Startup EtherSport Announces ICO to Develop Innovative Sports Betting Platform

Blockchain-based startup EtherSport announced the launch of token sale on November 13th, 2017 to develop ground-breaking sports betting platform,

Stay ahead of the crypto curve with in‑depth coverage of the digital‑asset ecosystem. Here you’ll find the latest on new coin launches, regulatory shifts, wallet innovations and market movements across major chains. Whether you’re a seasoned trader or just exploring the space, our timely updates offer clarity on the crypto universe’s fast‑evolving landscape.

Blockchain-based startup EtherSport announced the launch of token sale on November 13th, 2017 to develop ground-breaking sports betting platform,

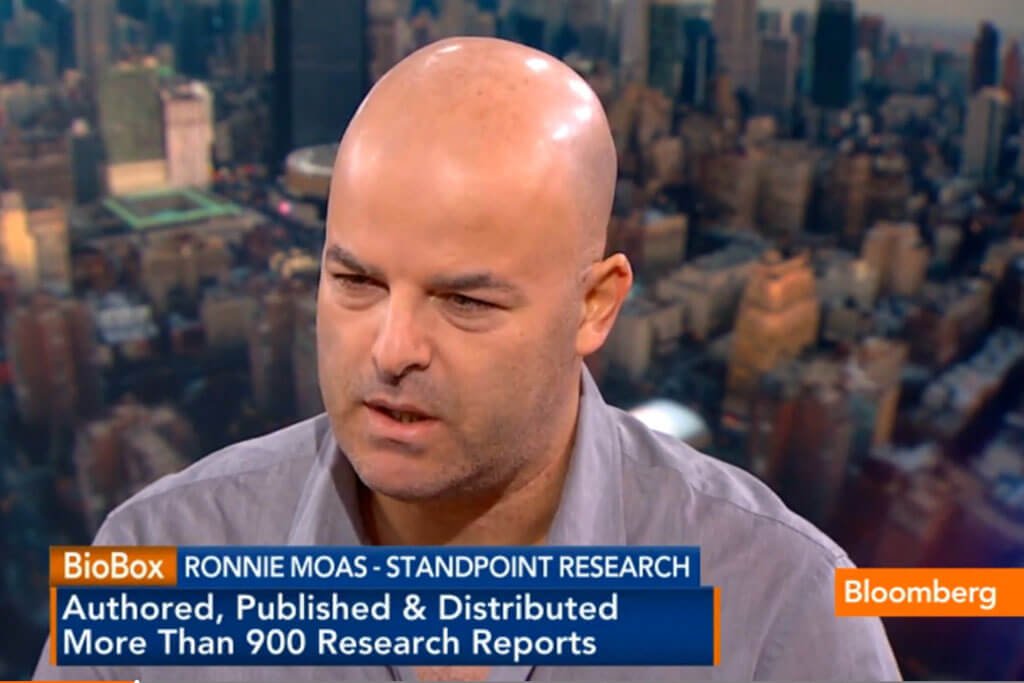

According to the stock research analyst, the digital currency will reach significant adoption in the next years and even catch tech giant Apple in terms of market cap.

What if every time you shopped online you got paid? What if for every order your purchased from the likes of Amazon, Walmart, Target, etc. that increased the value of the dollar?

Initial Coin Offering (ICO) or token sale require a lot of time and effort to run a digital token ecosystem, and because of that, many businesses fail on their ICO alone. This is what blockchain-based startup Simple Token is hoping to aid.

After CME Group decided to launch trading for Bitcoin futures contracts, the Mercado de Termino de Rosario, Argentina’s biggest futures market, considers offering services for investors in digital currencies.

Total cryptocurrency market capitalization has reached $200 billion as Bitcoin price gains over 5.68% hitting new all-time high of more than $7400.

Privatix aims to change the Virtual Private Networks (VPNs) market, by providing decentralised VPN services.

BTCC founder Bobby Lee discuses SegWit2x and China’s bitcoin exchange ban on Reddit AMA.

With the latest offerings, remote workers can now receive wages from their employers, and employers can fund payrolls in any of the new 18 currencies.

Monaize, an e-banking platform for freelancers and small businesses, and Komodo, a blockchain-based ICO platform, teamed up to conduct the world’s first decentralized ICO (dICO).

The U.S. regulators are getting concerned about the ICOs celebrity promotion calling it “unlawful”.

Ethereum founder has unveiled his plans aimed and the cryptocurrency’s technical development.

Privatix, the decentralized and 100% autonomous P2P VPN Network on blockchain tech, announced that it has recently reached its soft cap in the preliminary rounds of its ICO.

The price of bitcoin has reached yet another all-time high this week, rising past $7,000 for the first time.

The Etherecash Pre-ICO campaign will run from October 25th, 2017 until November 7th, 2017. The full ICO campaign will begin November 15th, 2017 and finish on December 19th, 2017.