HYPER Hits $6M Milestone: Could This Layer-2 Token Be August’s 100x Breakout?

Bitcoin (BTC) may be stalling under $120,000 as some investors shift capital across the market.

That slowdown hasn’t touched Bitcoin Hyper (HYPER). In less than two months, it has pulled in nearly $6 million, averaging $103,800 per day.

Most of that surge came in July, with over $4 million raised after Bitcoin’s new all-time high on July 15.

The draw is clear. Bitcoin Hyper is the first Layer-2 to integrate the Solana Virtual Machine (SVM) with Bitcoin. It extends Bitcoin’s utility, while its native token, HYPER, powers a faster execution layer on top of the Bitcoin network.

Getting in at this early stage, if Bitcoin Hyper delivers the scalability and programmability it’s aiming for, could set the stage for outsized returns. In strong market conditions, moves of 100x have precedent.

With funding closing in on $6 million, attention is turning to how long this window will stay open. No hard cap has been announced, but presales rarely run without a target.

For now, early backers can still buy HYPER at $0.01245 for the next eight hours before the price moves higher in the next round.

Rate Cuts, Bitcoin Highs, and the Altcoin Surge HYPER Aims to Ride

August is closing in, and Bitcoin is at a crossroads. It could make another push before September or start its cooldown early.

Investors are watching the Federal Reserve meeting for signals. U.S. Fed Chair Jerome Powell faces fresh pressure from President Donald Trump to deliver a rate cut, a demand the White House repeated just this past Sunday.

Lower rates have historically supported crypto prices. Looser monetary policy pushes liquidity into the market, often finding its way into risk assets like BTC and altcoins.

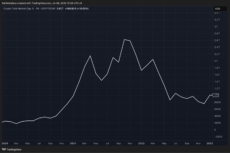

In 2020, near-zero rates sent crypto’s market cap from $190 billion at the start of the year to over $750 billion by year-end, nearly quadrupling in twelve months. Gains carried through 2021 until the Fed began raising rates in March 2022.

Source: TradingView

Conditions differ in this cycle, but rate policy remains a key driver. Institutional participation has also added consistent buy pressure. Strategy’s recent $2.4 billion BTC purchase from Preferred Stock proceeds is a prime example.

If Bitcoin hits a new all-time high in August, altcoins could follow just as they did over the past two weeks.

In that scenario, Bitcoin Hyper’s position as a BTC-linked Layer-2 becomes a pitch that could be difficult for investors to ignore.

Bitcoin Hyper: The Layer-2 Solution Supercharging BTC for the Fast Lane

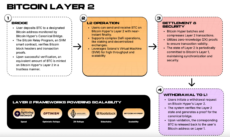

Bitcoin Hyper is the first Layer-2 to integrate the Solana Virtual Machine (SVM) with Bitcoin, unlocking speed and low-cost transactions that the base network cannot deliver on its own.

The breakthrough comes through its bridge technology. This serves as the entry point into an ecosystem where a single BTC can power dApps across DeFi, gaming, memes, and more – all inheriting Solana’s fast, efficient settlement.

Users, whether developers or dApp participants, access Bitcoin Hyper by locking BTC in the bridge. A wrapped BTC is minted, which can then move freely across applications built within the Bitcoin Hyper ecosystem.

In its current form, Bitcoin is used primarily as a store of value, rarely as a medium of exchange. Wrapped BTC on Bitcoin Hyper changes that. It can serve as payment within the ecosystem’s payment apps or function as currency for games and DeFi protocols.

BTC locked in the bridge stays secured on the Bitcoin network, released only when the original depositor withdraws.

This structure anchors Bitcoin Hyper to the security of the Bitcoin network while extending its reach with performance that mirrors Solana without the network congestion.

What Makes Bitcoin Hyper the Hottest Altcoin Pick for August?

Indeed, its structure is what gives HYPER its strength as an altcoin. As a Layer-2 token, it sits in a category where valuations have climbed into the billions. Mantle (MNT) holds a $2.6 billion market cap, Arbitrum (ARB) sits at $2.1 billion, and Optimism (OP) is around $1.2 billion.

Source: CoinGecko

Bitcoin Hyper is distinct from the aforementioned, which operate on top of the Ethereum blockchain with no direct link to Bitcoin. As touched on earlier, Hyper expands what can be done with BTC while staying anchored to its security.

Within the Bitcoin Hyper ecosystem, HYPER is the primary currency for transactions. As development progresses, it will also gain governance capabilities and additional utility across applications.

In effect, HYPER provides indirect exposure to Bitcoin, with the added benefit of participating in a high-performance Layer-2 network.

As the market shifts toward a future where utility will be essential to sustain Bitcoin beyond mining rewards, projects like Bitcoin Hyper become increasingly relevant.

August could then be a pivotal month. The project is still in its presale stage, the earliest point for anyone looking to secure allocation. At this stage, the token price is typically at its lowest, before broader investor participation and exchange listings.

History has shown that when strong Layer-2 projects transition from presale to market, returns in the triple digits are possible. For early Bitcoin Hyper backers, a 100x move is not an unrealistic scenario.

Bitcoin Hyper Nears $6M – Is the Presale Close to Wrapping Up?

The $6 million mark could be reached within hours, which could push the project closer to its hard cap.

For now, the opportunity to secure HYPER at presale pricing is still open. Head to the Bitcoin Hyper website to purchase while the current round is live. Tokens can be bought using SOL, ETH, USDT, USDC, BNB, or even a credit card.

For a streamlined experience, Best Wallet offers direct access. HYPER is listed under Upcoming Tokens, making it easy to track, manage, and claim once live.

Join the Bitcoin Hyper community on Telegram and X to stay updated.

Visit the Bitcoin Hyper Token site for full details

Disclaimer: This publication is sponsored. Coinspeaker does not endorse or assume responsibility for the content, accuracy, quality, advertising, products, or other materials on this web page. Readers are advised to conduct their own research before engaging with any company mentioned. Please note that the featured information is not intended as, and shall not be understood or construed as legal, tax, investment, financial, or other advice. Nothing contained on this web page constitutes a solicitation, recommendation, endorsement, or offer by Coinspeaker or any third party service provider to buy or sell any cryptoassets or other financial instruments. Crypto assets are a high-risk investment. You should consider whether you understand the possibility of losing money due to leverage. None of the material should be considered as investment advice. Coinspeaker shall not be held liable, directly or indirectly, for any damages or losses arising from the use or reliance on any content, goods, or services featured on this web page.