Safein Announces the Pre-Sale Token Event for Its Revolutionary Identity Payment Platform

Safein, an identity and payments wallet, has announced the pre-sale event for its revolutionary identity payment platform, which will start on April 3, 2018.

Stay ahead of the crypto curve with in‑depth coverage of the digital‑asset ecosystem. Here you’ll find the latest on new coin launches, regulatory shifts, wallet innovations and market movements across major chains. Whether you’re a seasoned trader or just exploring the space, our timely updates offer clarity on the crypto universe’s fast‑evolving landscape.

Safein, an identity and payments wallet, has announced the pre-sale event for its revolutionary identity payment platform, which will start on April 3, 2018.

Keyrypto, a Dubai-based platform connecting blockchain with e-commerce, has announced its main event starting on April 2, 2018.

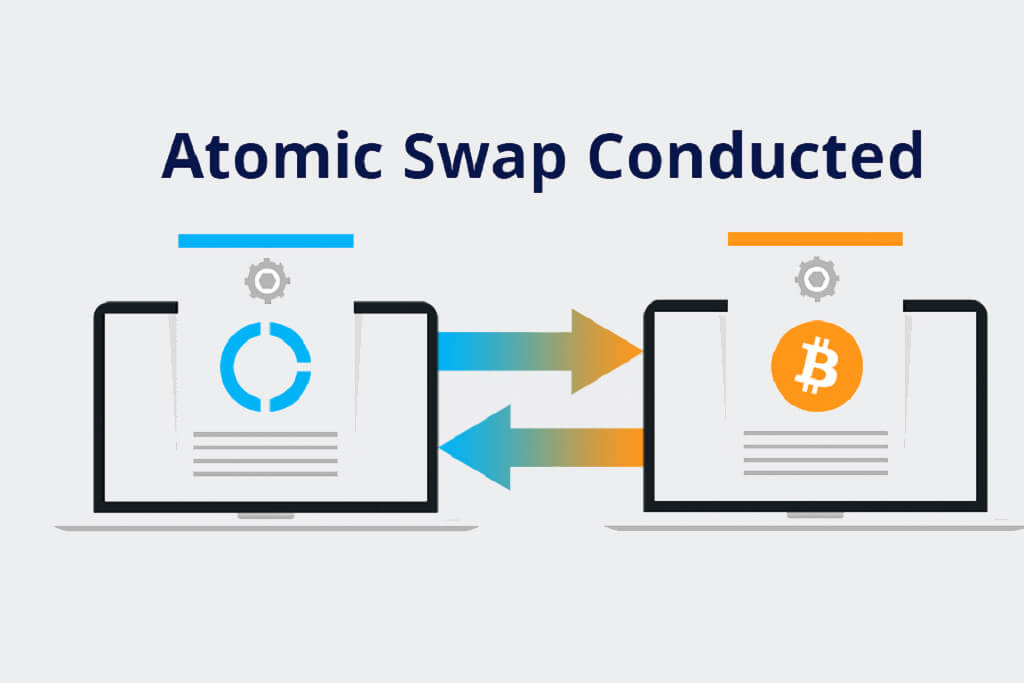

Minexcoin (MNX) has announced the release of its atomic swap protocol for public testing and looks forward to further testing.

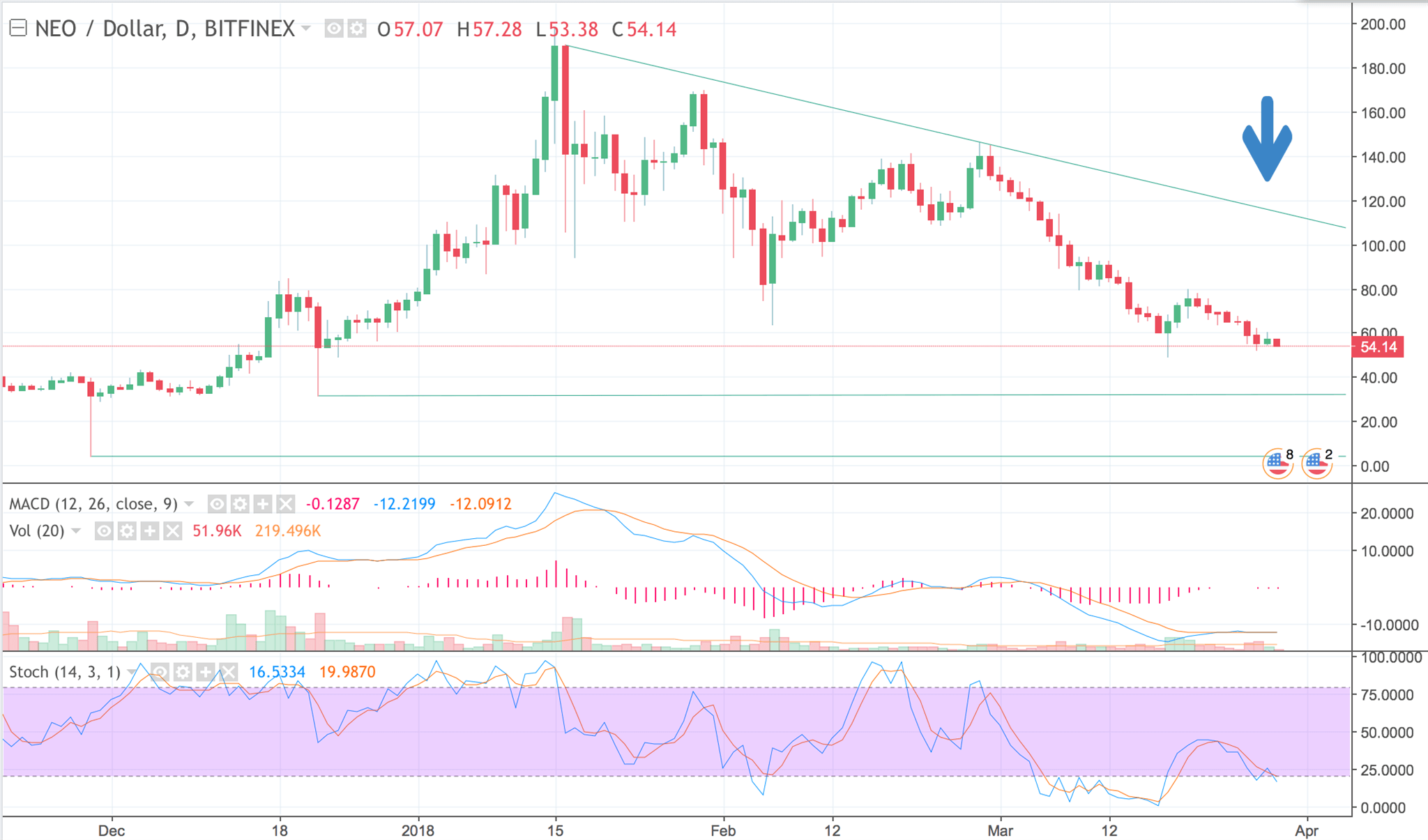

Here’s the technical analysis of NEO’s (NEO) price, which is currently making around $55.13, as reports Dmitriy Gurkovskiy, Chief Analyst at RoboForex.

Barhydt says that with the participation of hedge funds managers and institutional investors from West, Bitcoin will witness a huge price recovery ahead this year.

Coinspeaker spoke to Ihor Torshyn, whose ambitious project FTEC promises to improve trading performance of unprofessional investors on the cryptocurrency markets.

The first cross-blockchain securities lending platform released a thorough report on the attitude towards cryptocurrencies – the results are optimistic for the crypto community.

The latest correction in Bitcoin has brought it close to the dangerous levels of a “death cross” but analysts still prefer to remain bullish as many say the pain is “largely over”.

After a successful Private Sale, GIFcoin, deemed by investors as the most transparent and generous ICO in the field of online gambling industry, has sold out its Stage 1.

With a view to satisfy a huge demand for XRP, Uphold has added support for this cryptocurrency and has become one of the largest platforms to buy it.

OKEx is amongst the first global crypto exchanges to feature AUTO token designed to make ‘self-driving cars’ sector more secure.

CryptoCashbackRebate acts as a low-fee intermediary passing out a majority of the rest commission to their client via a transparent common cross-platform loyalty program that reinvests each saved cent.

Blockchain IoT sensor data marketplace DataBroker DAO has announced its successfully finishing the pre-sale for the company’s token, DTX.

Here’s the guest post by Kevin Nelson, who is sharing his vision on main principles of learning, and the role of artificial intelligence in the educational process of the future.

The leading payment app in the Eastern Europe creates an Ethereum-powered marketplace: the new ecosystem gives users a chance to become cryptocurrency investors simply by selling real goods.