Based on our research, the best short-term cryptocurrencies to buy have deep liquidity, high volatility, and sustained positive ma...

Based on our research, the best short-term cryptocurrencies to buy have deep liquidity, high volatility, and sustained positive market sentiment and attention, which is why Bitcoin sits at the top of our shortlist.

Other top short-term crypto to buy in 2026 that we’ve identified include BNB and Render. We chose BNB because it benefits from ongoing buybacks and burns, as well as its continued relevance in the Binance ecosystem. We selected RENDER for its relevance and sensitivity to AI narratives.

In this guide, we’ll share our top picks and our reasoning, along with our methodology and a framework for you to assess what the top short-term crypto is for you to buy. We’ll also go into the risks and considerations of short-term cryptocurrency trading.

Best Short-Term Cryptocurrencies: Our Top Picks

As the market trades sideways, but with subdued optimism, here are our strongest contenders for the best short-term cryptocurrencies right now.

Best for Fast Breakouts (High Momentum)

- Solana (SOL) – L1 with Proof of History mechanism for speed and staking rewards

- BNB (BNB) – The coin underpinning Binance, the CEX, and the Binance Smart Chain

- Render (RNDR) – Established AI-related coin with high liquidity

- Bittensor (TAO) – Bluechip AI project with high funding and institutional support

Best for Safer Short-Term Rotations

- Bitcoin (BTC) – The original coin has always been worth more in every bull run

- Ethereum (ETH) – Gas token of the Ethereum blockchain and various L2s on the EVM

- XRP (XRP) – One of the first cryptocurrencies designed for institutional use

Best for Meme Pumps

- Pepe (PEPE) – Meme coin based on the famous Pepe the frog character

- Dogecoin (DOGE) – Original memecoin with its own blockchain

- Shiba Inu (SHIB) – Large cap well known dog meme coin

Best for Early-Stage High-Risk Projects

- Bitcoin Hyper (HYPER) – Bitcoin L2, enabling smart contracts and cheap transactions

- Maxi Doge (MAXI) – New meme coin aimed at degen humor and perps traders

Best Short-Term Crypto in 2026 Review & Analysis

Here are our reviews of the best short-term crypto, along with our reasoning and analysis, as well as upcoming catalysts and other relevant information.

Solana (SOL) – L1 Blockchain with High Institutional and Retail Support

SOL is the gas token for Solana, which, according to CoinGecko, is the fastest functional blockchain. Solana also has low fees and high staking rewards, in part thanks to MEV rewards rather than simple inflation. It has several staking ETFs, with more on the way.

As one of the top cryptocurrencies by market cap, with institutional and retail support, liquidity is high, and price changes are frequent. Solana’s price is down with the overall market, but history has shown that SOL often rebounds well from lows, as in the case of the FTX crash, which brought Solana below $10.

Solana’s 7 Day net inflows exceeded BTC and ETH on December 16, 2025. Source: Lookonchain on X

Solana Summary

| Category | Layer 1 |

| Blockchain | Solana |

| Launch Status | Launched |

| Current Price | SOL $127.5 24h volatility: 1.7% Market cap: $72.14 B Vol. 24h: $3.69 B |

| Market Cap | $80.2B (Snapshot from CoinGecko, January 13, 2026) |

| Short-Term Strengths | Record-breaking SOL ETF inflows and the Firedancer and Alpenglow upgrades provide a potential catalyst for short-term growth |

| Tokenomics Highlights | Disinflationary with MEV rewards for stakers and 50% fee-burn to support price action |

BNB (BNB) – Binance Coin and Gas for the Binance Smart Chain

BNB is used within the Binance CEX and also as the gas token of BSC, Binance’s blockchain. BNB pays for trading fees and gas fees. Binance does regular buybacks and burns, and over the years, BNB is one of the few coins to consistently reach new all-time highs in bull markets.

Also, BNB’s cofounder, CZ, remains, for many, a highly regarded figure in crypto, which lends support to the coin and ecosystem, despite the fact that he was forced to step back due to legal issues.

Top dApps on the BNB Chain ecosystem showing the most active dApps and their user growth (Snapshot January 13, 2026). Source: BNB Chain Website

BNB Summary

| Category | CEX and blockchain gas token |

| Blockchain | Binance Smart Chain |

| Launch Status | Launched |

| Current Price | BNB $888.2 24h volatility: 0.5% Market cap: $121.15 B Vol. 24h: $1.21 B |

| Market Cap | $125.0B (Snapshot from CoinGecko, January 13, 2026) |

| Short-Term Strengths | BNB’s long-term resilience means that even if the market crashes, it will likely recover, making it safer for short-term trades in uncertain conditions |

| Tokenomics Highlights | Buy back/burns of CEX fees paid with BNB. Reduced trading fees for holders |

Render (RENDER) – Marketplace for Idle Graphics Cards’ Power

Render is a blue-chip AI project launched in 2020. Since AI is currently a trillion-dollar industry, Render’s GPU marketplace and network fit well with the short-term and longer-term metas of AI and decentralized processing power.

Unlike many older projects like Filecoin or Chainlink, which are still very relevant but whose tokens are underperforming, RENDER (formerly RNDR) reached a new all-time high in 2024. The coin dropped substantially in 2025, but may be in a good place for a recovery when the overall market recovers.

Render futures open interest and price (Snapshot January 13, 2026). Source: CoinGlass

Render Summary

| Category | AI and DePIN |

| Blockchain | Solana |

| Launch Status | Launched |

| Current Price | [NC] |

| Market Cap | $1.21B (Snapshot from CoinGecko, January 13, 2026) |

| Short-Term Strengths | High volatility and trading volume, combined with a relevant AI narrative |

| Tokenomics Highlights | A percentage of tokens used in the ecosystem are burnt, while 5% is reserved to pay for maintaining the network |

Bittensor (TAO) – Decentralized AI Model Training and Rewards

Bittensor is a challenger to big AI companies like OpenAI by creating a decentralized and open-source machine learning network. This allows people to train and be paid for training AI models, with the transparency of the blockchain.

TAO is used for transaction fees, DAO governance, and staking and validating, as well as paying out staking rewards. Miners contribute to the network by hosting machine learning and are rewarded in TAO.

Opentensor Foundation posted that the first TAO halving cycle happened. Source: X

TAO Summary

| Category | AI / DePIN |

| Blockchain | Subtensor (proprietary, built with Polkadot) |

| Launch Status | Launched |

| Current Price | TAO $238.8 24h volatility: 1.7% Market cap: $2.29 B Vol. 24h: $64.15 M |

| Market Cap | $2.7B (Snapshot from CoinGecko, January 13, 2026) |

| Short-Term Strengths | Demand for AI learning, high volatility, and high trading volume |

| Tokenomics Highlights | TAO’s max supply is 21 million tokens, with a halvening cycle |

Bitcoin (BTC) – Crypto’s First and Most Widely Adopted Coin

Bitcoin was launched in 2008 as the original (successful) digital and decentralized currency. Since then, newer coins and blockchains have been created, with faster speeds and smart contract abilities. This has led to a narrative of Bitcoin as the best crypto to represent digital gold.

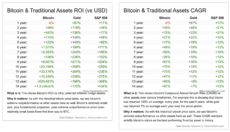

Bitcoin’s ROI and CAGR vs other assets. Source CaseBitcoin.com

While BTC currently performs more like a risk-on asset than gold, its high CAGR relative to other assets, deep liquidity, institutional investment via ETFs (exchange traded funds), and persistent achievement of new all-time highs in every bull cycle, make Bitcoin potentially the best crypto for short-term trades. And it is also most likely to rebound eventually, if caught in a bear market.

BTC Summary

| Project | Bitcoin |

| Type | Store of value / biggest decentralized currency |

| Blockchain | Bitcoin |

| Launch status | Launched (2009) |

| Current price | BTC $89 169 24h volatility: 0.8% Market cap: $1.78 T Vol. 24h: $40.13 B |

| Market cap | $1.83T (Snapshot from CoinGecko, January 13, 2026) |

| Short-term strengths | Institutional ETF adoption, improving regulatory clarity, Governments holdings |

Ethereum (ETH) – First Programmable Chain and EVM Tech Stack

While Bitcoin is often called the digital gold, Ethereum is famous for being the first decentralized computer, thanks to its smart contracts and programmability. In line with co-founder Vitalik Buterin’s vision, Ethereum serves as the base for many faster Layer 2s such as Optimism and Arbitrum.

Ethereum’s performance hasn’t been quite as strong or consistent as Bitcoin’s, but its lower market cap, institutional adoption, and high liquidity and volatility make it a good short-term crypto, particularly if you understand the ranges it tends to trade in.

Despite more blockchains than ever, Ethereum’s TVL continues to grow. Source: DefiLlama

ETH Summary

| Project | Ethereum |

| Type | Layer 1 |

| Blockchain | Ethereum |

| Launch status | Launched (2015) |

| Current price | ETH $2 941 24h volatility: 1.4% Market cap: $355.00 B Vol. 24h: $23.53 B |

| Market cap | $377.7B (Snapshot from CoinGecko, January 13, 2026) |

| Short-term strengths | Institutional ETF adoption, improving regulatory clarity, if treasuries resume purchases |

XRP (XRP) – the First Institutional-Grade Payment Rail

XRP is famous for its potential role in the future of banking and institutional needs. Since its inception in 2012, it has grown to comprise a full ecosystem and a blockchain called the Ripple Ledger (XRPL). As of 2025, Ripple began pouring fresh attention and money into the XRP Ledger, to attract developers to build DeFi apps.

While its use case is primarily targeted toward institutions, it’s a popular coin among retail crypto holders, with XRP one of the most searched for currencies in blockchain.

Reasons for developers to build on the XRP Ledger. Source. XRP Ledger

XRP Summary

| Project | XRP |

| Type | Banking and payment rails |

| Blockchain | XRP Ledger |

| Launch status | Launched |

| Current price | XRP $1.91 24h volatility: 1.7% Market cap: $116.19 B Vol. 24h: $2.21 B |

| Market cap | $124.9B (Snapshot from CoinGecko, January 13, 2026) |

| Short-term strengths | Institutional ETF adoption, large retail following, high liquidity |

PEPE (PEPE) – Cult Meme Coin with High Liquidity

Pepe the frog was launched as a meme coin in 2023, although there was an initial pump, holders who kept their bags until 2024 and beyond saw huge price spikes, making millionaires of many. While initial liquidity issues stopped some from cashing out, the coin has now matured and has high liquidity on a wide range of exchanges. Since then, PEPE, unlike many other meme coins, has continued to experience large spikes and dips, making it suitable for short-term trades, when considering timing.

Technical analysis based on indicators such as moving averages, pivots, and oscillators for Pepe on the 1-day charts (Snapshot, January 12, 2025). Source: TradingView

PEPE Summary

| Project | PEPE |

| Type | Meme coin |

| Blockchain | Ethereum |

| Launch status | Launched |

| Current price | PEPE $0.000005 24h volatility: 1.3% Market cap: $2.11 B Vol. 24h: $365.69 M |

| Market cap | $2.4B (Snapshot from CoinGecko, January 13, 2026) |

| Short-term strengths | Release of ETFs and potential adoption, cult following, and high liquidity |

Dogecoin (DOGE) – Original Dog Meme Coin

Dogecoin was famously created as a joke in 2013 to mock the proliferation of new cryptocurrencies. Fast forward to 2026, and it’s one of the biggest coins and top memecoins, with a high trading volume, and reasonably high volatility.

As well as having its own X account with 14M followers, Dogecoin has a community page on X with 15k members. Source: X

Like PEPE in 2026, Dogecoin has very high liquidity and trading volumes, making it easy to trade in and out. If retail enters crypto substantially, or institutions become bullish for memes, Dogecoin could be the next meme coin to explode in the short-term.

Dogecoin Summary

| Project | Dogecoin |

| Type | Meme coin |

| Blockchain | Dogecoin |

| Launch status | Launched |

| Current price | DOGE $0.13 24h volatility: 0.5% Market cap: $21.09 B Vol. 24h: $764.33 M |

| Market cap | $23.3B (Snapshot from CoinGecko, January 13, 2026) |

| Short-term strengths | Potential ETF adoption, cult following, high liquidity |

Shiba Inu (SHIB) – Meme Coin with Full Ecosystem and Active Community

Community support is one of the vital pillars of a memecoin’s ongoing popularity. Shiba Inu has attracted a large community through branding and expansion, with the coin part of the Shibarium blockchain and ecosystem, and tokenomics with regular buybacks and burns to support the price. As of 16th December, Coinbase offers SHIB US-regulated futures, which may bring Shiba Inu closer to institutional investors.

The Shib newspaper offers a way for community members to feel connected, while minting front cover NFTs. Source: Shiba Inu

Shiba Inu Summary

| Project | Shiba Inu |

| Blockchain | Shibarium |

| Launch Status | Launched |

| Current Price | SHIB $0.000008 24h volatility: 0.7% Market cap: $4.63 B Vol. 24h: $89.92 M |

| Market Cap | $5.0B (Snapshot from CoinGecko, January 13, 2026) |

| Short-Term Strengths | Highly-established dog-themed meme, and growing L2 ecosystem |

| Tokenomics Highlights | Frequent large-scale burns |

Bitcoin Hyper – Layer 2 Scaling Solution and Meme for BTC, Built on Solana

Bitcoin Hyper aims to add programmability to Bitcoin through its Layer 2, which uses the Solana EVM for speed. The project uses a canonical bridge and ZK proof technology to enable low-fee payments, smart contracts, dapps, and memes on BTC.

Bitcoin Hyper teasing a potential integration with the Lightning Network. Source: Bitcoin Hyper X

HYPER is also a meme coin with a mascot. Given the token’s connection to BTC and its presale status, this offers an opportunity that may correlate with Bitcoin’s overall performance, but with much greater volatility. It has potential as the next short-term 1000x crypto when the coin launches and another if it gets listed on Binance, however, this is an extremely speculative play.

Bitcoin Hyper Summary

| Category | Bitcoin Layer 2 / Meme |

| Blockchain | Bitcoin / Solana SVM |

| Launch Status | Presale |

| Current Price | $0.01362500 |

| Market Cap | $30.92M |

| Short-Term Strengths | Part of the high-momentum Bitcoin L2 narrative, with potential for post-launch exchange listings |

| Tokenomics Highlights | 40% staking rewards with a 7-day vesting lockup to reduce sell pressure on TGE |

Maxi Doge (MAXI) – Degen-Themed Dog Meme Coin

Maxi Doge is an irreverent meme coin that pokes fun at degen and gym bro culture, but also aims to attract them as a community. The Maxi X page shows that readers are engaged with the memes that are being shared, and the holder count is at 22,980. The price of MAXI is up by +11.80%, since the beginning of the presale, and could moon when the coin goes live, if the project manages to captivate a section of the meme audience. This gives it a chance to be the next best short-term penny crypto.

Maxi Doge meme commenting on a CZ (Binance Co-founder) tweet. Source: Maxi Doge X

Maxi Doge Summary

| Project | Maxi Doge |

| Type | Memecoin |

| Blockchain | Ethereum |

| Launch status | presale |

| Current price | $0.00027950 |

| Market cap | $4.51M |

| Short-term strengths | Meme will exit presale shortly, 72% staking rewards until that point |

Best Short-Term Crypto Compared

Here’s a table detailing the short-term gains potential, current price, market cap, and category for you to assess which cryptocurrency is right for your trading strategy.

| Coin | Short-term gains potential | Current price | Market cap | Category |

| Bitcoin (BTC) | Solid. Primary destination for institutional ETF capital and a market leader for rebounds. | BTC $89 169 24h volatility: 0.8% Market cap: $1.78 T Vol. 24h: $40.13 B | $1.8T | Store of value |

| Ethereum (ETH) | Moderate. Huge DeFi TVL and institutional interest with the best liquidity of any coin. | ETH $2 941 24h volatility: 1.4% Market cap: $355.00 B Vol. 24h: $23.53 B | $377.7B | Layer 1 |

| XRP (XRP) | Strong. Approved ETFs and new DeFi utility on the XRPL attracting retail and institutional investors. | XRP $1.91 24h volatility: 1.7% Market cap: $116.19 B Vol. 24h: $2.21 B | $124.9B | Payment rail |

| BNB (BNB) | Steady. High utility and consistent buy-back/burns lead to spurts of growth and relative stability. | BNB $888.2 24h volatility: 0.5% Market cap: $121.15 B Vol. 24h: $1.21 B | $125B | CEX / BSC gas |

| Solana (SOL) | Strong. Alpenglow upgrade and record-breaking ETF inflows. | SOL $127.5 24h volatility: 1.7% Market cap: $72.14 B Vol. 24h: $3.69 B | $80.2B | Layer 1 |

| Dogecoin (DOGE) | High. The original dog meme with high trading volumes and potential X payment integration. | DOGE $0.13 24h volatility: 0.5% Market cap: $21.09 B Vol. 24h: $764.33 M | $23.3B | Meme |

| Shiba Inu (SHIB) | Moderate. Meme cult following and SHIB futures on Coinbase. | SHIB $0.000008 24h volatility: 0.7% Market cap: $4.63 B Vol. 24h: $89.92 M | $5B | Meme / L2 |

| Bittensor (TAO) | Moderate. High volatility and momentum due to December 2025 halving event and AI. | TAO $238.8 24h volatility: 1.7% Market cap: $2.29 B Vol. 24h: $64.15 M | $2.7B | AI / DePIN |

| Pepe (PEPE) | High. Cult meme coin with high liquidity, frequent peaks, and potential for 2026 meme-ETF speculation. | PEPE $0.000005 24h volatility: 1.3% Market cap: $2.11 B Vol. 24h: $365.69 M | $2.4B | Meme |

| Render (RENDER) | High. Massive demand for decentralized GPU power in AI. | [NC] | $1.2B | AI / DePIN |

Our Methodology: What We Look For in the Best Short-Term Crypto Coins

We chose our short-term crypto coins using a set of criteria. Starting with the potential for short-term profit based on price action, to applicable narratives, appropriate fundamentals and tokenomics, micro and macro factors, market position, risk levels, and volatility.

Short-Term Profit Potential (45%)

We first considered ETF flows and potential speculation around new ETFs, with most of the currencies on this list either having an ETF or a high chance of an ETF approval in 2026. We also considered current market narrative cycles, such as a focus on AI, memes, and L2s.

Another factor to consider was price charts, looking at past all-time highs and lows and patterns, trading volume, as well as their relative strength to BTC and ETH.

Risk Level & Volatility (20%)

Here, we analyzed how volatile a token or coin is, as high volatility increases risk but also creates opportunities for timed trades in order to try to buy low and sell high. On the other hand, we also looked at more steady coins such as BTC and BNB, which, while also subject to volatility (as this is a feature of crypto), are also more likely to rebound more quickly, based on historical patterns.

We also considered high-risk coins, such as those in presales, to offer an asymmetric risk/reward profile.

Liquidity & Volume Trends (20%)

We looked at trading volumes across different timeframes and whether they are increasing or declining. Since open interest growth and perpetual funding rates can sometimes predict short-term moves, this was another factor that we included in our assessment.

Extremely high liquidity was something we looked for, as this makes positions potentially easier to trade in and out of, particularly in times of market stress.

Imminent Catalysts (15%)

We searched for protocol or on-chain developments such as partnerships with important players, performance upgrades, and mainnet and testnet releases. We also considered presales with upcoming launches, as this can be a catalyst for a price spike.

We also considered micro-market cycles, such as strong meme coin performance in 2026.

How to Evaluate Coins for Short-Term Profit Potential

If you want to perform an analysis of coins that have short-term potential, start by assessing your risk level.

Do you want a coin like BTC that has historically exceeded its all-time highs? Or one with more upside potential due to a smaller market cap? Another choice is active ICOs or early-stage projects with high growth potential but significantly greater risk.

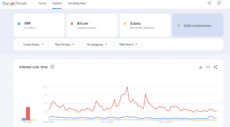

Once you’ve established that, check your coin for narrative attention. What are trusted blogs and news sites writing about? What sectors – e.g., AI or memes – are trending right now? Use social media sentiment tools, such as a Twitter checker like trends24.in, for very short-term analysis, and Google Trends to spot short to medium-term patterns.

Comparing search interest in XRP, Bitcoin, and Solana over the past 90 days. Source: Google Trends

Then, verify that your data matches the overall short-term patterns in trading history, using tools such as CoinGecko and TradingView. Check trading volumes and market caps to see how popular your token is, and assess liquidity.

Also consider on-chain data such as user metrics, TVL, and revenues, if applicable, from sites like DeFiLlama or L2 beat. Get a good sense of trading ranges for the cryptocurrencies you are considering, so that you can make carefully timed entries. You can check open interest trends on Coinglass or Coinalyze.

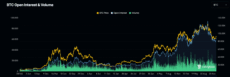

BTC Open Interest and Volume chart. Source: CoinGlass

Look out for technical upgrades or important news through official project social media accounts like X and Telegram, news sites, YouTube videos, project websites, and any other imminent catalysts that could affect the price. Also, take note of token unlocks as they can cause sell pressure, using a tool like Tokenomist.ai. Check ETF flows and approvals through data from The Block.

Finally, before trading, follow the news and consider macro events such as changing regulations or the US dollar, black swan events, global conflict, and interest rates/economic-related data. The crypto fear and greed index can be a useful metric to check. You may also wish to consult technical analysis tools such as those found on TradingView. Many traders rely heavily on technical analysis and often watch news or social media sentiment closely.

What Is a Short-Term Crypto?

A short-term crypto is one that is traded for its price movement and potential over days to weeks, rather than long-term hodling. The potential for its growth comes from volatility, attention, and timing.

Coins like BTC BTC $89 169 24h volatility: 0.8% Market cap: $1.78 T Vol. 24h: $40.13 B , XRP XRP $1.91 24h volatility: 1.7% Market cap: $116.19 B Vol. 24h: $2.21 B , ETH ETH $2 941 24h volatility: 1.4% Market cap: $355.00 B Vol. 24h: $23.53 B , and SOL SOL $127.5 24h volatility: 1.7% Market cap: $72.14 B Vol. 24h: $3.69 B , have strong long-term fundamentals that can help cushion downside relative to smaller-cap crypto currencies in a market downturn, and have historically delivered strong rebounds.

These coins also attract a lot of attention, which makes them more prone to speculation. Similarly, meme coins like PEPE PEPE $0.000005 24h volatility: 1.3% Market cap: $2.11 B Vol. 24h: $365.69 M frequently experience daily spikes of 6% and more, offering opportunities but also high risk. Meme markets and crypto presales coins tend to experience the most volatility and quick price changes, which can make them an option as a short-term crypto in a sideways market.

Coins in trending sectors like AI and ETFs are sensitive to overall narrative developments, again presenting opportunities and risks, such as a 7 day 74% gain in Render [NC] following a sector-wide rally.

Best Short-Term Crypto Trading Strategies in 2026

There are several short-term strategies, depending on market conditions and risk appetite. Short-term trading, from day trading to other time frames, is generally very risky, so all strategies should account for that.

Swing-style trading usually involves holding for days to weeks, often based on perceived short-term catalysts. This suits narrative and macro-driven investors who watch the news but don’t want to constantly monitor charts. Scalping is a shorter-term strategy, with positions often held for minutes to hours, aiming to take advantage of quick and frequent price changes. Price spikes may be smaller than with swing trading, but trades are quick, requiring more intensive chart watching, but over shorter time periods. Traders should also factor in the costs of regular trading and make sure fees don’t overtake profits.

These approaches are for context only and should not be considered recommendations.

What Are Short-Term Crypto Capital Gains Taxes?

Capital Gains Taxes (CGT) come into play when you sell, trade, or get rid of crypto at a profit. In most countries, crypto is taxed as property rather than as a type of currency. How long you have held the crypto is important when working out how much tax you owe.

In the US, if crypto is held for less than a year, it’s considered a short-term crypto. Since long-term crypto is usually given a preferential tax rate, this can represent a significant downside to short-term crypto trading, which is often taxed at ordinary income rates. In Germany, crypto held for over a year (under a certain threshold) is exempt from CGT.

For the most part, countries in the EU follow similar rules to the US, but there are exceptions. The January 1, 2026 DAC8 directive means that EU exchanges are legally required to automatically exchange data between exchanges and report to tax authorities.

Some countries, such as Singapore and the UAE, offer lower tax rates on crypto to tax residents, but for US citizens, taking advantage of this involves renouncing their US citizenship. Also, Singapore’s tax authorities may charge income tax for short-term crypto trading.

Factoring in tax and the organization needed to record and pay it correctly is an important consideration in deciding if short-term trading is for you. If in doubt, consult a local tax advisor or professional.

How to Buy the Best Short-Term Cryptocurrencies

Centralized exchanges are often the easiest way to buy crypto for the short-term as they tend to offer deeper liquidity and faster execution speeds for quick trading.

- Step 1. Choose a Tier 1 CEX that is easy for you to deposit into, with deep liquidity, such as Binance, Kraken, or Coinbase.

- Step 2. Fund your account with fiat and purchase stablecoins or the crypto you plan to trade.

- Step 3. Decide if you want to make on-chain swaps via a wallet, using providers like MetaMask or Best Wallet. If yes, send your coins to your decentralized wallet. If not, you are ready to trade.

- Step 4. Consider stop losses, trailing stops, take profit orders, and other risk management strategies.

Remember that slippage, fees, and volatility will affect your profitability, and that prices can change extremely quickly in crypto.

The Risks of Investing in Short-Term Cryptocurrencies

The main risk is that short-term cryptocurrencies offer an opportunity, but also carry a higher risk of losing your capital quickly and unpredictably.

Volatility

A feature of crypto is its large and frequent price swings over short time periods. This volatility creates the potential for quick profit, but also the potential for sudden loss in an ultimately unpredictable market. Volatility is a double-edged sword that can amplify both your gains and losses.

Liquidity Risk

Not all cryptos have deep or consistent liquidity. This can mean an inability to cash out of profitable positions, such as some PEPE traders in the early days of the coin’s ascent. Liquidity issues can also lead to high slippage when trying to buy or sell, particularly if there is market stress. CEXes often have the strongest liquidity for established coins but are also subject to failures and hacks, as are web3 protocols.

Bitcoin dropped to below $17K after the fall of exchange FTX, showing the power of black swan events. Source: CoinGecko

Bear Markets and Black Swans

In a bear market or after a black swan event, the majority of the market can drop sharply and remain at much lower levels than before. These events are hard to impossible to predict, and may leave you with permanent losses.

Should You Invest in the Best Short-Term Crypto Coins?

To make this investment decision, weigh the potential benefits against the key risks, then align it with your risk tolerance and financial goals.

The benefits are exposure to sharp short-term price movements for short-term traders and the ability to make use of narrative or event-related information.

The risks, though, are rapid and unpredictable price swings, a higher risk of losing money compared to holding or other types of financial trading, and extreme sensitivity in the crypto market to sentiment shifts, macro developments, and geopolitical world movements.

Investors should always bear in mind that history doesn’t repeat, but it often rhymes, and past performance is never a guarantee of future price action. Consider your risk tolerance and do due diligence.

Conclusion

Overall, our methodology has led us to large, established coins such as Bitcoin and XRP, which have historically retained or regained interest and are subject to volatility suitable for short-term cryptocurrency speculation.

We also chose narrative coins with good historical performance, such as in the AI sector. Established memes play an important part due to their inherent volatility, while the presales and early-stage projects we considered typically carry the highest risk but can offer short-term price spikes.

Make sure to do your own evaluation when choosing a short-term crypto, consider your financial situation, and don’t invest more money than you can afford to lose.

FAQ

What is the best short-term crypto?

What is a short-term crypto?

Can you make $100 a day with crypto?

Are short-term cryptocurrencies risky investments?

Should I invest in short-term crypto coins?

What are the best short-term crypto trading strategies?

References

- Comparative Analysis of Bittensor and Render Assets (Messari)

- Memecoins, Pump.fun, and the Role of Solana KOLs (Galaxy Research)

- State of the 2026 Crypto Market: Bullish Catalysts and Risks (Binance Square)

- Solana ETF Net Inflows: 7-Day Performance vs BTC and ETH (Lookonchain on X)

- 2026 Digital Asset Outlook: Dawn of the Institutional Era (Grayscale Research)

- Clearing the Decks: Bitcoin On-Chain Market Structure Jan 2026 (Glassnode Insights)

- Monthly Market Insights: January 2026 Turning Point (Binance Research)

- Early 2026 Rally: Altcoin Amplification and ETF Flow Recovery (Amberdata)

- The 2026 Crypto Crime Report: Maturation of On-Chain Ecosystems (Chainalysis)

- Future of Crypto: 5 Infrastructure and Treasury Predictions for 2026 (SVB)

- Bitcoin 2026: From Mispricing to Macro Recovery (Bitwise)

- Meme Coin ETFs to Be Launched By 2026, Says Senior Bloomberg Analyst (Binance)

Coinspeaker in Numbers

Monthly Users

Articles & Guides

Research Hours

Authors

VerifiedX (VFX) has officially launched, offering a Bitcoin-inspired decentralized network with unique on-chain features. Learn wh...

BMIC doesn't have a fixed presale end date yet. The team said they want to keep things flexible and let demand dictate when it wra...

Fact-Checked by:

Fact-Checked by:

34 mins

34 mins

Otar Topuria

Crypto Editor, 35 postsI’m a crypto writer and analyst at Coinspeaker with over three years of experience covering fintech and the rapidly evolving cryptocurrency landscape. My work focuses on market movements, investment trends, and the narratives driving them, helping readers what is happening in the markets and why. In addition to Coinspeaker, my insights and analyses have been featured in other leading crypto and fintech publications, where I’ve built a reputation as a thoughtful and reliable voice in the industry.

My mission is to demystify the crypto markets and help readers navigate the noise, highlighting the stories and trends that truly matter. Before specializing in crypto, I worked in the IT sector, writing technical content on software development, digital innovation, and emerging technologies. That made me something of an expert in breaking down complex systems and explaining them in a clear, accessible way, skills I now find very useful when it comes to unpacking the intricate world of blockchain and digital assets.

I hold a Master’s degree in Comparative Literature, which sharpened my ability to analyze patterns, draw connections across disciplines, and communicate nuanced ideas. I’m particularly passionate about early-stage project discovery and crypto trading, areas where innovation meets opportunity. I enjoy exploring how new protocols, tokens, and DeFi projects aim to disrupt traditional systems, while also evaluating their potential risks and rewards. By combining market analysis with forward-looking research, I strive to provide readers with content that is both informative and actionable.