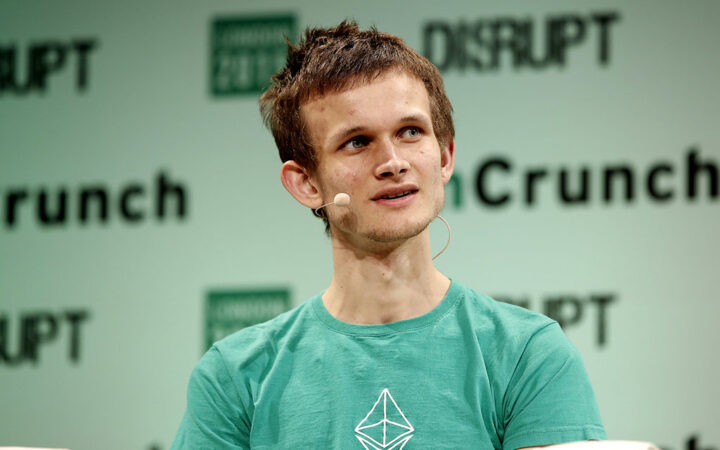

Vitalik Buterin Donates to Thai Zoo, MOODENG Meme Coin Surges 66%

The news of Buterin’s contribution sent the MOODENG meme coin soaring, with its price doubling within two hours of the announcement.

Stay ahead of the crypto curve with in‑depth coverage of the digital‑asset ecosystem. Here you’ll find the latest on new coin launches, regulatory shifts, wallet innovations and market movements across major chains. Whether you’re a seasoned trader or just exploring the space, our timely updates offer clarity on the crypto universe’s fast‑evolving landscape.

The news of Buterin’s contribution sent the MOODENG meme coin soaring, with its price doubling within two hours of the announcement.

Is Solana on the verge of a breakout or a breakdown? While bearish signals dominate the short-term charts, 2024 has been a year of explosive growth for Solana. Will a lead over Ethereum in social mentions drive a bullish 2025 for Solana?

Despite numerous rumors and speculations, there has been no official confirmation regarding the Blum airdrop or the launch of the BLUM token.

In this article, Bitget CEO Gracy Chen shares her perspective on three key developments that are expected to be trendsetters in the crypto industry next year.

Despite the substantial liquidations, the crypto market showed signs of recovery. Bitcoin, which had dipped below $95,000 earlier in the week, rebounded to hover around $98,337.

ESG-focused blockchain Trrue secures $10M investment from GEM Digital, strengthening its ecosystem development before December 27th token generation event.

LCX CEO says filing for the preliminary MiCA license is a pivotal step in their growth strategy, showcasing regulatory excellence.

As SOL token skyrocketed to a high of $198 in the past 24 hours, the total DEX trading volume on Solana surpassed $100 billion for a second consecutive month.

PancakeSwap closes 2024 with unprecedented $310 billion trading volume, showcasing massive growth through Layer-2 networks like Arbitrum and Base, while introducing innovative features like SpringBoard.

Binance and its founder Changpeng Zhao (CZ) have requested the dismissal of the SEC’s lawsuit, arguing that the agency failed to demonstrate how the complaint meets the Howey test.

With the fresh recovery run plans for the week ahead, Hyperliquid is ready to prolong the massive bull run. Although the Hyperliquid growth trajectory forms a bullish pattern, the North Korean hackers scare away the users, drying the netflows.

With a boost in key network standards, the SEI is positioning itself as one of the few rising cryptos in this volatile market. With the potential to start a parabolic rise, will SEI prices surpass $0.50?

Kick streaming’s X account got hacked to promote KICK token in a direct attempt to scam users

Independent Reserve has made history as the first exchange in Singapore to list Ripple’s RLUSD, offering trading pairs in SGD and USD.

Binance announced the delisting of low-liquidity trading pairs on December 27. The exchange will allow users to trade tokens through alternative pairs.