Big Four Giant KPMG Will Audit Newly Launched GBPT Stablecoin ‘Poundtoken’

Citing a major opportunity in UK’s evolving market, Blackfridge launched its new GBP-pegged stablecoin Poundtoken.

For the average millennial or at least anyone that pays attention to the business world, the term “cryptocurrency” would not seem like such a strange word. If that is, then the terms Bitcoin, Ethereum or at least Blockchain should ring a bell. One might wonder, why are these terms suddenly so prevalent, especially cryptocurrency news? Computing is getting rather pervasive and the society is leaning towards digital services. The finance world too isn’t spared as the disruption of technology into this sector has fostered the birth and development of Fintech organizations.

These Fintech organizations look to digitize payments and transactions, offering the same services that are currently in existence but in a better, efficient and more effective way.

Blockchain is the network upon which most of these cryptocurrencies operate on. The history of blockchain and bitcoin, in particular, does not have a definite story. In 2009, an individual or group of individuals known to be “Satoshi Nakomoto” developed and published the technology to allow people make digital payments between themselves anonymously without having an external party to verify or authorize the transfer of the currency being exchanged.

Although technologies like this might seem rather complex, understanding how Blockchain works is quite easy, given that one has a basic idea of how networks work. Blockchain is simply a database shared between several users, containing confirmed and secured entries. It is a network, where each entry has a connection to its previous entry.

This technology affords a very secure model whereby every record in the database cannot be tampered with. Apart from the stellar security that this network offers, the transparency and speed at which the network operates give it an edge over the conventional way of conducting transactions.

In simple terms, cryptocurrencies are just monies in digital form, transacted via digital means and over a digital network. The transfer of these currencies is utilized with cryptography and the aforementioned blockchain network. Up until the 2010s, cryptocurrencies were not really known until Bitcoin made its breakout and this gave rise to the birth of new cryptocurrencies.

Cryptocurrencies have had their fair share of bullish and bearish trends, going to show how unstable they can be. The latest cryptocurrency news reports lots of people predicting prices for various cryptocurrencies in the years to come but no-one can say for sure.

Blockchain, on the other hand, is making its way into pervasive computing, especially IoT, giving way for the development of new solutions that embrace data security and transparency.

Citing a major opportunity in UK’s evolving market, Blackfridge launched its new GBP-pegged stablecoin Poundtoken.

Arthur Hayes believes that because of the HODL culture 1 Bitcoin would eventually equal $1 million in about 8 years.

Revolut remains convinced that the lessons will be relevant to all crypto users, regardless of their expertise level.

While the crypto market downturn has strained the finances of many crypto firms, KuCoin appears to be going strong.

As per Voyager’s proposed recovery plan, it is going to pay users in cryptocurrencies, Voyager tokens, “common shares in the newly reorganized company,” and funds coming from the proceedings of 3AC.

As per reports, Celsius has repaid more than $300 million of debt since the beginning of July unlocking a major part of its collateral. It still has $140 million in loans left to be paid to Aave and Compound.

Playboy and The Sandbox are building MetaMansion upon Playboy’s Rabbitars NFT project that consists of as many as 11,953 unique 3D animated bunny avatars.

There was a general slump in metaverse tokens of popular blockchain projects over the last day, even as Bitcoin & Ethereum also trade down.

GMEX thinks that migrating from regulated asset classes into crypto would be an easier task with Pyctor.

The SEC categorized Bitcoin Futures ETF and spot Bitcoin ETF as separate products.

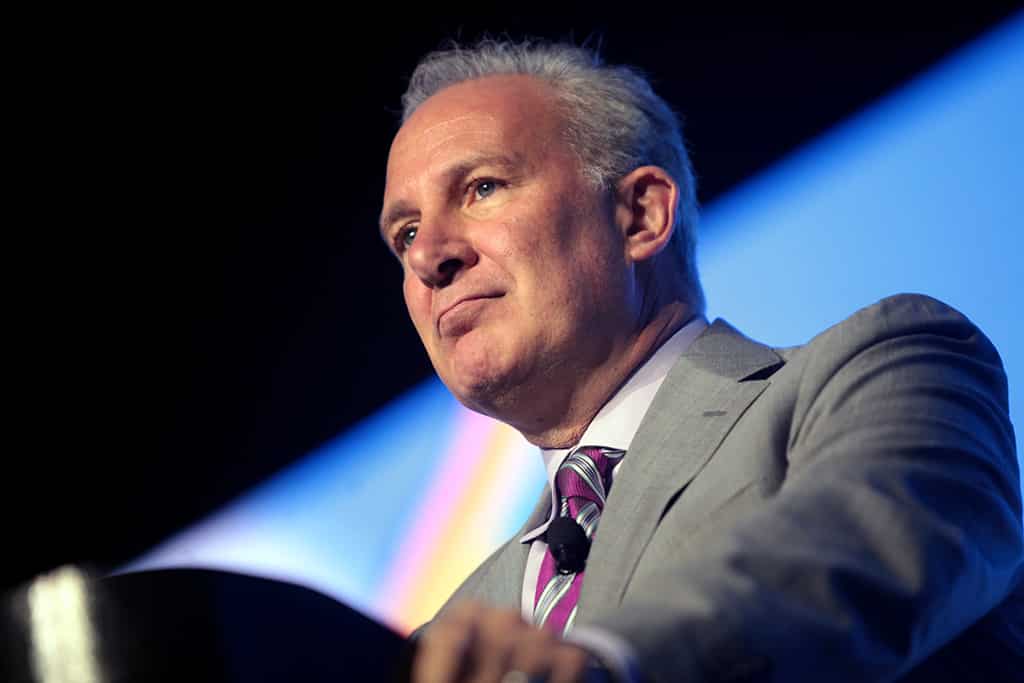

Bitcoin critic Peter Schiff said that he would be accepting BTC if that were to save customers of his now embattled bank Euro Pacific.

Recently, CoinGecko data disclosed that $2 trillion has been wiped off the market value for cryptocurrencies since last year.

According to CoinFLEX, it will take up to 12 months to fully recover the deficit. Currently, while seeking arbitration, CoinFLEX is also trying to fix the problem and looking to raise funds from its investors.

OMNI suffered a reentrancy hack and confirmed it would suspend the protocol until all parties auditing and investigating the attack are done.

In their latest report, Private Shares Fund has marked down BlockFi series E warrants as totally worthless.