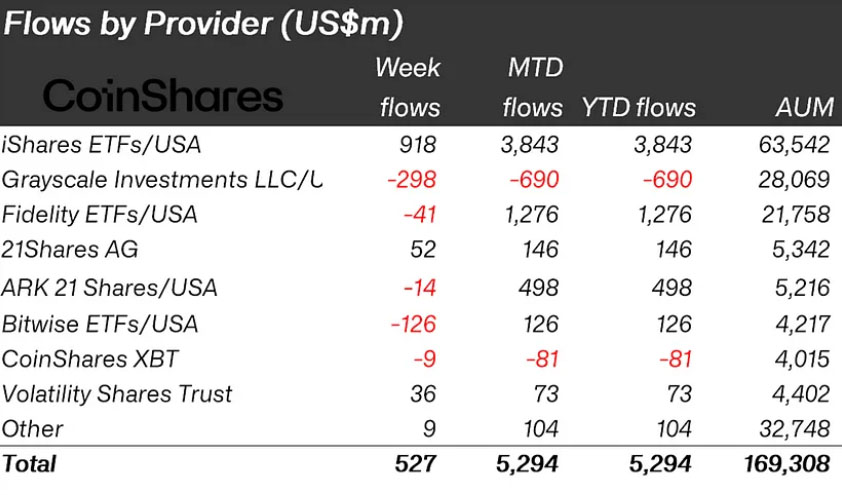

Crypto investment products saw a strong net inflow of $527 million last week, according to CoinShares. However, the ride was far from smooth. A massive $530 million outflow hit on Monday, triggered by DeepSeek-related concerns. But the market quickly bounced back, with over $1 billion flooding in later in the week.

Source: CoinShares

The swings reflect the volatile nature of investor sentiment, heavily influenced by broader market worries. Despite this turbulence, crypto investment products have already amassed $44 billion in inflows in 2024 and $5.3 billion year-to-date (YTD), indicating strong overall momentum.

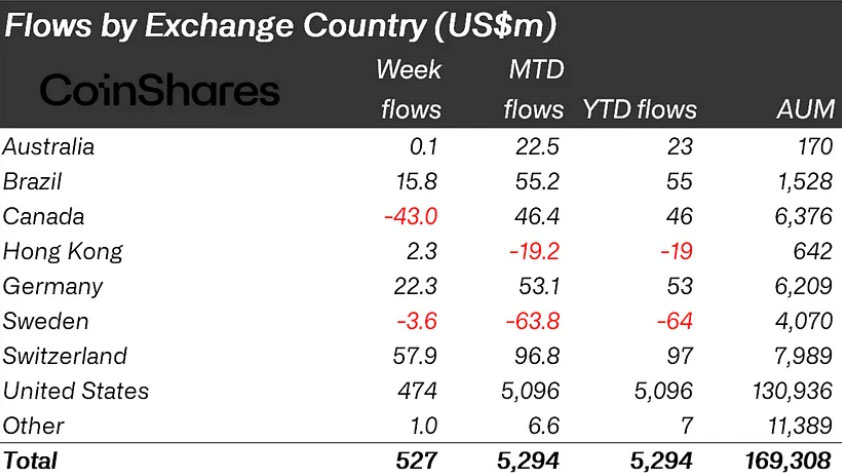

Looking at regional trends, the United States led with $474 million in inflows last week and $5 billion YTD. European investors contributed $78 million in new investments, bringing their total to $93 million YTD. Canada, however, bucked the trend with $43 million in outflows, possibly due to rising concerns over U.S. trade tariffs.

Source: CoinShares

Bitcoin BTC $108 241 24h volatility: 0.6% Market cap: $2.15 T Vol. 24h: $23.05 B continued to dominate investor preference, attracting a staggering $486 million in inflows last week. Short-bitcoin products also saw interest, recording a second consecutive week of inflows at $3.7 million. Meanwhile, Ethereum struggled to find traction. It ended the week with net-zero flows after experiencing early-week outflows, likely due to its exposure to the broader technology sector.

Among altcoins, XRP XRP $2.23 24h volatility: 0.2% Market cap: $131.83 B Vol. 24h: $1.66 B made a strong showing, bringing in $15 million last week and securing its spot as the second-best performing altcoin of the year with $105 million in inflows YTD. Blockchain equities also remained attractive, seeing YTD inflows of $160 million, as investors took advantage of price dips to buy in.

“XRP is now the 2nd best performing altcoin, seeing YTD inflows of US$105m with US$15m inflows last week,” the report said.

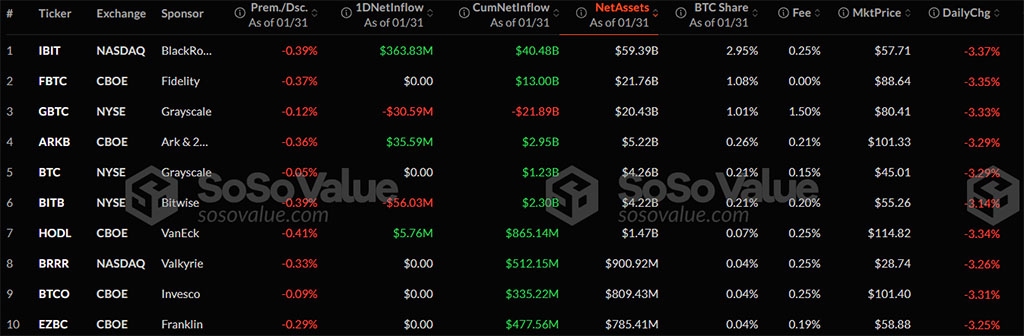

Spot Bitcoin ETFs played a crucial role in these gains. Their total cumulative net inflows have hit $40.5 billion as of January 31, 2025, reflecting the growing influence of institutional investors. However, daily net inflows have been inconsistent, standing at $318.56 million — far below the $802.50 million recorded on January 21.

BlackRock’s IBIT emerged as the biggest winner, securing an impressive $918 million in inflows. However, not all players shared in that success. Fidelity, Grayscale, and Bitwise collectively lost $465 million, offsetting some of the week’s gains.

IBIT now leads the Bitcoin ETF space with $40.48 billion in cumulative inflows, followed by Fidelity’s FBTC at $13 billion. In contrast, Grayscale’s GBTC continued its decline, shedding $30.59 million last week and bringing its total outflows to $21.89 billion. The downward pressure pushed IBIT’s market price to $57.71, marking a 3.37% daily drop.

Source SoSoValue

The ETF market remained highly active, with Bitcoin ETF trading volume reaching $3.45 billion on January 31. Bitcoin price hovered around $101,680, closely mirroring ETF movements. The highest trading day of the month came on January 23, when the total value traded peaked at $9.59 billion.

January’s ETF inflow trends have been largely positive, with multiple days surpassing $500 million in new investments. However, sharp outflows on January 14-15, amounting to -$209.82 million and -$284.19 million, respectively, highlight the market’s volatility.

Disclaimer: Coinspeaker is committed to providing unbiased and transparent reporting. This article aims to deliver accurate and timely information but should not be taken as financial or investment advice. Since market conditions can change rapidly, we encourage you to verify information on your own and consult with a professional before making any decisions based on this content.

With over 3 years of crypto writing experience, Bena strives to make crypto, blockchain, Web3, and fintech accessible to all. Beyond cryptocurrencies, Bena also enjoys reading books in her spare time.