BlackRock CIO Hints at Boosted Bitcoin Allocation in Portfolios

Rieder remains optimistic about Bitcoin’s potential, citing the increasing acceptance of the cryptocurrency as an asset class.

For the average millennial or at least anyone that pays attention to the business world, the term “cryptocurrency” would not seem like such a strange word. If that is, then the terms Bitcoin, Ethereum or at least Blockchain should ring a bell. One might wonder, why are these terms suddenly so prevalent, especially cryptocurrency news? Computing is getting rather pervasive and the society is leaning towards digital services. The finance world too isn’t spared as the disruption of technology into this sector has fostered the birth and development of Fintech organizations.

These Fintech organizations look to digitize payments and transactions, offering the same services that are currently in existence but in a better, efficient and more effective way.

Blockchain is the network upon which most of these cryptocurrencies operate on. The history of blockchain and bitcoin, in particular, does not have a definite story. In 2009, an individual or group of individuals known to be “Satoshi Nakomoto” developed and published the technology to allow people make digital payments between themselves anonymously without having an external party to verify or authorize the transfer of the currency being exchanged.

Although technologies like this might seem rather complex, understanding how Blockchain works is quite easy, given that one has a basic idea of how networks work. Blockchain is simply a database shared between several users, containing confirmed and secured entries. It is a network, where each entry has a connection to its previous entry.

This technology affords a very secure model whereby every record in the database cannot be tampered with. Apart from the stellar security that this network offers, the transparency and speed at which the network operates give it an edge over the conventional way of conducting transactions.

In simple terms, cryptocurrencies are just monies in digital form, transacted via digital means and over a digital network. The transfer of these currencies is utilized with cryptography and the aforementioned blockchain network. Up until the 2010s, cryptocurrencies were not really known until Bitcoin made its breakout and this gave rise to the birth of new cryptocurrencies.

Cryptocurrencies have had their fair share of bullish and bearish trends, going to show how unstable they can be. The latest cryptocurrency news reports lots of people predicting prices for various cryptocurrencies in the years to come but no-one can say for sure.

Blockchain, on the other hand, is making its way into pervasive computing, especially IoT, giving way for the development of new solutions that embrace data security and transparency.

Rieder remains optimistic about Bitcoin’s potential, citing the increasing acceptance of the cryptocurrency as an asset class.

On average Bitcoin price has rallied by 11% during the Chinese New Year. Analysts also expect the pre-halving market rally to continue with BTC price going to $51,000.

Hamad Al Mazrouei, CEO of the ADGM registration authority, described the collaboration as a “key milestone” in strengthening ADGM’s position in the blockchain sector.

A Type 1 prover represents the utmost compatibility with the Ethereum blockchain, requiring no modifications to any Ethereum component for proof generation. This includes hash functionality, storage structure, or any consensus logic.

Six Republican senators express “great concern” to SEC Chair Gary Gensler about the regulator’s conduct in the Debt Box case, alleging unethical behavior.

In parallel, Ethereum (ETH) has experienced a 3% surge, reaching a two-week high following amendments to spot ETH ETF filings by asset managers Ark Invest and 21Shares.

Kresus has lavished particular attention on educating new users on the sort of things they can do on-chain as well as helping them stay safe.

The ENS service has become more crucial in the last two years as crypto adoption has skyrocketed.

Earlier this month, financial authorities ordered Zipmex Thailand to cease digital asset trading and brokerage services on the platform.

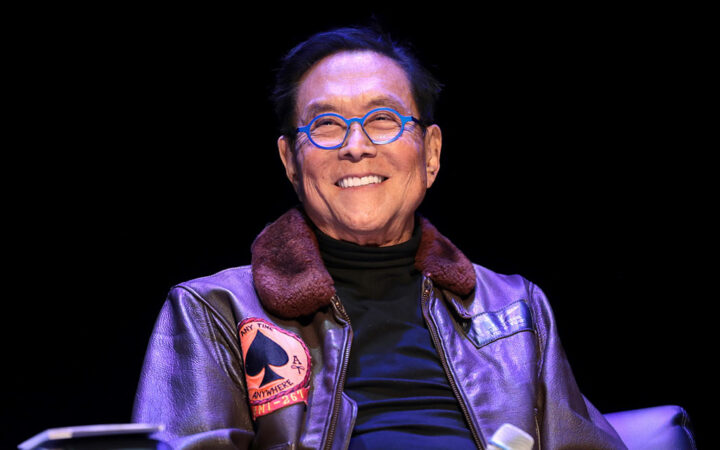

The author of ‘Rich Dad, Poor Dad’ Robert Kiyosaki said in a recent tweet that the situation with banks account the world is concerning and that investors need to be prepared.

Waters said a deal with the feds, to create some oversight in the US stablecoin market, has been worked out.

PIXEL serves as the native utility and governance token within the Pixels ecosystem, facilitating various functions such as NFT minting, VIP membership, Guild participation, quality-of-life upgrades, and governance of the community treasury.

The exchange thinks that the current financial system in the US is expensive for an average American.

The lawsuit also names Voyager Digital’s law firm McCarter & English. It is alleged that the firm played on its credibility to issue a bogus “legal opinion” that Voyager’s native utility token Voyager Token (VGX) was not an unregistered security.

According to Bakkt, all hope is not lost though. The firm has put forward a new plan that it believes will set it right back on the path to success.