Pi Network Gains 3% as Market Dips – Can PI Keep Its Momentum?

Pi Network has climbed 0.1% in the past 24 hours, rising to $1.70 even as the broader cryptocurrency market posts a 1% loss today.

Despite its short-term gains, PI remains down 9% in a week and 36% in a month.

However, it has recovered by an impressive 35% since hitting a one-week low of $1.26 on Sunday, signaling renewed momentum.

With Pi Network continuing to be one of the most talked-about new cryptocurrencies, it has the potential to deliver strong gains in the medium and long term, especially if it secures major exchange listings.

Is Pi Network the Best Trade Right Now? PI Price Surges from Recent Lows

Pi Network’s one-hour chart suggests the possibility of another dip in the next day or two, based on recent price movements.

Its 30-period moving average has recently overtaken its 200-period moving average, forming a bullish crossover. However, the last time this happened, PI’s rally lost momentum and consolidated before experiencing a temporary decline.

Adding to this, PI’s relative strength index (RSI) has risen above 70, a sign that the asset may be entering overbought territory.

While previous dips were also influenced by macroeconomic factors, these indicators suggest that traders may see short-term resistance before further upside.

That said, PI remains 42% below its all-time high of $2.99, meaning that from a long-term perspective, it could still be undervalued.

Long-term investors may see the current level as an opportunity, particularly as Pi Network has already amassed a substantial following, with 4.2 million users tracking its updates on X.

14-03-2025

Are you ready? Pioneers $Pi

— Pi Network (@PiNetwork_8) March 12, 2025

Excitement within the Pi community is also building ahead of Pi Day on March 14, which could generate additional attention and price action.

A more significant catalyst would be major exchange listings, with Binance, Coinbase, and Kraken yet to add support for PI.

A listing on one of these platforms could spark a substantial rally, potentially sending PI toward $2 by the end of the month and $5 by the second half of the year, assuming broader market conditions remain stable.

New Altcoins Offering Stronger Fundamentals

While Pi Network has built a large and enthusiastic community, some traders may look for alternatives with stronger fundamentals and clearer utility.

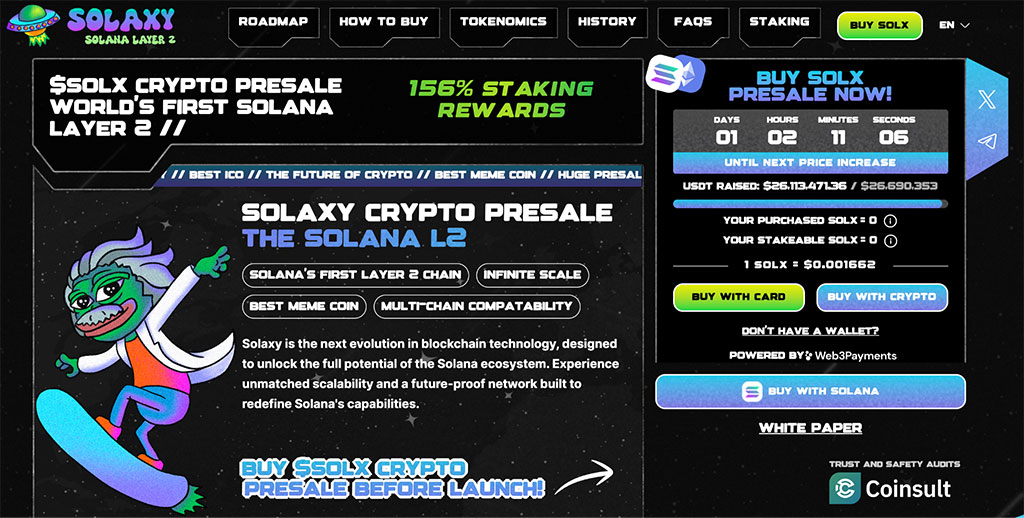

One project that has been rapidly gaining traction is Solaxy (SOLX), a new layer-two network for Solana that has already raised $26 million in its ongoing presale.

Solaxy has captured investor interest because it addresses a major issue in the Solana ecosystem – transaction failures, congestion, and network reliability.

Even with Solana’s recent upgrades, the network still suffers from frequent transaction errors, particularly during peak activity.

Solaxy aims to solve this by bundling transactions off-chain, offering faster processing speeds, lower fees, and seamless bridging between Solana and other blockchains.

The team behind Solaxy also has plans to expand its compatibility beyond Solana, potentially integrating with other leading chains in the future.

Since SOLX will be required to pay for transaction fees on the network, its demand is expected to grow as adoption increases.

Investors can buy SOLX at a discounted presale price of $0.001662 via the Solaxy website.

This price will continue to rise every few days until the presale ends, at which point SOLX will be listed on exchanges, where it could see significant gains.

Disclaimer: This publication is sponsored. Coinspeaker does not endorse or assume responsibility for the content, accuracy, quality, advertising, products, or other materials on this web page. Readers are advised to conduct their own research before engaging with any company mentioned. Please note that the featured information is not intended as, and shall not be understood or construed as legal, tax, investment, financial, or other advice. Nothing contained on this web page constitutes a solicitation, recommendation, endorsement, or offer by Coinspeaker or any third party service provider to buy or sell any cryptoassets or other financial instruments. Crypto assets are a high-risk investment. You should consider whether you understand the possibility of losing money due to leverage. None of the material should be considered as investment advice. Coinspeaker shall not be held liable, directly or indirectly, for any damages or losses arising from the use or reliance on any content, goods, or services featured on this web page.