Gemini Refuses to Hire MIT Graduates Due to Gary Gensler’s Role

Gemini halts hiring MIT graduates until Gary Gensler is removed as an instructor, citing his controversial SEC leadership.

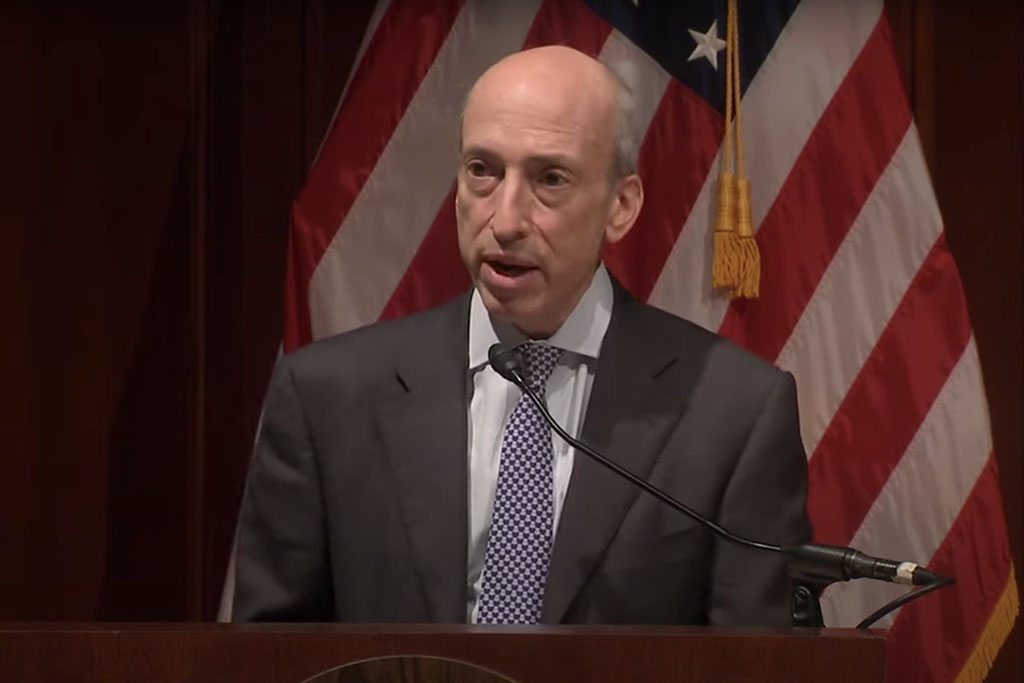

Chairperson, US Securities and Exchange Commission

Gary S. Gensler is an American financial regulator, academic, and former investment banker who played a central role in shaping U.S. cryptocurrency policy and enforcement. He is best known for serving as the 33rd Chair of the U.S. Securities and Exchange Commission (SEC) from April 17, 2021, to January 20, 2025.

Gensler’s tenure marked one of the most consequential regulatory eras for crypto. It was defined by enforcement actions, legal challenges, and high-profile litigation aimed at applying U.S. securities laws to digital assets and platforms. Under his leadership, the SEC escalated oversight of exchanges, lending platforms, token issuers, and decentralized finance (DeFi) actors. Sometimes, the regulator invokes existing securities laws in the absence of comprehensive crypto-specific legislation.

Gensler’s approach of favoring “regulation by enforcement” was both praised for protecting investors and criticized for creating uncertainty and stifling innovation.

| Year | Milestone | Notes |

|---|---|---|

| 1957 | Born | Born Oct 18, 1957, in Baltimore, Maryland. |

| 1979–1997 | Investment banker (18 years) | Joined Goldman Sachs in 1979 and spent 18 years there; became a partner. |

| 1997–1999 | Assistant Secretary for Financial Markets | U.S. Department of the Treasury. |

| 1999–2001 | Under Secretary for Domestic Finance | U.S. Department of the Treasury. |

| 2001–2002 | Senior advisor (Sarbanes-Oxley work) | Senior advisor to Sen. Paul Sarbanes; helped write Sarbanes-Oxley Act (2002). |

| 2009–2014 | Chairman | Commodity Futures Trading Commission (CFTC) — served May 26, 2009, to Jan 3, 2014. |

| 2014–2021 | Professor of the Practice (FinTech/blockchain teaching & research) | MIT Sloan School of Management; taught and researched fintech, blockchain, and financial policy. |

| Apr 14, 2021 | Confirmed as SEC Chair | U.S. Senate confirmed Gensler as SEC Chair. |

| Apr 17, 2021 | Began tenure as SEC Chair | Started as the SEC’s 33rd Chair on April 17, 2021. |

| 2021–2024 | “Regulation-by-enforcement” era for crypto | SEC expanded crypto oversight and enforcement actions during his chairmanship. |

| Nov 21, 2024 | Announced planned departure | SEC announced he would step down effective Jan 20, 2025. |

| Jan 20, 2025 | Stepped down as SEC Chair | Departed the SEC effective noon on Jan 20, 2025. |

| 2025– | Returned to academia | Returned to MIT Sloan (post-SEC). |

Gary Gensler was born on October 18, 1957, in Baltimore, Maryland. He completed undergraduate and MBA degrees at the Wharton School of the University of Pennsylvania. Gensler established a foundation in economics and finance that would guide his multifaceted career.

Before entering public service, Gensler spent nearly two decades in investment banking at Goldman Sachs. He worked across fixed-income and currency markets and rose to become a partner. This early experience gave him deep insights into capital markets and financial structuring: skills he would later apply to regulation.

Gensler’s government career began in the U.S. Department of the Treasury, where he served as Assistant Secretary of the Treasury for Financial Markets (1997–1999) and then as Under Secretary of the Treasury for Domestic Finance (1999–2001). In these roles, he advised on fiscal policy, debt issuance, and domestic finance operations.

From 2009 to 2014, Gensler served as Chairman of the Commodity Futures Trading Commission (CFTC) under President Barack Obama. He oversaw landmark reforms of the over-the-counter swaps market and implemented provisions of the Dodd-Frank Act. His leadership at the CFTC earned him a reputation as a tough financial regulator focused on transparency and market integrity.

After leaving the CFTC, Gensler transitioned to academia, joining the Massachusetts Institute of Technology (MIT) Sloan School of Management as a Professor of the Practice in Global Economics and Management. There, he co-directed the FinTech@CSAIL initiative and taught blockchain, money, and financial technology. Gensler gained firsthand exposure to the technical and economic aspects of cryptocurrency that would inform his later regulatory approach.

In January 2021, President Joe Biden nominated Gensler to lead the SEC. He sought an experienced regulator to oversee a broad agenda of financial market reforms, including scrutiny of crypto markets. The U.S. Senate confirmed his appointment on April 14, 2021, and he was sworn in on April 17, 2021.

Gensler succeeded an acting chair and entered an agency confronting rapid innovation in digital assets, market structure challenges, and high retail participation in crypto trading. His perspective on crypto regulation was shaped by both market risk concerns and his academic engagement with blockchain technologies.

Gensler frequently described the cryptocurrency landscape as a kind of “Wild West,” arguing that many digital assets and platforms lacked investor protections and adequate disclosures. In testimony before Congress, he called for stronger regulation and significant increases in SEC staffing to effectively oversee crypto markets.

He maintained that most digital assets functioned as investment contracts (i.e., securities) under U.S. law and therefore fell within the SEC’s jurisdiction. This interpretation carried significant implications for how tokens and platforms would be regulated or litigated.

However, Gensler always treated BTC $68 110 24h volatility: 0.9% Market cap: $1.36 T Vol. 24h: $47.80 B as a commodity.

During Gensler’s tenure, the SEC dramatically increased its enforcement actions related to crypto. Digital asset oversight became a central regulatory priority.

From 2021 to 2024, the SEC initiated 125 cryptocurrency-related enforcement actions under his leadership, compared with 70 under his predecessor. The regulator imposed more than $6 billion in monetary penalties—nearly four times the amount under earlier leadership. These actions targeted alleged unregistered securities offerings, fraudulent schemes, and market abuses involving exchanges, lending platforms, and token issuers.

Enforcement actions were taken against firms, including trading platforms, lending services, and initial coin offerings (ICOs), that were deemed to violate securities laws. All this reinforced the message that companies dealing with crypto tokens must either register or face litigation.

Gensler’s SEC also took public roles in high-profile suits, including actions against major exchanges (such as Binance and Coinbase) and project issuers, highlighting regulatory uncertainty in the absence of bespoke crypto legislation.

Under Gensler’s leadership, the SEC pursued the following significant regulatory and enforcement initiatives:

His public speeches underscored the need for market integrity and the application of securities law to protect investors, emphasizing that technology neutrality should guide regulatory enforcement.

Gensler’s enforcement-first approach attracted substantial criticism from the crypto industry, some lawmakers, and policymakers. Most argued that it stifled innovation and created regulatory uncertainty. Opponents claimed that the heavy emphasis on litigation and retroactive regulatory actions drove innovation offshore and discouraged U.S.-based market builders.

In some debates, industry advocates argued that the regulatory framework needed clearer legislative guidance rather than expansive enforcement under existing securities laws. This view echoed in discussions of pending federal bills like the Financial Innovation and Technology for the 21st Century Act, intended to clarify digital asset regulation.

Gensler’s term as SEC Chair concluded on January 20, 2025, coinciding with the transition to the Trump administration’s appointment of Paul S. Atkins as the new SEC Chair. As an official, Atkins is viewed as more pro-crypto in his regulatory philosophy.

Although many of Gensler’s crypto enforcement proposals did not result in finalized rulemakings before his departure, his administration established a “regulation-by-enforcement” environment that significantly shaped how U.S. courts, industry actors, and policymakers viewed digital asset oversight.

By aggressively pursuing enforcement actions and emphasizing the application of existing securities law to crypto markets, Gensler’s legacy includes heightened scrutiny of exchanges, token issuers, and crypto intermediaries. SEC forced many firms to reconsider legal compliance, registration, and market conduct.

Gensler’s tenure reshaped industry dynamics:

Whether viewed as a necessary steward of investor protection or an obstacle to crypto innovation, Gensler’s influence on U.S. crypto regulation remains profound and continues to shape policy discussions under subsequent leadership.

US SEC

Oct 18th, 1957

American

The Wharton School, University of Pennsylvania, MBA, 1979

The Wharton School, University of Pennsylvania, Undergraduate Degree in Economics, 1978

Maryland Financial Consumer Protection Commission, Chair, 2017-2019

MIT Sloan School of Management, Professor of the Practice of Global Economics and Management

MIT’s Fintech@CSAIL, Co-Director

MIT Media Lab Digital Currency Initiative, Senior Advisor

Commodity Futures Trading Commission, 11th Chairman, 2009-2014

Treasury for Domestic Finance, Under Secretary, 1999-2001

Treasury for Financial Markets, Assistant Secretary, 1997-1999

Gemini halts hiring MIT graduates until Gary Gensler is removed as an instructor, citing his controversial SEC leadership.

While crypto advocates cheer the SEC’s decision, skeptics like Jacob King warn that the industry’s shift toward bank custody contradicts Bitcoin’s original vision of decentralization.

Gensler’s SEC tenure saw 18% of complaints tied to crypto violations, impacting Binance, Coinbase, and others.

Emmer is a pro-crypto Congressman who now joins Bryan Steil as part of the subcommittee’s leadership to oversee crypto regulation in the US.

“Bitcoin is a highly speculative, volatile asset. But with 7 billion people around the globe, 7 billion people want to trade it just like we do have gold for 10,000 years,” said Gensler.