December 19th, 2025

Voyager and Celsius are forging ahead with their bankruptcy plans but only Voyager seems to be making any crypto transfers.

There is a recorded rally in some Bitcoin stocks as the push for a spot BTC ETF continues with Cboe submitting multiple refilings.

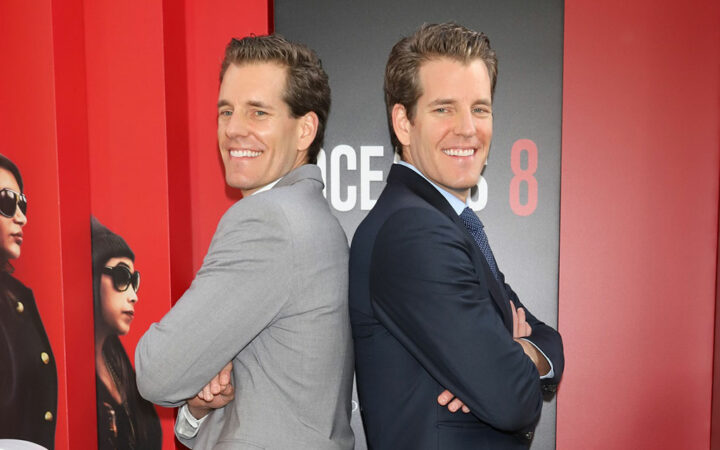

The Gemini founders filed for the first Bitcoin ETF with the US SEC ten years ago, which was rejected for almost the same reason the recent BlackRock and Fidelity products were dismissed.

When categorizing the funding by sector, the infrastructure category emerged as the frontrunner, with $213 million recorded in June.

The Bittrex motion to dismiss in its legal case with the SEC is similar to an earlier Coinbase filing as they both claim the SEC is operating outside its authority.

Rumors of Gensler resigning might gradually be becoming a thing as this isn’t the first time such would be making the rounds.

In the Coinbase defense that triggered a new hearing date in July, the exchange noted that many of the tokens SEC highlighted in its allegations are outside the Commission’s purview.

Since BCH became one of the four cryptocurrencies traded on EDX, its price has continued to rise. In the last 24 hours, the crypto has spiked more than 30%, reaching $325 for the first time since April 2022.

When providing his opinion on the regulatory environment for cryptocurrencies in Canada compared to the United States, Anthony Scaramucci stated that Canada had learned from the US.

3iQ intends to offer staking for its Ether Fund and 3iQ Ether ETF with the help of Coinbase Custody Trust Company in a regulated manner.

Following BlackRock’s growing chance of an approval, Fidelity Investments has submitted another application for a spot Bitcoin ETF.

SEC lawsuits on crypto exchange Binance and founder Changpeng Zhao has dented the company’s business operations with trading volumes taking a hit.

The Thursday filing shares a detailed explanation of the company’s stance on the subject matter.

Cboe has amended its spot Bitcoin ETF proposal to include an SSA agreement for market surveillance, to prevent fraudulent activity.

Ledger launched an institutional-grade trading network to meet the risk management and regulatory requirements of institutions.