Let’s talk web3, crypto, Metaverse, NFTs, CeDeFi, meme coins, and Stocks, and focus on multi-chain as the future of blockchain technology. Let us all WIN!

US Senator Cynthia Lummis has already proposed the US government purchase 1 million Bitcoin units in the next five years and hold them for the next 20 years to counter the country’s debt crisis.

Edited by Julia Sakovich

Updated

3 mins read

Edited by Julia Sakovich

Updated

3 mins read

The state of the United States’ economic outlook, regarding the debt crisis, has been a hot topic in the recent past, especially ahead of the 2024 general elections. Both sides of the political spectrum have publicly admitted that a change of strategy is needed to address the ballooning debt crisis.

Moreover, the US dollar is gradually losing value as the BRICS movement gradually moves to their respective currencies to settle international trade.

According to tech billionaire Elon Musk, the high government spending is gradually leading the country into a state of bankruptcy.

The US national debt is likely to rise by $16 trillion in the next ten years. Currently, the US government spends around $1 trillion per year to pay off interest related to the $35.3 trillion debt. As a result, some Wall Street analysts believe the US government is significantly contributing to dollar inflation.

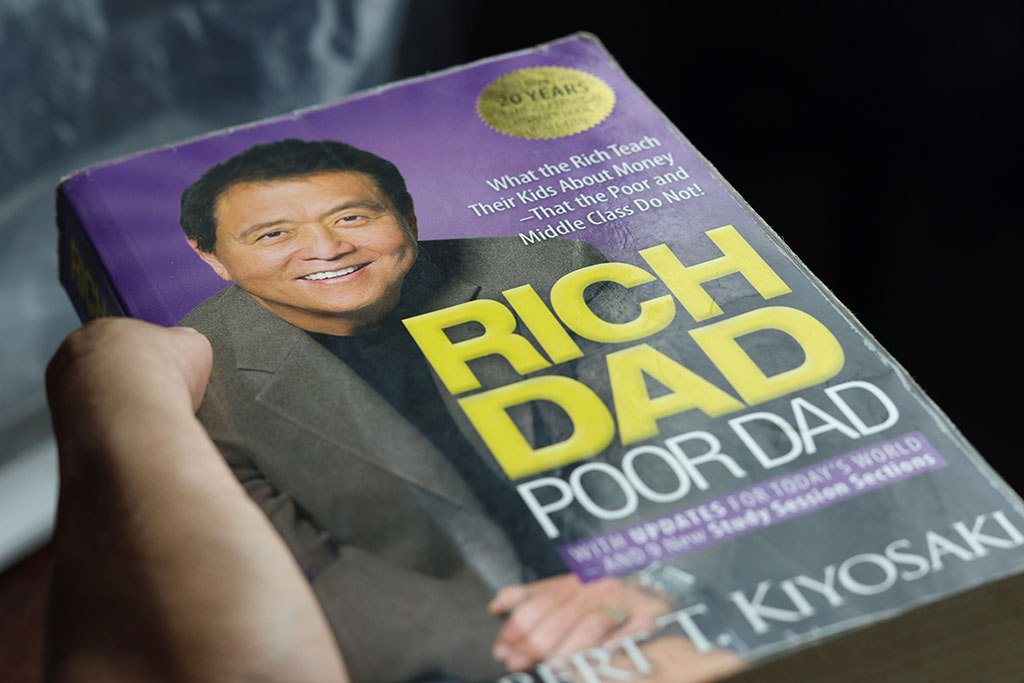

According to Robert Kiyosaki, a popular author and investor, the real problem in the United States is the debt crisis, which, ostensibly, none of the political parties can solve. With the fast-rising United States debts, Kiyosaki believes the only way out for investors grappling with unsound money will be Bitcoin BTC $107 466 24h volatility: 0.0% Market cap: $2.14 T Vol. 24h: $22.52 B , Gold, and Silver.

While I want Trump to win… it really makes little difference if Trump or Harris win.

The real problem is the $35 trillion in US debthat is the real problem….neither Trump nor Kamala can solve.

As stated in earlier tweets the US debt goes up by $1 1trillion every 100 days.…

— Robert Kiyosaki (@theRealKiyosaki) September 13, 2024

Furthermore, Kiyosaki highlighted that the three commodities are real money and are likely to stand the test of time.

The use of the Bitcoin strategy to save the United States from collapsing in real time has already been advocated by US Senator Cynthia Lummis during the 2024 Bitcoin conference. According to Lummis, the United States should buy at least 1 million Bitcoins in the next five years, which would be almost the same amount held by Satoshi Nakamoto.

In order to solve the big elephant in the room, Lummis suggested in front of the Republican presidential candidate, Donald Trump, that the US government should then hold more than 1 million Bitcoins in the next 20 years.

With the BTC price expected to rally exponentially in the coming years, the country can then easily pay off its debt and still save its Gold reserves. Already, the Gold price has been soaring in the recent past and reached an all-time high on Friday, September 13, thus signaling the inevitable return of the macro bull market that will, in turn, involve crypto assets.

The United States Federal Reserve is expected to initiate the first interest rate cut on September 18. Such a move would help the US investors easily access the so perceived as easy money, due to its lower interest rates, and compete better internationally.

Already, the European Central Bank (ECB) has initiated several interest rate cuts, to stir up economic activity. Furthermore, the escalating crisis between Russia and NATO could spell further difficulties for more economies around the world.

Disclaimer: Coinspeaker is committed to providing unbiased and transparent reporting. This article aims to deliver accurate and timely information but should not be taken as financial or investment advice. Since market conditions can change rapidly, we encourage you to verify information on your own and consult with a professional before making any decisions based on this content.

Let’s talk web3, crypto, Metaverse, NFTs, CeDeFi, meme coins, and Stocks, and focus on multi-chain as the future of blockchain technology. Let us all WIN!