Tether will Relocate to El Salvador After Securing DASP License

Tether is moving to El Salvador and will collaborate with the authorities for innovative projects while pushing for the adoption of stablecoins.

Business news features trending events about all activities that relate to daily business engagements around the world.

Explore the latest business news today about high-profile deals, the world’s biggest investors, key initial public offerings (IPOs), ambitious startups, and more.

The primary goal of every business is to make a profit. Making profit involves various economic and commercial activities such as operations, investments, financing, etc.

For the most part, a business starts with a business idea (the thought) and a name. Subject to the idea of the business, broad statistical surveying might be important to decide if transforming the thought into a business is plausible, and if the business can convey an incentive to customers. The business name can be one of the most significant resources of a firm; cautious thought should, in this manner, be given while picking a business name. Organizations working under invented names are usually enlisted with the regulatory bodies. The ownership of a business can either be in a sole proprietorship or a form of partnership among shareholders, although most of the top firms in the world today are jointly owned.

Most organizations are usually based on the structure of a strategy for continuous growth and expansion, which is a conventional record itemizing a business’ objectives and targets, and its systems of how it will accomplish the objectives and destinations. Marketable strategies are practically fundamental when getting capital to start business activities.

It is equally essential to decide on the legal framework of a business. Based on the nature of a business, there might be need to obtain suitable grants, stick to staffing prerequisites, and get licenses to lawfully work. In numerous nations, business firms are viewed as a juridical entity, this implies that they can possess property, procure debt, and be charged in the court of law.

Coinspeaker offers you cutting edge business news and headlines on the world’s most important companies as it relates to their services, operations, and market involvements.

Tether is moving to El Salvador and will collaborate with the authorities for innovative projects while pushing for the adoption of stablecoins.

Bitcoin has corrected by over 15% from its recent all-time high of $108K dampening hopes for a traditional Santa Claus rally this holiday season.

If successful, Bitbank intends to invest in emerging technologies like AI, diversifying beyond the crypto market.

Circle is entering the Hong Kong market to drive the adoption of USDC among retail and institutional investors.

As the US presidential election nears, a record-setting $25 million Bitcoin options trade on Derive highlights growing institutional bets on a post-election Bitcoin rally.

Fold is set to go public following a merger with FTAC Emerald, with potential stockholder gains reaching $419.75 million depending on Bitcoin’s value.

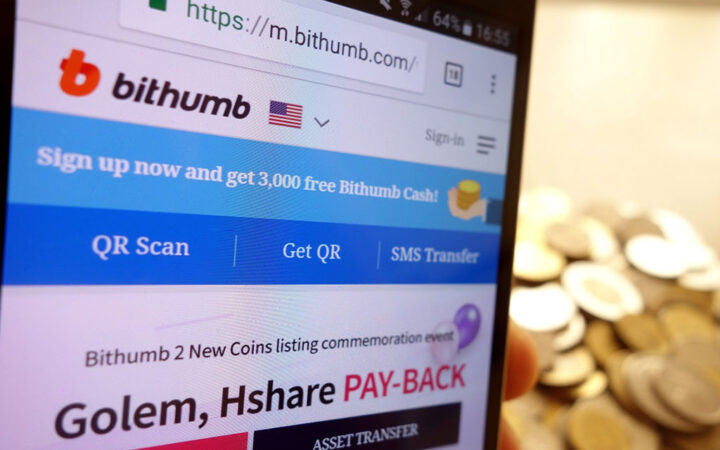

Bithumb eyes US expansion through a potential listing on the country’s stock exchange Nasdaq in 2025.

Blockdaemon entered the crypto scene in 2017 and has since then established itself as a leading infrastructure provider, offering products such as node deployment, staking, and API access to businesses across the space.

Animoca plans for a public listing but has not decided on a location or a timeline, with Siu citing market status as a deciding factor.

World Liberty Financial will sell non-transferrable WLFI tokens, which “are pure governance tokens, only providing the right to make proposals and vote on matters related to the platform.”

Hong Kong aims to stay ahead in fintech by issuing AI guidelines, seeking both innovation and stability.

Since this year began, ARK Invest has initiated multiple offloads of COIN shares. Right before it presented ìs Q2 earnings reports, the company offloaded 12,077 Coinbase shares worth $2.7 million.

Samsung Next will be part of the Soneium Spark Incubation Program by Startale Labs and support a community of creators and builders poised to shape the future of Web3.

Despite its massive user base, Telegram has yet to break even, raising concerns about its long-term viability.

Creditors of Ionic Digital, a crypto mining firm linked to Celsius, are considering liquidating the company due to delays in its public listing plans.