LiquidChain is a Layer 3 blockchain project that wants to unify the liquidity of Bitcoin, Ethereum, and Solana into a single execu...

10 New Upcoming Binance Listings to Watch in February 2026

43 mins

43 mins Based on our analysis, Bitcoin Hyper is the main candidate for an upcoming Binance listing in February 2026. It’s a Bitcoin Layer 2 (L2) that plans to make transactions on the Bitcoin blockchain faster and cheaper.

Two alternatives are Maxi Doge, a doge-themed speculative meme coin, and Mantle, a more established Ethereum L2.

We analyzed over 100 cryptocurrencies using our methodology, which evaluates narrative fit, on-chain traction, exchange readiness, and risk flags. This guide includes 11 projects to watch and is better suited for high-risk traders tracking potential listing catalysts.

Upcoming Binance Listings Key Takeaways

- Tokens listed on Binance historically gained an average of 41% within 24 hours of announcement, according to Ren & Heinrich.

- Bitcoin Hyper leads our upcoming Binance listings, as an L2 expanding Bitcoin’s utility. It remains a highly speculative play.

- Mantle was chosen for its interoperable liquidity chain with RWAs and an AI trading strategy builder.

- Maxi Doge is our top play for a future meme coin listing; Hyperliquid for its trading volume and popularity.

- Regularly monitor your tokens for a Binance listing announcement; coins often spike but can retrace quickly.

Predicted New Binance Listings in February 2026

- First Bitcoin Layer 2 enabling fast, low-cost transactions

- Fixes Bitcoin’s speed and fee limitations with near real-time performance

- Enables a Bitcoin-native DeFi ecosystem

- Degen meme coin inspired by max-leverage trading

- A tribute to high-risk hustle — fueled by sweat and conviction

- Ethereum-born, culture-driven, aiming for multichain

- Quantum-resistant security infrastructure for wallets and enterprise use

- Uses deflationary tokenonomics, including burns, tied to quantum workload execution

- Staking and governance participation expand token utility

- Shared liquidity spanning Bitcoin, Ethereum, and Solana

- Improved trade execution through faster speeds and secure cross-chain capital movement

- Opens up greater cross-ecosystem connectivity for builders and developers

- AI-Powered Virtual Influencers

- 20% APY Staking Rewards

- VIP perks: livestreams, BTS content, credits, and more.

- High-performance broker for pros and newcomers alike

- Rebates and buybacks come from VFX's own market activity

- 10% bonus on sign up and early staking access

10 New Binance Listings to Watch in 2026

These are the coins we believe have potential for Binance Listing

- Bitcoin Hyper (HYPER) – Bitcoin’s first SVM Layer 2 for fast, low-cost transactions

- Maxi Doge (MAXI) – Whimsical meme that makes fun of other dog coins

- BMIC (BMIC) – Web3 wallet using post-quantum cryptography

- Mantle (MNT) – Scalable Ethereum Layer 2 with governance token

- Hyperliquid (HYPE) – Fast Layer 1 blockchain and HyperEVM ecosystem with high volume perps

- SUBBD (SUBBD) – Web3 and AI content subscription platform for creators and fans

- Vortex (VFX) – AI foreign exchange Web3 platform with yields

- Trusta AI (TA) – Blockchain-verified identity and reputation token built for Web3 and AI

- Build on BNB (BOB) – Memecoin inspired by a drawing from a Binance intern, on Binance Alpha

- Flare (FLARE) – Blockchain for interoperability and data that specializes in XRPfi

Exploring the Top Upcoming Binance Listings

Learn more about our predicted Binance new coin listings. Each crypto project will be fully explained, allowing you to assess whether a Binance listing could be imminent.

1. Bitcoin Hyper (HYPER) – Bitcoin’s Layer 2 Meme Coin Designed for DeFi and Speed

Bitcoin Hyper is a Layer 2 ecosystem for Bitcoin, built on the Solana Virtual Machine (SVM). While Bitcoin has the largest market cap, it’s also among the slowest blockchains. Hyper aims to change this by enabling fast, low-cost transactions with high-speed, high-volume activity, making payments, meme coins, and dApps practical on the BTC network.

Our view (Otar Topuria): BTC L2 from Bitcoin Hyper is, in my view, an ambitious solution with strong utility and real value for the wider industry. Because of this, a HYPER listing on Binance looks quite possible. However, there is no large company with huge budgets behind the project, so I have to remind you that the risks are high.

Bitcoin Hyper blog post about technical developments with running SVM programs. Source: Bitcoin Hyper

Key Points on Bitcoin Hyper:

- Why We Picked It: Bitcoin Layer 2s may become the key to unlocking BTC’s next phase by enabling faster apps and payments

- Best For: Degens, builders, and BTC holders looking to do more with their Bitcoin

- Risks & Considerations: Uncertain pace of user adoption and development, L2 competition

| Ticker | HYPER |

| Chain | Ethereum |

| Total Supply | 21 billion |

| Distribution | 20% for presale, rest goes to the team and ecosystem |

| Utility | Transaction fees, voting rights, staking for 40% APY |

| Market Cap | $31.39M raised in presale |

| Price | $0.01367540 |

| Next Increase | 3 hours, 7 minutes |

2. Maxi Doge (MAXI) – Dog-Themed Meme Coin Using Humor and Leverage

Maxi Doge is a community-based meme coin with a mascot that traces its lineage to ‘cousin Doge’. The deeper concept behind Maxi Doge is the idea of uniting traders through humor and memes, as well as competitions, alpha groups, and a leverage trading partnership.

Our view (Otar Topuria): To my taste, Maxi Doge is a very stylish meme coin with genuine degen culture for high-risk traders. I believe the community will like it and that it may end up listed on Binance one day. Still, remember the high risks that come with all meme coins.

Maxi Doge whitepaper with key features and a marketing plan. Source: Maxi Doge

Key Points on Maxi Doge:

- Why We Picked It: Doge-themed meme coins continue to outperform the market

- Best For: Meme coin traders, DOGE fans, degen speculators comfortable with high volatility

- Risks & Considerations: High competition, team’s anonymity, lack of audits

| Ticker | MAXI |

| Chain | Ethereum |

| Total Supply | 420 billion |

| Distribution | 40% for marketing, rest goes to the MAXI fund, dev, liquidity and staking |

| Utility | Transaction fees, staking for 72% APY, community competitions |

| Market Cap | $4.59M raised in presale |

| Price | $0.00028030 |

| Next Increase | 2 days, 11 hours |

3. BMIC (BMIC) – a Wallet That Claims to Tackle Quantum Computing Threats

BMIC is a Web3 wallet ecosystem that claims to use “post-quantum cryptography” (PQC) to protect digital assets. The project highlights that current crypto wallet infrastructure relies on encryption methods that quantum computers could likely crack. BMIC states that it is building a wallet ecosystem with “NIST-approved” algorithms, alongside features like smart account architecture.

Our view (Otar Topuria): BMIC is addressing a real issue in crypto security, and its wallet-first strategy offers a more immediate use case compared to other infrastructure projects. The project also outlines plans to launch staking, a credit card system, and, eventually, a decentralized compute network that links quantum hardware providers. But we are still in the early days with no shipped product thus far, so investors should keep an eye out for execution risk.

BMIC positions itself as a 100% decentralized service. Source: BMIC

Key Points on BMIC:

- Why We Picked It: Targets a security challenge related to blockchain encryption methods

- Best For: Investors interested in infrastructure and the security of digital assets

- Risks & Considerations: The technology is complex, and full development is likely years away

| Ticker | BMIC |

| Chain | Ethereum |

| Total Supply | 1.5 billion |

| Distribution | 50% for presale, rest for team/ecosystem/liquidity |

| Utility | Staking, Payments, Burn-to-Compute |

| Market Cap | $410,404 raised in presale |

| Price | $0.049474 |

4. Mantle (MNT) – Scalable Ethereum Layer 2 with Governance Token

Mantle Network is a DeFi ecosystem and a high-performance, modular Ethereum Layer 2, backed by BitDAO. The Bybit exchange helps to provide Mantle with deep liquidity. Mantle’s modular aspect is designed for advanced DeFi strategies, allowing developers to build dApps that benefit from the liquidity of Ethereum while using the speed of Mantle.

Our view (Julia Sakovich): In my opinion, Mantle is a fundamentally strong L2, and Binance often pays attention to ecosystems like this. Despite the project’s potential, competition in the L2 sector is growing, so investors should do their own research.

Mantle offers various ways to buy MNT, including third-party bridges. Source: Mantle

Key Points on Mantle:

- Why We Picked It: Robust Ethereum Layer 2 with governance and utility in a growing ecosystem

- Best For: DeFi users, developers, infrastructure tokens traders

- Risks & Considerations: Layer 2 competition, uncertain development pace

| Ticker | MNT |

| Chain | Ethereum L2 |

| Total Supply | 6.2 billion |

| Distribution | 49% for treasury, rest is circulating |

| Utility | Gas fees on Mantle L2, governance voting, staking |

| Market Cap | $2.8 billion |

| Price | MNT $0.61 24h volatility: 4.0% Market cap: $1.99 B Vol. 24h: $33.93 M |

5. Hyperliquid (HYPE) – High-Performance L1 Ecoystem with Perps DEX

Hyperliquid is both a Layer 1 blockchain and a DEX that specializes in perps trading. It has low latency and an order book system to improve speeds and liquidity. The HyperEVM ecosystem has various dApps that benefit from and boost Hyperliquid’s overall liquidity. HYPE has a market cap of $6.5B (Snapshot from CoinGecko, January 27, 2026).

Our view (Julia Sakovich): Hyperliquid has proven itself as a promising DEX, just think of the popularity of trader James Wynn. I believe a Binance listing is only a matter of time, but the token’s prospects after that are still uncertain. Ecosystem tokens are more robust than meme coins, but they are still a risky investment.

Hyperliquid perps DEX offers BTC-USD trading with up to 40x leverage. Source: Hyperliquid

Key Points on Hyperliquid:

- Why We Picked It: Combining an ultra-fast L1 with on-chain DEX perpetuals and strong volume

- Best For: Active derivatives traders, high-frequency DeFi users

- Risks & Considerations: Technical complexity risk, slow development

| Ticker | HYPE |

| Chain | Hyperliquid Layer 1 |

| Total Supply | 1 billion |

| Distribution | 31% for airdrop, rest goes to the future community rewards and contributors |

| Utility | Transaction fees, network governance, participation in future community reward programs |

| Market Cap | $6.5 billion |

| Price | HYPE $29.07 24h volatility: 2.3% Market cap: $6.93 B Vol. 24h: $320.56 M |

6. SUBBD (SUBBD) – Web3-Powered Content Subscription Platform

SUBBD is a new cryptocurrency and AI-powered platform built for the creator economy. It will help users to create, manage, and monetize content across formats, making it easier for digital creators to grow and streamline their work.

Our view (Julia Sakovich): SUBBD combines SocialFi and AI into a single ecosystem for creators. The concept is strong, but the main risk is whether users are ready to move from Web2 to Web3. This will likely take time, so investors should be cautious about expecting quick, outsized returns.

SUBBD tokenomics shows 50% of the supply is reserved for marketing and product development. Source: SUBBD

Key Points on SUBBD:

- Why We Picked It: Innovative project, crosses over multiple Web3 verticals (AI and SocialFi)

- Best For: Creator-economy investors, SocialFi speculators

- Risks & Considerations: Success depends on audience acceptance, slow development, uncertain future of AI sector

| Ticker | SUBBD |

| Chain | Ethereum |

| Total Supply | 1 billion |

| Distribution | 10% for airdrops, rest goes to the marketing, dev, liquidity, staking, treasury, and creator rewards |

| Utility | Transaction fees, governance, staking for 20% APY, creator-community utility |

| Market Cap | $1.48M raised in presale |

| Price | $0.05747500 |

| Next Increase | 19 hours, 25 minutes |

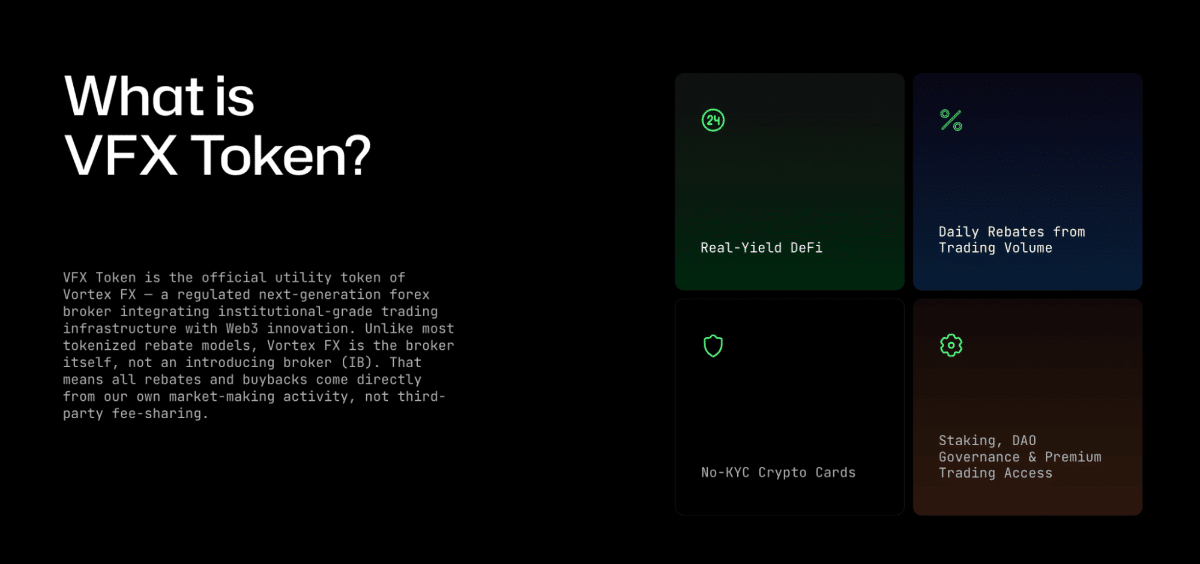

7. Vortex FX (VFX) – Regulated Forex Platform With Decentralized Yield

Vortex FX is a regulated forex and trading firm that claims to unlock “real yield” by sharing revenue from operations with its native VFX token holders. The project’s whitepaper highlights that the platform uses AI-powered automated trading and may also offer features like crypto debit cards and staking rewards.

Our view (Otar Topuria): Since Vortex FX seeks to tie Web3 token incentives to an existing revenue stream of brokerage fees, we think it has the potential to build a sustainable DeFi model. But the reliance on a centralized trading entity also means investors need to trust the firm’s operational transparency.

VFX token utilities, including the ability to have no-KYC credit cards. Source: VFX presale

Key Points on Vortex FX:

- Why We Picked It: Targets DeFi sustainability by generating yield from external markets

- Best For: Passive income seekers, investors interested in RWA

- Risks & Considerations: Success depends on sustained trading volume, regulatory risks

| Ticker | VFX |

| Chain | Solana |

| Total supply | 100 million |

| Distribution | 55% public, balance for team, staking, and liquidity |

| Utility | Staking rewards, debit card access, and governance |

| Market cap | $2.21 million raised in the presale |

| Price | $0.355 |

| Next increase | – |

8. Trusta AI (TA) – On-Chain Identity & Reputation Token Built for Web3 & AI

Trusta AI’s token powers a decentralized identity and reputation protocol designed for both human users and AI agents. By providing attestations, trust scoring, and permissionless identity layers across multiple chains (handling 2.5M attestations and 200K MAUs), Trusta AI addresses a critical infrastructure need in growing Web3 ecosystems.

Our view (Julia Sakovich): Trusta AI is targeting the on-chain identity niche, and its early activity looks strong to me. However, it is hard to assess the project’s long-term prospects. If the team strengthens security and maintains user activity, a Binance listing looks quite realistic.

Safety and analysis of an example wallet address. Source: Trusta AI

Key Points on Trusta AI:

- Why We Picked It: First-mover identity layer token for AI/Web3; live Binance Alpha listing

- Best For: Infrastructure-focused investors, AI and Web3 developers

- Risks & Considerations: Smart-contract risks, development pace

| Ticker | TA |

| Chain | BNB Chain, Arbitrum, EVM-compatible chains |

| Total Supply | 1 billion |

| Distribution | 25% for community, rest goes to the treasury, team, marketing, liquidity and airdrop |

| Utility | Identity attestations, reputation scoring, transaction fees, and governance across supported chains |

| Market Cap | $6.5 million |

| Price | $0.0361 (Snapshot from CoinGecko, January 27, 2026) |

9. Build on BNB (BOB) – Binance-Made Builder Meme Coin on Binance Alpha

Build on BNB, also known as BOB, is a memecoin developed by Binance that’s been gaining attention in February 2026. The story behind it is this: an intern created the stick figure mascot, and the community chose the name BOB. According to the homepage, BOB’s mission is to ‘make BSC great again’.

Our view (Julia Sakovich): I believe BOB’s core strength lies in its active community and the degen energy of the meme coin. It fits BNB ecosystem supporters and fans of high-risk meme plays. Given that the token has already appeared in Binance Alpha, a potential Binance listing looks entirely plausible.

BOB meme coin from an intern’s drawing, promoting building on BNB. Source: Build on BNB

Key Points on Build on BOB:

- Why We Picked It: Strong community, direct alignment with the BNB Chain ecosystem

- Best For: Meme coin traders, BNB Chain ecosystem users, low cap speculators

- Risks & Considerations: High competition, success depends on community

| Ticker | BOB |

| Chain | BNB Chain |

| Total Supply | 420.69 trillion |

| Distribution | No data |

| Utility | Transaction fees, community governance, staking incentives within the BNB Chain meme ecosystem |

| Market Cap | $6.8 million |

| Price | $0.0000000163 (Snapshot from CoinGecko, January 27, 2026) |

10. Flare – PoS Blockchain That Focuses on Interoperability and Data

Flare is an EVM-compatible Layer 1 blockchain, founded in 2019. It specializes in interoperability, data, and bringing smart contracts to blockchains that don’t have them, such as the XRP Ledger from Ripple. To ensure that data is correct, Flare uses its own oracle called the Flare Time Series Oracle (FTSO).

Our view (Julia Sakovich): With so many active blockchains, interoperability is very important, and Flare enables XRPfi, BTCfi, and Dogefi through its wrapped assets. However, I notice the homepage’s primary focus is on processing massive amounts of data, and I wonder if they have an AI in mind. It will be interesting to see what projects get built on Flare’s stack.

Flare’s ecosystem and tech, comprising data, EVM compatibility, and PoS staking. Source: Flare

Key Points on Flare:

- Why We Picked It: Flare taps into the popular narratives of scaling solutions and interoperability

- Best For: Blockchain token holders, data infrastructure plays, long-term holders, XRP bulls

- Risks & Considerations: Flare’s been airdropping FLR to Wrapped FLR holders since 2023, which could cause sell pressure when the rewards end in 2026

| Ticker | FLR |

| Chain | Flare |

| Total Supply | 104.42 billion |

| Distribution | 60% to the public, the rest to the ecosystem, VCs, backers, and team |

| Utility | Secures the network, governance, and transaction fees. |

| Market Cap | $871 million |

| Price | $0.01051 (Snapshot from CoinGecko, January 27, 2026) |

Tested by Editors

Among the memecoins we tested, Maxi Doge had the most appealing branding, but also less utility and higher risk than Maxi Doge or Bitcoin Hyper. Since all are in presale, roadmap development and community growth remain unproven, and the teams are anonymous. In contrast, Build on BNB (BOB) is a more established memecoin on Binance Alpha, increasing its chances of listing on Binance. However, like Maxi Doge, BOB has no real utility past speculation.

Projects like Trusta AI and SUBBD fit the narrative of AI and AI infrastructure. Trusta AI have doxxed teams, Binance Alpha inclusion, and CEX listings, while SUBBD is still in presale with an anonymous team, but is a crypto with high potential. All are audited. These projects may offer firmer foundations than memes, but are likely to see slower growth as well.

Flare tackles blockchain interoperability and data integrity, which may be one reason it isn’t listed on Binance (due to integration complications). Still, as a top 100 coin with an active presence, it has strong potential. Mantle and Hyperliquid are the most established and tested, offering higher chances of ongoing success but less price action potential than early-stage coins.

| Ticker | Primary Category | Maturity Status / Backing | Risks and Security | Binance Alpha? |

| HYPER | Bitcoin L2 / DeFi / Meme | Presale, $0.01367540 raised | High competition; audited by Coinsult. | No |

| MAXI | Meme Coin | Presale, $0.00028030 raised | Anonymous team. Minimal utility. SolidProof/Coinsult Audits. | No |

| MNT | Ethereum L2 / DEX | Established, high-profile backing | Risks around perps trading. Audited | No |

| BMIC | Web3 Wallet | Presale, $300,000 raised | Product hasn’t been developed yet. Audited | No |

| HYPE | L1 / Perpetual DEX | Established, high-profile backing | Audited, risks around perps trading | No |

| SUBBD | SocialFi / Creator / AI | Presale, $0.05747500 raised | Anonymous team. Success depends on Web2 user migration. Audited. | No |

| VFX | Foreign Exchange | Presale, over 900k raised | Financial regulations, no full whitepaper, audited | No |

| TA | Web3 Identity / AI | Early stage, provides Binance with first soul-bound token | Doxxed team, Coinsult audited. | Yes |

| BOB | BNB Memecoin | Early stage, BNB Chain support | Purely community-dependent. No utility past speculation. Audited | Yes |

| FLR | Interoperability and Data | Established, high-profile backing | Airdrop sell pressure risk until 2026. Audited | No |

All the projects we tested have audits but carry different levels of risk, from high-volatility presales to more established projects; some have a Binance Alpha listing, but this is a promising signal rather than a listing guarantee.

Other Strong Picks Worth Considering

Here are some other strong contenders that didn’t quite make the list but are also worth watching:

- Kaspa (KAS) is a Directed Acyclic Graph (DAG) based chain launched through user mining. Its use of DAG makes it fast, and the team claims that it solves the blockchain trilemma. KAS listed on HTX on December 24th, suggesting that more CEX listings may be on the way.

- Aerodrome Finance (AERO) is a DEX, an AMM, and a liquidity hub for BASE. It uses Uniswap’s V3 to offer concentrated liquidity pools, to reduce slippage, and allow liquidity providers to maximise the efficiency of their positions. Aerodrome Finance’s websites were compromised in Q4 last year, but the token appears to be recovering. AERO is on Binance Alpha.

- Monad (MON)is a new EVM-compatible blockchain that calls itself ‘the most performant’ due to its architecture that allows for parallel processing and claiming a TPS of 10,000. The chain has had cult-like support, though many were disappointed by the MON airdrop. If supporters remain and the tech holds up as users grow, it could be one to consider.

These coins have potential, but may not have been listed yet by Binance due to things like technical complexity in the case of KAS, and newness in terms of AERO and MON.

What Users Are Saying

The most talked about projects on social media are Mantle and Hyperliquid. Mantle is praised for its strength and ongoing potential, while Hyperliquid’s integration with Rainbow Wallet is attracting attention.

- Mantle: Reddit users perceive it as a strong Layer 2 contender, noting its market cap is higher Polygon, while X users are excited by the recent Bybit partnership and the resulting gameified pet that is leveled up through quests.

- Hyperliquid: People on Reddit are mostly positive about its smooth trading experience, while X posters are excited about its new perps trading feature embedded in the Rainbow wallet for a friendlier UI.

- Trusta AI: With only one post on Reddit, we examined X for more context. Users were generally positive about the potential, but some had concerns about recent price action.

- Build on BNB: The majority of the community is on X and is bullish about the future of the project, creating and sharing BOB memes. Official posts tend to get hundreds of likes.

Keep in mind that community sentiment matters because it affects adoption, and exchanges like Binance take it into account; however, it does not guarantee any outcome.

Our Methodology for Predicting Binance Listings

Predicting Binance listings can be challenging, so we examined several important criteria during our research and analysis that help determine which coins will list on Binance, including the following:

Narrative and strategic fit – 20%

We selected projects that align with trending narratives (from BTC and ETH Spot ETFs, AI, memecoins, Layer 2s, Web3, and DeFi), and matched them to specific types of investors.

Use cases – 15%

As the world’s leading crypto exchange by trading volume, Binance will likely prioritize cryptos with clear utility and ecosystems that address and solve real-world problems.

Reputation and track record – 15%

To be included in our list, each project needed to have a strong and reliable reputation in the Web3 space. Other factors like community strength, roadmap delivery, and transparent communication were also considered.

Key metrics – 10%

We looked at on-chain and off-chain metrics, including a project’s number of token holders, social media followers, and audience engagement.

Price (or presale) performance – 5%

Our Binance coin predictions often focused on historic price performance and the amounts raised during token presales (where relevant).

Potential risk – 10%

As Binance generally avoids projects with a high likelihood of failure, we factored in each coin’s regulatory standing, smart contract audits, and whether or not it had previously experienced controversial events.

Associated blockchains – 10%

Although projects built on Binance’s BNB Chain might have an edge, integration with other leading ecosystems (such as Ethereum and Solana) can also improve a coin’s chances of getting listed on Binance.

Previous listings – 10%

Projects on mid-level and top-tier crypto exchanges will likely be listed on Binance. Such listings indicate a clear demand for a given token, potentially making it a lucrative business opportunity for Binance.

Market cap (or presale fundraising total) – 5%

A Binance listing forecast can help support and grow a token’s market cap, and prevent its value from dropping too far. Therefore, we chose coins with strong support floors and positive investor sentiment, and hand-picked some crypto presales that have been extremely popular in 2026.

Market Snapshot

Despite Bitcoin setting a new all-time high of $126,080 in October, January has been quite an unfavourable month for the flagship cryptocurrency. Its price has been consolidating below the 21‑week moving average, a level near $96,000 since November 14. Its closest attempt to a breakout was on January 15, when it soared to $97,000-$98,000. The bearish movement comes amid high outflows. SoSoValue data shows that BTC ETFs have only recorded 7 days of inflows out of 16 (Snapshot, January 27, 2026).

Daily BTC/USDT chart on Binance. Source: TradingView

Bitcoin’s dominance has fallen to 59.1% (Snapshot from CoinMarketCap, January 27, 2026), down from its July 2025 high of 64%, suggesting accumulation of altcoins.

Macroeconomic activities such as the Greenland crisis, President Trump’s tariff wars with Europe, and political unrest between the United States and Iran have affected investors’ sentiment. With Gold soaring past the $5K recently, crypto whales are reportedly turning to digital gold assets like Tether Gold and Pax Gold.

On the other hand, Meme coins have been performing well, with dog-themed memes performing best, and 4chan-inspired memes taking the second spot, according to Coingecko.

Presales are making a comeback, with top ICOs like Bitcoin Hyper and Maxi Doge collectively raising over $10 million in the past month, while builders like Andre Cronje are launching ICOs.

This suggests that retailers are participating in the ICO markets, particularly with meme/utility plays and DeFi projects.

A common pattern is emerging in investor behaviour, where we see FOMO-style buying into presale rounds, then waiting for catalysts such as a CEX listing to push the price up.

Binance listings are one of the most bullish signals for a new crypto coin, as they tend to create a price pump and a spike in trading volume.

Overall, trending narratives for ICOs in 2026 include:

- Meme coins, often with utility, such as scaling solutions and BTCFi

- DeFi projects and infrastructure, such as payment rails and AI trading tools

- Web2 to Web3 solutions

Binance is increasing its transparency for new listings by revealing its criteria. It’s also aiming to increase user safety by providing clearer insights into things like locked token supply and holder concentration to help users assess risk more accurately.

This means it’s important to consider presale activity, hype, and popularity to ensure that tokens are distributed among many holders.

Why this matters to you: This is a crucial window for early-stage participation. As Bitcoin’s price falls, investors are seeking higher yield potentials. Presales backed by real progress, including presale caps met, development targets achieved, user growth, and a sustained community, are prime candidates for listing and subsequent performance. Our guide tracks these kinds of metrics, so you get first-mover insight on what could be Binance’s next significant addition.

Most Recent New Binance Listings

Listed below are the most recent Binance coin listings:

| Project Name | Symbol | Listing Date | Category |

| Brevis | BREV | January 6, 2026 | Zk-proof computing and data processor |

| KGST | KGST | December 24, 2025 | Sovereign stablecoin pegged to the Kyrgyzstani Som |

| Apro | AT | November 27, 2025 | AI-enhanced decentralized oracle network |

Binance’s Criteria for New Coin Listings

Binance’s official listing requirements page was published in 2021 – no updates have been made to that page since then. Projects should assume that the existing guidelines are valid.

However, on October 15, 2025, Binance released a clarifying tweet about their listing process.

A tweet from Binance explaining that they don’t make money from the listing process. Source: X

Here’s a quick overview of the main points from the official listing requirement page:

- No Set Requirements: Binance initially states that there are no set requirements, meaning it judges each application on a case-by-case basis.

- Minimum Viable Product: Binance states that projects should only apply if they have at least a minimum viable product. This means pre-development projects are unlikely to be considered.

- Proven Team: Binance notes that projects with proven teams are preferred. However, Binance lists multiple projects with anonymous teams, including Shiba Inu (SHIB) and Pepe (PEPE).

- Real Adoption: Another requirement is that the project is focused on real user adoption. This could cover increased holder numbers, trading volume, or daily active users.

- Community Updates: Binance also prioritizes projects that frequently engage with its community, such as weekly AMAs or Telegram updates.

- Large User Base: Binance requires listing applicants to have a substantial user base, although no specific minimum number is specified.

- BNB Incorporation: As the exchange’s native coin, new Binance listings should incorporate BNB into their ecosystems.

- Conduct: Binance also expects professional and responsive conduct from projects. It states that applicants should avoid “shilling” to get a listing.

One key takeaway is that many cryptocurrencies have been listed on Binance without meeting the above requirements, indicating that these requirements are open to interpretation.

How to Get Your Coin Listed on Binance. Source: Binance

Nonetheless, let’s take a closer look at each listing stipulation.

Minimum Viable Product

Binance mentions a minimum viable product (MVP), which means the project’s core product or service should be more than just a technical whitepaper.

For example, a new decentralized exchange (DEX) with basic swapping features would likely be accepted. However, applicants with no evidence of any development progress are certain to be rejected. This ensures that only legitimate cryptocurrencies are added to the Binance exchange.

In this regard, it’s a good idea to focus on projects with strong utility, ensuring credible evidence of the respective concept. These projects have the best chance of being one of the next Binance new coins.

Proven Team

This Binance listing requirement is peculiar. Binance states that applicants should have a proven team, likely with experience in blockchain or key fields related to the project. For example, a decentralized hedge fund should be backed by experienced financial professionals, preferably at the C-Suite level.

This ensures that the right people manage projects and indicates that the founders must complete Know Your Customer (KYC) processes. Otherwise, Binance cannot verify any of the claims made.

However, it’s important to remember that several new coin listings have been given to projects with anonymous teams. This includes Shiba Inu, whose creator, “Ryoshi,” remains unknown to this day. This confirms that Binance will consider applications, even if the founders opt for anonymity, although this may be subject to more scrutiny.

Real Adoption

Coin listings should “focus on adoption”. This requirement is ambiguous because adoption could relate to various performance metrics. For example, adopting meme coins could mean consistent increases in token holders.

This could be why popular meme coins like dogwifhat and Bonk were listed, considering their large communities.

Alternatively, the adoption of utility-driven projects likely means actual users. For example, play-to-earn games or metaverse projects should have a sufficient number of daily or monthly active users, often measured by the number of connected wallets or smart contract transactions. However, like most Binance listing requirements, no specific figures are provided.

Community Updates

Binance prioritizes project founders with a community-centric mindset. It states that token holders and Binance itself should receive regular updates before and after any approved listings.

Communication could include social media updates, AMAs, ecosystem statistics (e.g., user or holder growth), or recordings from the core developer. Binance mentions weekly or monthly updates, which is a reasonable expectation for most projects.

Large User Base

This listing requirement follows the “real adoption” specification. However, Binance doesn’t mention what it considers “large”, so it’s another requirement that can be interpreted.

Nonetheless, it likely refers to tens of thousands of unique holders and perhaps at least 100,000 real followers per social network. Binance likely wants to see thousands of adopters for technical projects with real products. A large social following helps to demonstrate a promising altcoin for 2026.

BNB Incorporation

According to the requirements page, Binance’s new crypto listings are favored when incorporating BNB into their ecosystems. BNB is Binance’s native coin, so BNB adoption directly benefits the exchange.

This isn’t a minimum requirement, as most cryptocurrencies on Binance listings have no affiliation with BNB. Nonetheless, BNB “incorporation” can relate to several different things. This could mean that the project has been bridged to the BNB Chain. FLOKI is a good example here. It’s an Ethereum-based meme coin that operates in the BNB ecosystem.

Binance also mentions that incorporation includes BNB acceptance when running fundraising campaigns (e.g., presales and launchpad events). Many token launches, including Solaxy, accept BNB as a payment method.

Conduct

Professional conduct is also required when applying for coin listings. Binance expects ethical behavior and explicitly states that pressure tactics should be avoided.

It claims that any projects “spreading FUD or negative comments” about Binance will be blacklisted. This is why aggressive shilling can be counterproductive.

The Binance Listing Process for New Coins

We’ve covered the requirements for coin listings. Now, let’s move on to the listing process itself.

Submitting an Application Form

Founders must complete a Binance listing application form. The form is different depending on the required platform. First, projects can apply for a direct listing, meaning spot trading pairs are added. This option is for projects with a working product or an established community.

The second application form is for the Binance Launchpad. This is for new projects seeking funding, similar to presales but directly on Binance. Binance users typically make investments with BNB. Launchpad projects are added to Binance’s spot exchange after the funding process is over.

Waiting Process

Binance will assess listing applications on a case-by-case basis. It provides no timeframe for when projects will receive a decision. Binance typically requests further information from projects that pass the initial review stage.

Founders are expected to respond promptly. However, projects should avoid following up with Binance for an update, as this can harm the application’s chances of approval.

One-Way NDA

Binance requires all applicants to sign a one-way non-disclosure agreement (NDA). This prevents projects from discussing any of the materials discussed with Binance.

Doing so is almost certain to end the listing process.

Internal Binance Listings

New Binance listings are often made internally, meaning projects don’t formally submit an application form. These listings are often cryptocurrencies with standout performance metrics or unique characteristics.

For example, OFFICIAL TRUMP TRUMP $3.20 24h volatility: 3.2% Market cap: $744.38 M Vol. 24h: $85.43 M , the meme coin backed by Donald Trump, was listed on Binance almost immediately after its launch. This was a unique event considering its association with the 47th US president.

X Announcement of the TRUMP listing on Binance, with a seed tag, which is used to show there may be high volatility. Source: Binance X

Similarly, Binance often lists cryptocurrencies that blow up, including multiple meme coins with significant volumes. Binance generates revenue from trading commissions and wants to list the most in-demand projects.

How Does Binance Announce New Listings?

As per the NDA signed by applicants, coin listings can only be announced by the exchange. Announcements are made on the Binance listing and X pages. The X page is ideal for receiving real-time notifications, ensuring you stay aware.

The website announcement offers more comprehensive information about the listing. For example, Binance lists the time and date when tokens will go live, typically within 24 hours of the announcement. The available pairs are also provided, often covering USDT and USDC.

Important: Projects’ claims about new Binance listings are certain to be fake. Being listed on Binance is one of the biggest achievements possible for cryptocurrencies. Announcing the news before Binance would breach the NDA, meaning the listing approval would be revoked.

What Is Binance Alpha?

Binance Alpha is a feature of the Binance wallet app, where users can get early access to web3 projects and their tokens. These tokens are not yet featured on Binance’s main CEX, but Binance notes that while it’s not guaranteed, some tokens on Binance Alpha will go live on Binance.

Alpha tokens may or may not get listings on the Binance exchange. Source: Binance

Binance Alpha allows users to view the tokens Binance is considering for a wider listing. And in return, it serves as a testpad to help Binance in considering a full listing.

Like for full CEX listings, Binance likes to see good community traction, a real and often innovative use case, and projects that are aligned with the latest trends in crypto. It then aims to spread awareness and education around these projects, to help them succeed.

Tokens in the Binance Alpha section feature slippage protection and extra MEV security, in order to reduce liquidity or other issues.

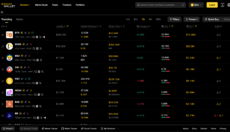

You can explore the Binance Web3 wallet, along with Binance Alpha, a launchpad, wallet trackers, and more. This can be a good way to spot potential future Binance listings.

The Binance Web3 Wallet showing a selection of low-cap coins. Source: Binance Wallet

How to Use Binance Alpha

To start, you’ll need to download the Binance Web3 Wallet. Ensure it’s properly backed up and that your Binance app is updated to at least version 2.93.0; otherwise, the Alpha section will not appear.

New Launches. When a new token is coming to Binance Alpha, Binance shares the details across its official social channels. Inside the Markets tab, you’ll see the Alpha section, complete with a countdown clock and chain information. You’ll also want to have enough of the chain’s native token ready in your wallet so you can join when it goes live, since Binance Alpha supports BNB and other chains.

Each Alpha showcase runs for 24 hours. During that time, projects are highlighted in batches, with full details available in-app. If you want to get involved, the Quick Buy button lets you pick up tokens directly during the window.

Once the 24 hours end, the tokens remain in the Alpha section, where you can continue to follow the projects and trade if you like.

How to Find Upcoming Binance Listings

The official website and X page are the primary sources for discovering Binance’s upcoming listings. Even so, seasoned investors often look for clues about potential approvals, giving them a first-mover advantage.

Read on for best practices when finding coin listings.

Join a Binance Listings Alert Service

First, joining a listing alert service is crucial. You’ll receive a near-instant notification whenever Binance announces a new listing through its official channels. In contrast, relying solely on X notifications will likely mean missing that initial advantage.

Cryptocurrency listing alerts, important for finding out about new listings on Binance. Source: Cryptocurrency Alerting

This is because Binance listing announcements are made from the main X page, which posts multiple times daily. Only a small fraction of those posts are related to listing announcements, meaning you’d need to check each one manually.

Cryptocurrency Alerting is a good option for beginners, as its free plan supports up to three active alerts. You can add Binance and two other tier-one exchanges, such as Coinbase and Kraken. Cryptocurrency Alerting offers multiple alert types, including email, SMS, and phone calls.

Follow Binance Launchpad Announcements

New crypto projects use Binance Launchpad without any existing exchange listings. Projects raise capital from Launchpad users through an initial exchange offering (IEO) process. After the fundraising event, Launchpad projects are listed on the Binance exchange.

Only a small number of projects are accepted by Binance Launchpad. The exchange conducts significant due diligence, ensuring the Launchpad is only used by quality projects. Moreover, considering that all Binance Launchpad cryptocurrencies get a Binance listing, events are always oversubscribed.

Considering the available discounted token price, the best-case scenario is investing during the Launchpad. However, those who miss out can purchase the respective tokens once they go live on the Binance exchange.

Keep Tabs on Trending Cryptocurrencies on the BNB Chain

Binance clearly states in its listing requirements that incorporating BNB is highly preferable. This means the listing team views cryptocurrencies operating on the BNB Chain favorably, giving them an edge over other ecosystem projects. The best practice is to analyze BNB Chain trends for potential gems.

DappBay showing the top Dapps on the BNB chain and daily transactions as of October 7. Source: DappBay

For example, look for BNB Chain tokens with increased holder counts, trading volumes, and adoption rates. DappBay is a good option – it specializes in trending dApps on the BNB Chain, including transaction growth, users, and price performance.

Track Whale Wallet Movements for BEP20 Tokens

Another strategy to find new Biance listings before others is to track whale activity. Crypto whales are individuals or companies that hold a significantly large amount of crypto to affect market prices. Whales sometimes can pre-empt the market, due to insider knowledge, such as a Tier 1 exchange listing or similar.

Nansen and Arkham are popular platforms for tracking whale wallets, as is Whale Alert on X. Notifications are sent whenever the tracked wallet transacts, including buy and sell orders on DEXs. When tracking transactions, it’s best to focus on BEP20 tokens, which operate on the BNB Chain.

Follow CZ on X for Potential Clues

Changpeng Zhao (CZ) is Binance’s founder and former CEO. Although CZ is prohibited from managing Binance (per a settlement agreement with the US Department of Justice), he’s likely still highly influential in key decisions. Therefore, following CZ on social media is a solid strategy for predicting new Binance listings.

CZ is highly active on X, with almost 10 million followers. Most posts are crypto-related and often focus on the BNB Chain ecosystem. Any potential clues, such as specific narratives (e.g., AI agents or meme coins), could be pivotal when forecasting upcoming listings.

Assess New Listings from Other Tier-One Exchanges

Having analyzed the best new coins on Binance, we found that many new listing announcements were “reactionary”. Unlike any other business, Binance isn’t the only exchange with a tier-one status, so it has competitors.

As such, we found that Binance often lists trending meme coins and cryptocurrencies recently added to other major exchanges.

For example, suppose a new meme coin with tens of millions of dollars in daily trading volume is added to Coinbase and Crypto.com. These competitors have millions of active traders, meaning the respective meme coin is likely to generate big numbers. This means Binance is missing out on commission revenues. In this scenario, Binance could add the meme coin to its spot exchange, ensuring it maximizes the potential commissions available.

This strategy also works well with alert services like Cryptocurrency Alerting. For instance, suppose you get an alert about a new OKX listing. You can then track the listed crypto project to see if any other tier-one exchanges follow suit. If they do, a new Binance listing could be imminent.

Follow the Binance Alpha Wallet New Coin Listings

Although not a guarantee, many projects that are listed in the Web3 wallet feature Binance Alpha are considered and sometimes approved for a full listing on the Binance CEX. Coins on Binance Alpha have usually already garnered significant community support, such as Trusta AI, and often show promise of true innovation.

Another way to quickly check Binance Alpha coins is via CoinGecko.

Why Do Crypto Traders Buy Upcoming Binance Coins?

Seasoned investors track upcoming listings and immediately enter the market when the announcement is made.

Coingecko page for Aster, showing the recent 6% pump after listing, as well as a pump on October 2, as traders anticipated the launch. Not investment advice. Values shown are for educational purposes only. Source: CoinGecko

The newly approved token will often “pump”, with the hype of a Binance listing attracting waves of speculative investors. This means an initial pricing rally is almost always the case.

The reasons for this include:

- Biggest Exchange: Binance is the world’s biggest crypto exchange across measurable metrics. It boasts over 275 million registered users, including millions of daily active traders.

- Significant Trading Volumes: Like any exchange, Binance’s trading volumes are influenced by broader market conditions. Nonetheless, Binance attracts substantially more volume than any other platform. For example, recent 24-hour volumes on Binance and Coinbase were almost $12 billion and $1.7 billion, respectively.

- Exclusive Club: Binance currently lists about 500 cryptocurrencies. This is a micro-fraction of the wider market, home to millions of tokens. Those listed on Binance are part of an exclusive club that attracts new investors.

- Easy Market Access: Binance accepts instant deposits with fiat money in many countries, allowing seamless market access with credit cards and e-wallets. This makes Binance highly accessible to first-time investors.

That said, it’s important to remember that new Binance listings aren’t guaranteed long-term success. We found that most approved tokens saw an immediate price pump, often lasting several days, and penny crypto projects sometimes benefit the most from listing on Binance. However, prices can reverse quickly once the hype dies down.

Buying cryptocurrencies on the back of a Binance listing often only works in the short term. Projects with strong fundamentals, alongside other exchange listings, have the best chance of producing long-term growth.

How Often Does Binance Add New Cryptocurrencies?

Binance’s new listings occur sporadically. Some weeks, there will be no new listings; in others, there can be multiple.

November 2025, for example, saw seven cryptocurrencies added to the Binance exchange, while just one was added in December.

Ultimately, there are no set criteria that Binance needs to meet. If a specific token is trending and generating significant trading volume, it could be added to Binance at any time. When new currencies are listed, Binance makes an announcement.

Is Binance Regulated? Legal Status Worldwide

Understand Binance’s legal standing in your country if you are considering using it.

United States

Binance faces restrictions following a historic $4.3 billion settlement. Because of this, Binance.US was created as a separate, regulated entity for North American users.

Changpeng Zhao (CZ), the platform’s founder, received a full pardon for his conviction in October 2025, and the SEC dismissed its action against Binance in May.

United Kingdom

Binance does not have authorization from the Financial Conduct Authority (FCA) and has stopped accepting new UK users. Existing customers can use parts of the platform, but cannot on/off-ramp fiat and have no access to the Financial Services Compensation Scheme.

European Union

Binance is subject to the Markets in Crypto-Assets (MiCA) regulations and has licenses in 21 countries. However, there have been country-specific issues such as:

- Netherlands, where Binance exited in 2023 when it failed to get regulatory approval, and received a €3.3 million fine.

- In Germany, Binance withdrew its application for a license because of regulatory problems.

Asia

- India: Binance is registered with the Financial Intelligence Unit (FIU).

- Japan: Operates compliantly, re-entering the market after a partnership with a local entity.

- South Korea: Binance entered the market by acquiring local exchange GoPax.

How Crypto Bought on Binance is Taxed

When crypto is sold at a profit, then for many countries, this becomes a taxable event, under Capital Gains Tax (CGT). This includes selling crypto to fiat, or selling one crypto for another.

Other events on Binance, such as receiving crypto staking rewards from applicable coins, airdrops, and more, are usually classed as income, and are your responsibility to declare.

United States

Binance.US is required to issue Form 1099-DA to users who earn over $600 from income-generating activities, detailing capital gains and losses, according to CoinLedger. Currently, Binance also provides information to the Internal Revenue Service (IRS) upon request.

Europe

- United Kingdom – Binance’s future cooperation with His Majesty’s Revenue and Customs (HMRC) in the UK, is highly likely and has been confirmed in some instances.

- European Union – An EU directive called DAC8 requires crypto exchanges to report customer data.

- Malta – Long-term crypto gains are not taxed for individuals, but frequent, business-like trading is taxed as income, rather than capital gains.

Worldwide

- Australia – The Australian Taxation Office (ATO) also requires reporting of Capital Gains Tax events from crypto disposals.

- India – Charges a flat 30% fee on crypto profits.

This list is not exhaustive, and things are constantly changing, so users should do their own research.

Staying Compliant as a Binance User

Binance does not provide customers with official accounting forms for reporting tax. There are outside programs such as those provided by Koinly, which can help you track your crypto transactions, in order to make filing your taxes easier.

Conclusion

With over 275 million users, Binance is the world’s most sought-after exchange for crypto projects. Depending on market conditions, a Binance listing can result in an immediate pricing rally, often lasting for days or weeks. It also legitimizes the project’s vision.

However, predicting new Binance listings is speculative, as the exchange must make announcements directly. Even so, a potential incoming listing could be in sight for Bitcoin Hyper, a Layer 2 network for Bitcoin currently in presale. Bitcoin Hyper has raised over $31.39M so far.

FAQ

How do you find upcoming coin listings before they go live?

Where can I buy coins before they are listed on Binance?

Can a delisted coin be listed again on Binance?

References

- Binance Research on Key Trends in Crypto – Binance

- Whale Alert – X

- ARKHAM Intelligence – Arkham

- Solana Onchain Data and Wallet Tracker – Nansen

- The Ultimate Guide to Staying Listed on Binance – Binance

- Crypto & Blockchain Venture Capital Q4 2024 – Galaxy

- Market Reaction to Exchange Listings of Cryptocurrencies – ResearchGate

- Web3 Developer Report 2024 – Electric Capital

- Analysis: A Binance Listing Adds +41% on Crypto Prices – Ren & Heinrich

- DappBay – BNB Chain

- Cryptocurrency Alerting – Cryptocurrency Alerting

- BitcoinFi: A 2025 Market Report – Maestro

- ASTER Price Stages Unexpected 5% Rebound on Binance Listing – Coinspeaker

Coinspeaker in Numbers

Monthly Users

Articles & Guides

Research Hours

Authors

The team behind IPO Genie has not yet announced an end date for the presale.

AI cryptocurrencies combine blockchain with artificial intelligence to power decentralized machine learning networks, GPU computin...

Fact-Checked By:

Fact-Checked By:

Otar Topuria

Crypto Editor, 39 postsI’m a crypto writer and analyst at Coinspeaker with over three years of experience covering fintech and the rapidly evolving cryptocurrency landscape. My work focuses on market movements, investment trends, and the narratives driving them, helping readers what is happening in the markets and why. In addition to Coinspeaker, my insights and analyses have been featured in other leading crypto and fintech publications, where I’ve built a reputation as a thoughtful and reliable voice in the industry.

My mission is to demystify the crypto markets and help readers navigate the noise, highlighting the stories and trends that truly matter. Before specializing in crypto, I worked in the IT sector, writing technical content on software development, digital innovation, and emerging technologies. That made me something of an expert in breaking down complex systems and explaining them in a clear, accessible way, skills I now find very useful when it comes to unpacking the intricate world of blockchain and digital assets.

I hold a Master’s degree in Comparative Literature, which sharpened my ability to analyze patterns, draw connections across disciplines, and communicate nuanced ideas. I’m particularly passionate about early-stage project discovery and crypto trading, areas where innovation meets opportunity. I enjoy exploring how new protocols, tokens, and DeFi projects aim to disrupt traditional systems, while also evaluating their potential risks and rewards. By combining market analysis with forward-looking research, I strive to provide readers with content that is both informative and actionable.