JPMorgan: Bitcoin ETF Approval by SEC Won’t Revolutionize Crypto

The report acknowledges that physically-backed Bitcoin ETFs offer certain advantages over futures-based funds.

The report acknowledges that physically-backed Bitcoin ETFs offer certain advantages over futures-based funds.

Fink believes that a spot Bitcoin ETF has the potential to be as revolutionary for the financial sector in general as traditional ETFs were for the mutual fund industry.

The Nasdaq exchange refiled the Bitcoin ETF application after the SEC insisted the earlier documents were not clear despite being issued by the BlackRock investment fund manager.

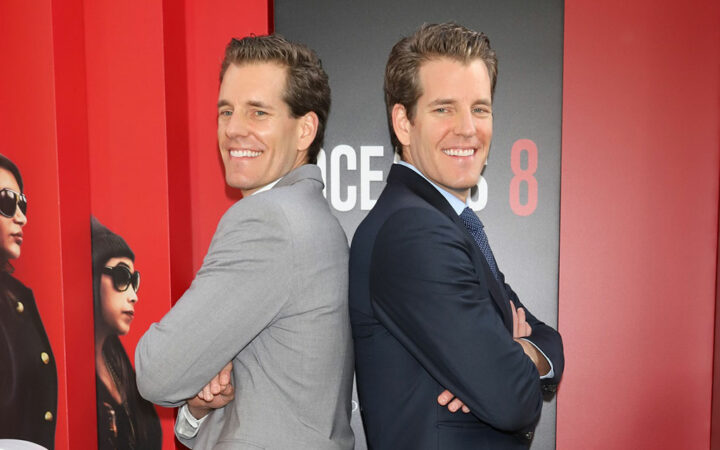

The Gemini founders filed for the first Bitcoin ETF with the US SEC ten years ago, which was rejected for almost the same reason the recent BlackRock and Fidelity products were dismissed.

The settlement of the ETH/BTC ratio futures will be linked to the value of CME Group Ether futures final settlement price, divided by the corresponding CME Group Bitcoin futures final settlement price.

3iQ intends to offer staking for its Ether Fund and 3iQ Ether ETF with the help of Coinbase Custody Trust Company in a regulated manner.

Following BlackRock’s growing chance of an approval, Fidelity Investments has submitted another application for a spot Bitcoin ETF.

Cboe has amended its spot Bitcoin ETF proposal to include an SSA agreement for market surveillance, to prevent fraudulent activity.

The SEC may prefer to give BlackRock the approval because of its reputation.

Once the investment giant Fidelity files for a spot Bitcoin ETF with the US SEC, it will be the second time following the dismissal of the first one two years ago.

Allaire noted that progress has been made in putting necessary market structures in place.

In conjunction with its decision to allow Bitcoin and Ethereum ETF trading, HSBC has launched the Virtual Asset Investor Education Centre.

As per Bernstein research, there is the “headroom for a compliant ETF to grow its share as a bitcoin on-ramp solving the pain of custody”.

Amid the strong recovery in the Bitcoin price this year, ProShares’ BITO witnessed a strong resurgence with growing institutional inflows.

The BITX being a 2x leveraged ETF can help investors to increase their profit two times faster than they would do without the leverage.