Charlie Shrem Wins His First Battle with Winklevoss Twins, Order to Freeze Assets Lifted

On hearing both sides of the story, the judge has recently given a decision to release Shrem’s assets while not disclosing the explanation behind it.

Stay ahead of the crypto curve with in‑depth coverage of the digital‑asset ecosystem. Here you’ll find the latest on new coin launches, regulatory shifts, wallet innovations and market movements across major chains. Whether you’re a seasoned trader or just exploring the space, our timely updates offer clarity on the crypto universe’s fast‑evolving landscape.

On hearing both sides of the story, the judge has recently given a decision to release Shrem’s assets while not disclosing the explanation behind it.

Having an aim to satisfy its customers demand, Coinbase has taken a decision to add BAT to its trading platform and apps.

The SEC notes that EtherDelta allowed its customers to trade ERC20 which were deemed as securities, and without registering with the agency.

More debates heat up on the eve of the upcoming Bitcoin Cash hard fork. While a number of prominent crypto exchanges already granted support for the new coins, there are those, who believe that the roadmap has no chances.

In case the demand zone of $0.075 holds, Cardano price will resume its uptrend movement which may break the supply zone of $0.081 upside

Decentralized global lending network Cred now provides USD loans, collateralized by XRP. The company has secured over $300 million in total credit facilities available for lending.

Potential integration between SWIFT and Ripple, which would make Ripple’s products available to 4,000 new banks, is a faked rumour.

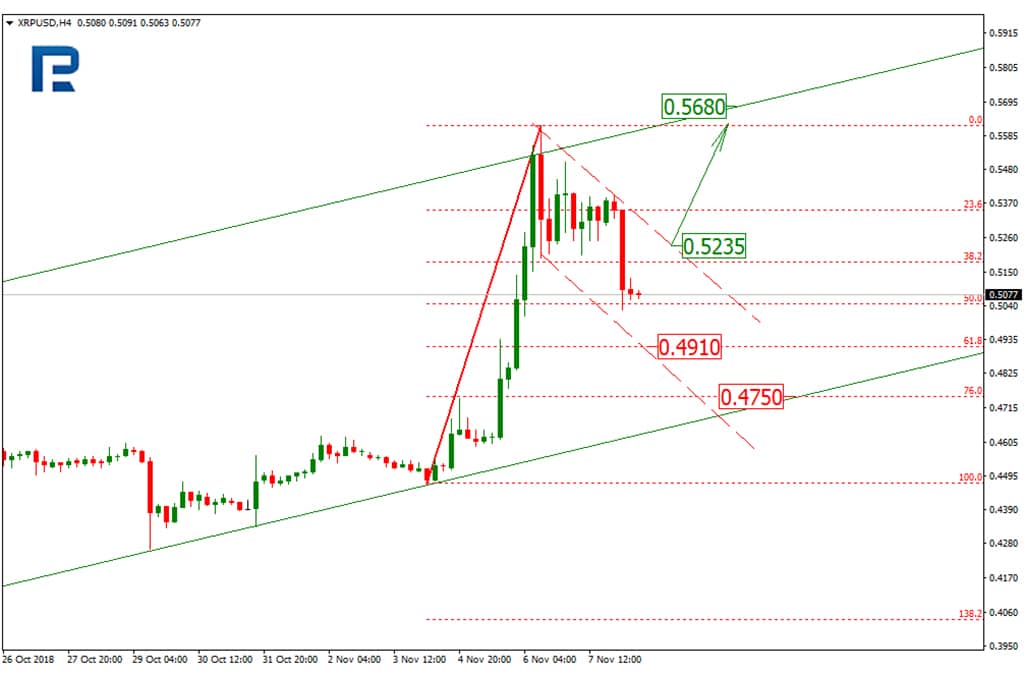

XRP is still slightly moving down on Thursday Nov 8, trading at $0.5169, says Dmitriy Gurkovskiy, Chief Analyst at RoboForex.

Former Google CEO Eric Schmidt recently revealed that he’s a fan of blockchain technology and digital currencies, specifically referencing the likes of Bitcoin (BTC) and Ethereum (ETH).

Three new governors with pro-Bitcoin and pro- blockchain stand take the governor seat while two others with similar views retain them.

Nomura Research Institute’s cybersecurity subsidiary revealed its new security tool called “Blockchain Security Monitoring Service” and confirmed its partnership with ConsenSys.

A Californian student thought that he had the run of his life last year by turning his small $5,000 investment into cryptocurrency to $880,000 in December 2017.

![Best 101 Bitcoin Facts [Infographics]](https://www.coinspeaker.com/wp-content/uploads/2018/11/bitcoin-facts.jpg)

PlayCasinoOnline has gathered 101 interesting facts about Bitcoin and its history that will probably surprise you.

Should the bears continue with their increased momentum the Stellar price would break the demand level of $0.23 and expose to the demand level of $0.22.

Crypto mining company BitFury has closed a $80 million private funding round led by European venture capital firm Korelya Capital and billionaire Mike Novogratz.