SHIB Surges +5% as Meme Coins Catch a Bid: What’s Next for Shiba Inu?

SHIB Resistance Levels to Watch in March 2026

Stay ahead of the crypto curve with in‑depth coverage of the digital‑asset ecosystem. Here you’ll find the latest on new coin launches, regulatory shifts, wallet innovations and market movements across major chains. Whether you’re a seasoned trader or just exploring the space, our timely updates offer clarity on the crypto universe’s fast‑evolving landscape.

SHIB Resistance Levels to Watch in March 2026

Bitcoin Tests $62,300 Support Amid $9B ETF Outflows

Iran’s $7.8B Crypto Hub: Utility or Sanctions Evasion?

SHIB Price Analysis: Weak Bounce Near Critical Support

Bitcoin Price Prediction: March Survival Guide for BTC Traders

Michael Saylor Hints at Strategy’s 100th Bitcoin Purchase

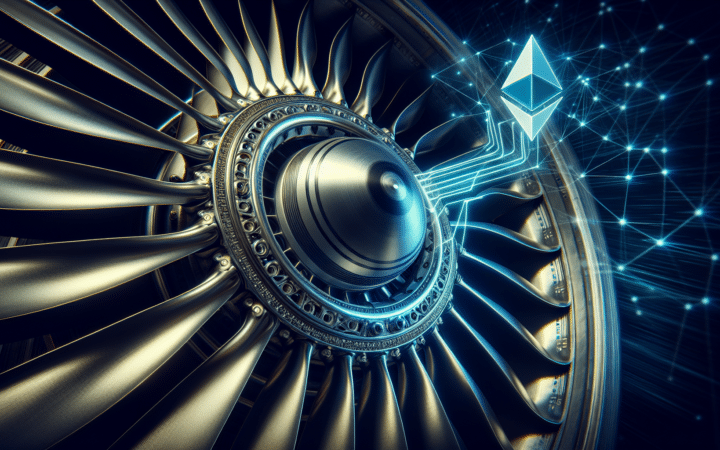

ETHZilla Launches Tokenized Jet Engine Lease Product on Ethereum

Israeli Traders Arrested for Polymarket Military Bets

Bitcoin, Crypto Markets Brace for US Inflation Data Impact

CZ Backs 2026 Super Cycle: Regulatory Catalysts to Replace Halving

Vitalik Buterin Outlines Ethereum’s Role in Future of AI

Ex-SafeMoon CEO Gets 8 Years in Prison for $9M Crypto Fraud

Metaplanet reaffirmed its Bitcoin-first strategy amid the crypto market crash, while reaffirming his accumulation.

Since Oct. 10, 2025, Bitcoin’s price has fallen about 44%, but US spot Bitcoin ETFs have reduced their BTC holdings by only 6.6%, showing major strength.

Michael Saylor’s Strategy Inc. disclosed a $12.4 billion quarterly loss driven by unrealized bitcoin losses as crypto markets collapsed, yet continued accumulating digital assets through January 2026.